Growth stocks: Behind our portfolio's winning performance

Summary: Since inception the Growth First model portfolio is up 21.5 per cent, while the broader ASX200 us down eight per cent over the same period. Over this time we have held 30-40 per cent of the portfolio us cash. Our approach is to find undervalued, high quality growth stories, and the benchmark unaware approach has contributed to returns - for instance, the portfolio has no exposure to the resources sector. |

Key take out: Holdings have been rebalanced as strong performers have started to take too larger weighting in the portfolio. In the last quarter two new stocks - XTD Ltd and Retail Food Group - were added, and going forward we will continue look for new opportunities. |

Key beneficiaries: General investors. Category: Shares. |

The Growth First portfolio declined 2.61 per cent in the first quarter against a decline of four per cent for the ASX200. Since inception on July 1 2015, the portfolio is up 21.5 per cent, against a decline of eight per cent for the ASX200 index.

The approximate 29.5 per cent outperformance has been achieved despite consistently holding 30-40 per cent cash. If the portfolio had been fully invested, the return would have been approximately 30 per cent, with 38 per cent outperformance. The reason the cash level is so high is to allow the opportunity to benefit from any broader market weakness. With the mix of high growth stocks, we held the view that the portfolio would still be able to achieve excellent returns in a positive market despite the large cash position.

We haven't included any fees, but offsetting this we also haven't included any interest income from the cash position.

The strategy behind the portfolio is to find high quality growth stocks, trading at discounted prices. The key reason the large outperformance has been achieved is because we have made no attempt to track the ASX200 index or worry about matching index sector weightings. Financials and resources are the major sectors in the ASX200, yet we have no exposure to either.

A large percentage of Australian fund managers are mandated to be “index aware”: That is, to closely track index sector weightings and only slightly deviate when they have high conviction. They are then monitored on a short term basis, as to how their returns compare to the index. These restricted mandates make it very difficult to achieve large outperformance over the longer term.

A large percentage of Australians' funds are also invested in the ASX100, with many dominated by the ASX20. The Australian market is not diversified and has an unhealthy weighting towards banks and resources. For many funds, it is a function of size and being invested in the largest stocks, but it makes no sense if you are focused on achieving the best returns. Currently, with the market's yield focus many of the larger stocks have poor growth prospects and have record high dividend payout ratios. This further ensures their growth will be below par in years to come.

Some have suggested that because research shows on average active fund managers don't beat the market, it's best to just invest in passive low cost index tracking ETF products. This also makes no sense, as one of the major reasons for under-performance from active fund managers is their restricted mandates that force them to be very much “index aware”.

In our opinion, the best way to achieve longer-term outperformance is to invest in the best quality growth/value opportunities available, and not be overly focused in comparing 1-3 month returns to the index.

