Has the hunt for yield peaked?

Summary: The latest cash rate and its effect on the share market have boosted equity prices as more investors hunt for yield. But this buying appears indiscriminate, with not enough attention being paid to the potential for dividend growth and payout ratios. |

Key take-out: It would seem the yield trade no longer pays. When buying stocks for their income generating ability, value and the price paid for yield needs to be a primary consideration for any long term investor. We prefer companies that can grow their dividend over time and have some degree of valuation support. |

Key beneficiaries: General investors. Category: Economics and investment strategy |

The recent RBA decision to cut the cash rate to 2.25 per cent has sparked a wave of analysis. Some commentators are calling for further cuts in 2015 and last week's surprise increase in unemployment supports this view. If history is any guide rate cuts rarely come in isolation.

So what does this mean for the investor who is looking to generate an income from their investments? Needless to say, it makes things harder.

We weighed into the debate last week and considered whether or not we are valuing stocks correctly in this new low interest rate era. We discussed how sustainably lower rates can lead to increases in fundamental valuations.

This week we will consider yield and, importantly, whether the yield trade has peaked.

For us at Eureka Report the question becomes more complicated: do we follow the yield-seeking crowd, or do we sit back and risk being wrong in the short term by highlighting the increasing risks of chasing shares at current prices?

In answering this question it is important to distinguish between value and yield. It can be argued that a business (or stock) is worth the present value of its future cash flows, whereas yield is a function of a company's share price and the amount of earnings paid out to shareholders. They are two very different concepts.

Is there dividend growth?

When constructing a portfolio to create an income stream, yield is an important consideration. Often investors will look at next year's expected dividend, the share price, calculate the yield and make an investment decision. This is an understandable process.

But not all yield is created equally.

If you are looking at yield as a proxy for value it is important to consider the potential for dividend growth and company pay out ratios.

When paying high prices for a yield stock, compared both to the market as well as history, it is important to consider whether a company can grow its dividend.

The much loved defensive high yield stock Telstra didn't increase its dividend in the five years leading up to FY13. Consensus estimates currently assumes another period of relative stability from FY15-17. Nevertheless, the stock has materially re-rated over the last 3 years.

As with any stock trading on a FY16 price-earnings (PE) multiple of over 19 times and yielding around 5 per cent (with limited expected dividend growth) we would caution chasing the stock aggressively from here for its yield.

As a yield play, the risk/reward proposition on Telstra has deteriorated from 12 months ago when you could acquire the same business for $5 a share. To own or buy the stock from here you really need to have a positive view of the underlying growth prospects of the business. (For further discussion on this point take a look at Alan Kohler's recent interview with Telstra's chief financial officer Andy Penn)

Is the company increasing payout ratios?

In recent years the boards of many ASX listed company's have listened to shareholders and increased capital management initiatives. One way of doing this is to increase the company's payout ratio.

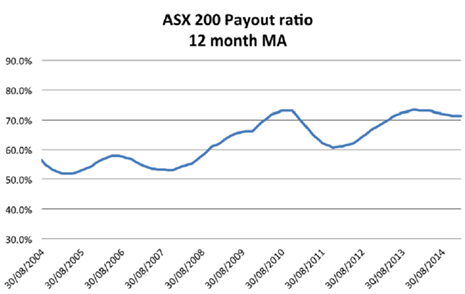

This trend has been emerging for some time as can be seen with the ASX200 payout ratio over the past decade. The relative increase in payout ratios have clearly been more pronounced in recent years, as shown in the graph below.

We have previously looked at Retail Food Group, which has more than doubled its payout ratio in the past five years.

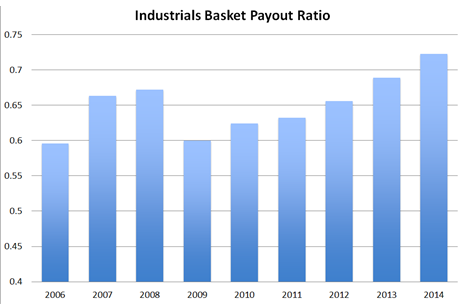

Over that same period many other ASX listed companies have steadily lifted payout ratios. We have looked at the average payout ratio of 20 large ASX listed industrials stocks and, as can be seen from the chart below, the average payout ratio of these companies has steadily increased in recent years.

There are two observations to take away from this chart:

- Further increases in dividends probably won't be driven by increases in payout ratios – dividend growth will be driven by earnings growth.

- With companies paying out such a significant proportion of their earnings, instead of reinvesting in their businesses, the potential for future earnings growth (outside one off foreign exchange and cost-out benefits) is arguably diminished.

Adding these two observations together paints a fairly modest picture for future dividend growth among many industrial stocks.

For any business that is entering a period of limited dividend growth, then the price paid for yield becomes a critical consideration for investors.

Price is all important

Anyone who has owned high yielding stocks over the past year has been very well rewarded. However, performance has come in the form of capital appreciation rather than income.

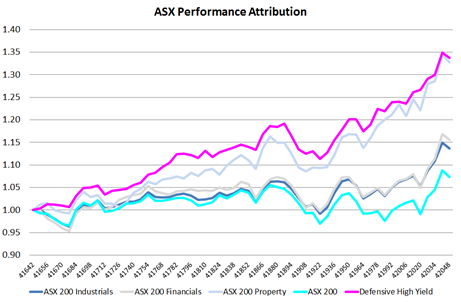

Outlined below is a performance chart of a basket that we created of high yielding stocks with defensive and predictable earnings compared to a number of ASX sectors. These well-known yield stocks are Spark Infrastructure, Transurban, Telstra, Sydney Airport Holdings, APA Group, BWP Trust and Duet Group.

The chart clearly outlines that these defensive high yielding stocks and the property sector have significantly outperformed industrials, financials and the S&P/ASX 200 in 2014. This is despite modest changes earnings expectations. In other words investors are paying more for similar earnings.

It is understandable that investors who require an income from their portfolio will be attracted to higher yielding stocks. However, at this point it has to be asked: at what cost and at what risk does this yield come at?

The challenge is balancing a need to preserve the capital value of a portfolio versus a need for income.

While there are many reasons to believe that interest rates will remain low for some time, over the long term all markets are cyclical. This time will be no different.

We had an important reminder of this last week in the 10-year government bond rate, which moved materially higher following the RBA's decision to cut rates.

Why would long term bond yields increase when the RBA looks like its set to cut the cash rate further this year? The logic goes that a more aggressive policy stance now will lead to less accommodative policy settings in the future.

We aren't suggesting interest rates are likely to move higher any time soon, but what would happen if they did in five years time?

That certainly isn't an implausible scenario. And when will share prices start discounting a higher rate environment?

When considering what would happen to share prices if we returned to a normal interest rate environment, ask yourself these questions:

- Would you pay a PE of 19 times and a 35 per cent premium to the net market value for a commercial property even if it does have good tenants?

- Would you pay a PE of 19 times for a business that hasn't grown its dividend in 7 years and is unlikely to do so materially in the future?

- Would you pay a PE of 19 times for 4.5 per cent yield at an 85% payout ratio for a business with a number of structural headwinds?

If you answered no to any of these questions then you probably shouldn't own Bunnings Warehouse Property Trust (BWP), Telstra (TLS) or Coca Cola (CCL), unless you have a fundamental reason to want to own the stock. Yield is not enough.

With the traditional high yielding stocks now offering a modest 5% dividend (pre-franking), ask yourself how much share price depreciation you could withstand if we entered a normal interest rate environment to justify that income.

It is easy to be comforted into thinking that a business with a defensive and predictable earnings stream is a low risk investment. Those characteristics certainly influence what a business is worth. But investment risk is taken on when there is a difference between price and value. That certainly appears to be the case with some stocks now.