Comparison

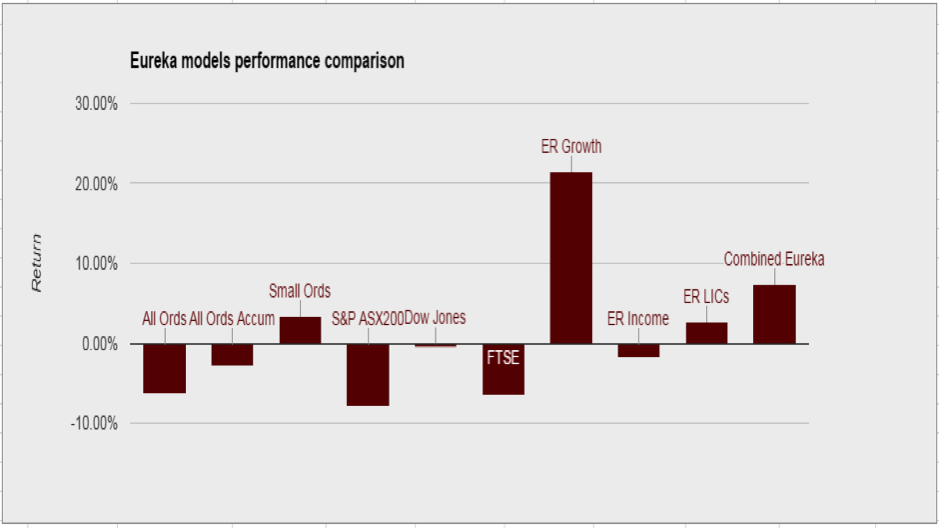

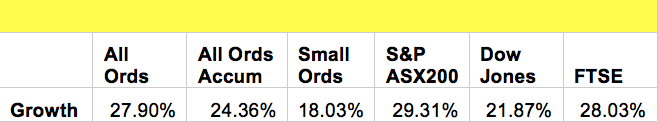

Although we are not focused on short term comparisons, the chart and table below compare our “Growth First” portfolio performance since July 1 2015 (9 months) to some major indices.

Longer term focus

As an example of our longer term growth focus, we can have a look at our highest conviction position in Netcomm (NTC). We have confidence the stock will be well above our current $3.60 target price in two to five years' time. The company is developing a first mover advantage in the $80 billion global rural broadband rollout. Despite our longer term confidence, the share price fluctuations over, say, a six month timeframe, are much more difficult to predict. This longer term confidence of a higher share price, and shorter term uncertainty is a common dynamic for many of the best growth opportunities. If managers are overly concerned by a one to three month performance compared with an index, naturally they will miss out on these longer term opportunities that tend to provide the largest gains.

We measure quality by the strength of the business model, and therefore the level of confidence in earnings projections. Some of the best growth opportunities trade on short term earnings multiple premiums. But there is a big difference between a high PE growth stock with a lack of earnings visibility, and one with earnings certainty and visibility. Therefore it is critical to have a strong enough understanding of the business and industry to be in a position to assess the risk to future earnings and therefore what price you can justify paying for a stock.

Again using Netcomm (NTC) as an example, the stock is currently on a PE of 90 times FY15. This would instantly create the perception for many that the stock is expensive. To the contrary, we would argue the stock is actually cheap. With very conservative assumptions, the stock is currently trading on a PE of 12 times FY19. The key here is the earnings certainty created from both the Australian Rural NBN, and the recently won US Rural broadband contract. Both of these will take many more years to rollout, and our forecasts assume the absolute base case with large upside from both projects. Further, just about every developed nation will be rolling out a rural fixed wireless broadband project, and so far Netcomm (NTC) has won the first two contracts announced. Given there are some European contracts to be awarded shortly, it is highly likely that Netcomm will be winning more work. As we approach 2020, the amount of Machine-to-Machine (M2M) opportunities is only going to increase, and NTC is well placed to benefit.

We also consider traditional “value” stocks, but only if we have confidence around future growth. In recent years there has been a large amount of businesses and industries that have been structurally disrupted by technology. This dynamic is ongoing, and we would argue this means that extra care should to be taken to ensure there is no buying of stocks just because they are cheap based on past earnings. If a business is in the process of being structurally disrupted, then further earnings downside is likely and what looked cheap will become cheaper.

Quarterly changes

During the quarter we added a new six per cent position in XTD Ltd (XTD), the cross track outdoor advertising operator. They are an emerging participant in the fast growing outdoor advertising sector. With an existing seven year rail contract in Melbourne and Brisbane, the company is now focused on winning overseas contracts and developing its “Contact Light” technology.

We also added a new six per cent position in Retail Food Group (RFG) with our view that the company has successfully integrated the three coffee acquisitions from last year. The food and beverage franchisor is well placed for growth, trading at an approximate 20 per cent discount to valuation.

We sold our position in the building fixtures and fittings supplier GWA Group (GWA), with concerns around growth – partly due to poor execution of the company restructure and also our view that the housing construction market is in the process of peaking.

Due to large share price gains, our position in Vita Group (VTG) had increased to approximately 11 per cent. Although we still like the company, we rebalanced it back to 6 per cent, and used the proceeds for the Retail Food Group (RFG) addition.

Portfolio mix

The aim of any portfolio is to optimise returns without taking excessive risk. Despite having two terrible performers in Capitol Health (CAJ) and Empired (EPD), we would argue we have successfully achieved the right mix. Of the 14 stocks in our portfolio, six have been material gainers, five have been roughly flat, one slightly down, and two awful reporters.

With 35 per cent cash, we will continue to add stocks as opportunities arise. However unless there is a severe market sell-off with over-sold bargain opportunities, we are comfortable maintaining a relatively high cash position.

We re-balanced or reduced our position in Netcomm (NTC) three times on the way up, AMA Group (AMA) once and also Vita Group (VTG) once. Although our entry price for NTC was $0.74, the original Eureka buy recommendation at $0.35 is approaching 10-bagger territory.

Company | Entry Price | Current Price | % Profit |

Netcomm (NTC) | $0.74 | $3.18 | 329.7% |

Vita Group (VTG) | $1.70 | $3.20 | 88.2% |

AMA Group (AMA) | $0.60 | $0.92 | 53.3% |

Pental (PTL) | $0.50 | $0.69 | 38.0% |

DWS Ltd (DWS) | $0.95 | $1.17 | 23.2% |

Brickworks (BKW) | $13.80 | $15.60 | 13.0% |

Ridley Corporation (RIC) | $1.25 | $1.27 | 1.6% |

GWA Group (GWA) | $2.28 | $2.31 | 1.3% |

Retail Food Group (RFG) | $5.25 | $5.23 | -0.4% |

Tox Free Solutions (TOX) | $3.02 | $3.00 | -0.7% |

Qube Logistics (QUB) | $2.35 | $2.33 | -0.9% |

XTD Ltd (XTD) | $0.31 | $0.26 | -16.1% |

Empired Ltd (EPD) | $0.76 | $0.34 | -55.3% |

Capitol Health (CAJ) | $0.77 | $0.12 | -84.4% |

Although we re-balanced or sold down our strong performers on the way up, we haven't re-balanced or increased our positions in the two disaster stocks of Capitol Health (CAJ) and Empired (EPD). CAJ is currently 0.8 per cent of the portfolio and EPD is 2.6 per cent. Both of the stocks still have significant uncertainty despite the share price falls, and as such we can't justify increasing our positions at this stage.

Capitol Health (CAJ) has been hit by a double blow of reduced GP referrals in anticipation of changes from the Medicare review, as well as a pending bulk billing rebate cuts due to be enforced from July 1 this year. The GP referral impact has seen declines in CT scans for the first half of FY16 and lower growth in MRI scans in Victoria and NSW.

In a recent company presentation, announced to the ASX in late March, CAJ stated that it has seen a stabilising of referral patterns for the second half to date. As such the company has forecast for the second half to be stronger than the first. However, the company also noted that regulatory uncertainty provides for potential adverse outcomes. One of the potential downside risks is around whether competitors pass on the rebate cut to customers from July this year, or alternatively absorb the pricing hit and use it as a chance to gain market share from smaller competitors.

IT services company Empired (EPD) sees challenges are around the costs from a sales team re-structure and slower than expected integration of acquisitions. In combination with this, the company has absorbed the establishment costs for a number of new contracts. The risk with EPD is more around timing, and another earnings downgrade before they get back on track. We believe the stock is cheap, but also acknowledge the chance that the re-structure takes longer than initially anticipated.

In terms of some of the other positive performers, we remain confident of AMA Group (AMA) continued earnings and share price growth – driven by continued consolidation of the panel repair sector.

Pental (PTL) is making solid traction with its strategy of export sales to China. At $0.69 the stock is fair value if just assuming domestic operations. But with the potential of 15 per cent of sales to be China exports in the next one to two years we are still comfortable with the BUY recommendation at this price.

Qube Logistics (QUB) is working towards final approval for the acquisition of the Asciano Patrick ports business. ACCC approval is the main hurdle from here, and assuming successful it will only improve the company's longer-term growth opportunities. A longer-term view is required with Qube, as we expect they will continue to face difficult market conditions over the next one to two years.

Conclusion

We are pleased with the performance of the portfolio to date, and given the generally weak earnings environment, we believe our strategy of looking outside the top 100 for growth will continue to provide outperformance.