The yield trade no longer pays

Here's what you really need to think about:

- The risk reward proposition of investing in defensive high yield stocks has deteriorated when compared to 12 months ago. These stocks may pay you now but what are the risks of chasing these stocks at current prices?

- When investing in high yielding stocks we prefer buying businesses that have a somewhat sensible valuation. A good example would be Dick Smith (DSH), yielding around 6 per cent, trading on a PE of less than 10 and offering a clearly articulated growth strategy.

- We also prefer buying businesses that have the ability to grow their dividend. We are comfortable with a number of the financials including OFX in this regard as well as CTX as an example in the industrials space.

It would seem the yield trade no longer pays. When buying stocks for their income generating ability, value and the price paid for yield needs to be a primary consideration for any long term investor. In this regard, we prefer to look for companies that can grow their dividend over time or at least have a degree of valuation support.

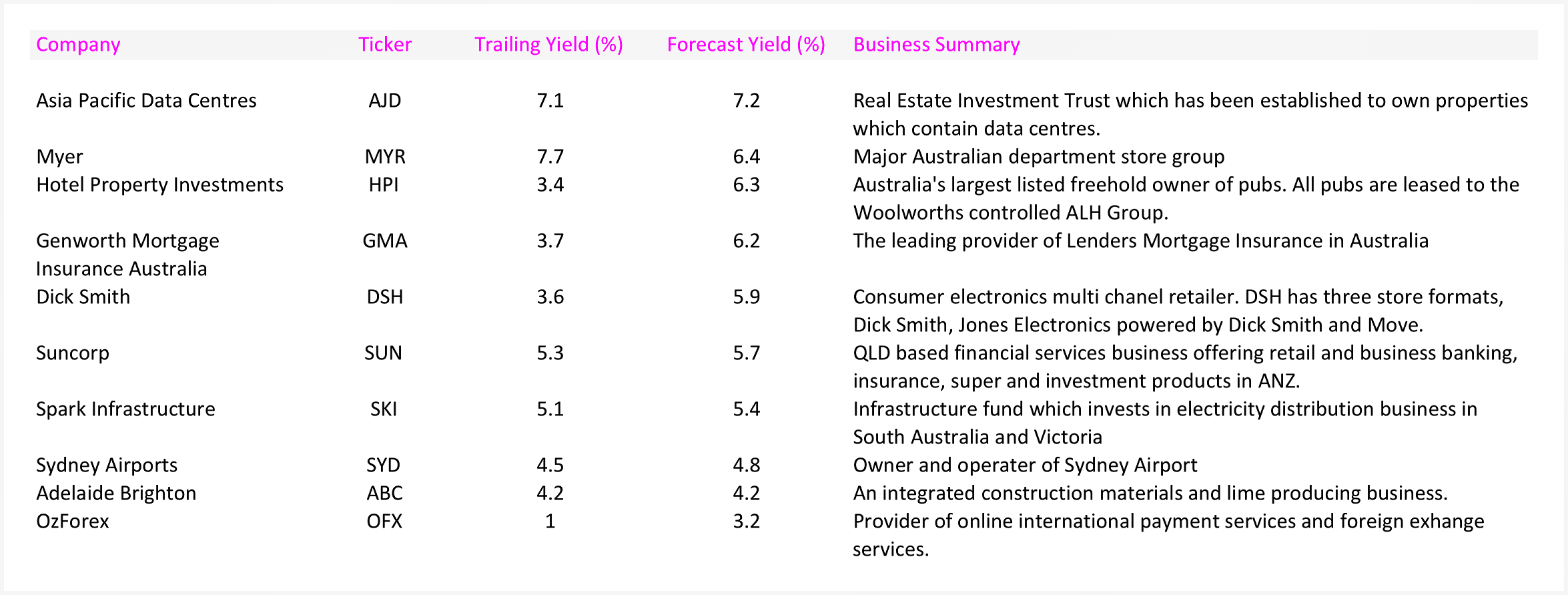

Below we outline below a number of stocks, which still screen to us as worthy of further research when looking to add yield to a portfolio.