Gottliebsen's Week: Market downturn, Oil, Nevsky Capital, RBS, Danger ahead

Last Night

Dow Jones, down ~2.5%

S&P 500, down ~2.3%

Nasdaq, down ~2.9%

Aust dollar, US68.6c

Market downturn

For the next two months you will have me on a Saturday. Alan Kohler chose a wonderful time to be away.

It has been a torrid Christmas break for equity markets and I would like to share with you my experiences over this period, which have certainly helped me understand the forces that are driving the current market downturn. And as I will describe later, those forces have caused me to slightly adjust lower my equity percentages but work out a likely outcome. In summary a number of people whom I respect around the world have suddenly become much more cautious than they have been in recent years. And because they are widely followed, their caution – and the reasons for it – has had multiple effects on the market.

Just before Christmas I received an email from the man who in former years was recognised as close to the best economist in the US, Albert Wojnilower.

Al is now in his eighties but from time to time comes up with remarkable insights. And in this pre-Christmas email he pointed out that the US had taken significant steps to make its large banks safer but the gap has been filled with non-bank institutions which have grown rapidly, partly from the making and packaging of loans.

Many of these loans are commodity based and the packages have been sold to a range of different groups. They are now showing large losses but no one fully understands exactly where the losses are and the exercise has clear resemblances to what happened in 2008.

According to Wojnilower, while individual investors and taxpayers are better sheltered than before, the wider economy may be at greater risk.

Oil

Come January and the well regarded chief investment officer of Trend Macrolytics, Donald Luskin, pronounced that the global economy is slipping into recession. That recession is showing up in all the usual ways including slower output growth, slumping purchasing managers' indexes, widening credit spreads, declining corporate earnings, falling inflation expectations, receding capital investment and rising inventories.

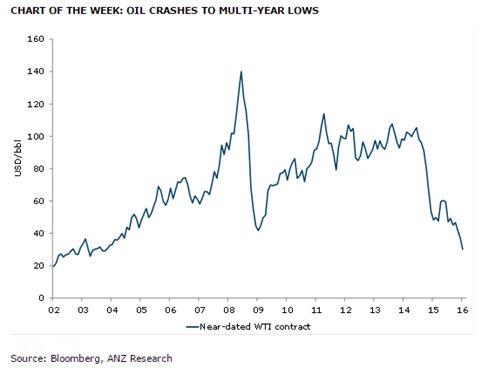

But according to Luskin, what makes the current situation unusual is that the biggest driver of the downturn is falling oil prices, mainly because the market has been flooded with American oil.

The misery created for those involved in the energy industry is spilling over into the economy generally so the US non-investment bond market is in tatters. US banks have syndicated leveraged loans worth $US276 billion for the oil and gas industry, 15 per cent of which are now regarded as distressed.

These blows reverberate around the world and include difficulties in a wide range of oil producing countries, which again has an impact on the debt market. As those sentiments from Luskin spread around equity markets, they added increased nervousness.

Nevsky Capital

But what really knocked markets was the decision by the $US1.5bn hedge fund, Nevsky Capital, to call it quits and return its money to its supporters. Nevsky Capital has been one of the best performing funds in the world and predicted the 2009 crash.

Nevsky Capital is a fund that has been brilliant at analysing corporate results and global economic trends by constructing and maintaining detailed economic forecasts and company models. But now it says that is becoming more and more difficult to do, as a greater amount of the global market is being driven by what's happening in China and, to a lesser degree, India.

The Nevsky Capital group is finding that the economic figures coming out of both countries are less and less reliable. China claims its GDP growth is 7.1 per cent and India claims its own GDP growth is 7.4 per cent.

Nevsky says that both GDP estimates are substantially overstated. “This obfuscation and distortion of data, whether deliberate or inadvertent, makes it increasingly difficult to forecast macro and hence micro trends for an ever growing share of our investment universe,” the fund said in a note to investors.

In addition, corporations have responded to greater market scrutiny since the global financial crisis by disclosing less, not more, of their information on the basis that the less they reveal the less they can be often proved wrong by regulators, investors or law courts. As a result the likelihood of earnings projections being proved wrong has become much greater.

At the same time, Nevsky says, the new regulations introduced as a result of the GFC have largely removed the market-making role of investment banks and this coincided with a massive increase of the share of “dumb” index funds and “black box” algorithmic funds. This can create major distortions in the market. A statement like that from Nevsky unsettled the market.

RBS

On top of that came the Royal Bank of Scotland's advice to its clients to brace for a cataclysmic year and a global deflationary crisis that could send markets down by 20 per cent. I emphasise that, to say the least, the Royal bank of Scotland does not have anywhere near the record of groups like Nevsky Capital.

RBS' research chief for European economics says that global trade and loans are contracting – a nasty cocktail for corporate balance sheets and equity earnings. This is particularly ominous given that global debt ratios have reached global highs. Like Luskin, RBS sees the fall in oil prices as dangerous for world economies and believes the decline in China has set off a major correction, which will snowball.

Danger ahead

As these sorts of sentiments spread throughout the world we are seeing a rush to quality, with the US bond rates in the market going into decline despite the Federal Reserve interest rate increase in December.

That yield decline will almost certainly cause substantial losses for those who have shorted US bonds on the expectation of greater profits from the effect of higher US interest rates on bond values.

It is clear from what is happening in the Shanghai sharemarket that all is not well in the China capital scene and Chinese leaders are on the wrong foot and seem more interested in political forces and maintaining power. I believe the leadership problems in China are a real danger.

And of course we have the US election at the same time. What this tells us is that the level of risk in global markets has increased. It doesn't necessarily mean that there is going to be a catastrophe but risk levels have increased. In Australia, a great many people shifted money from bank deposits to equities because of the yield. Those that have done this in the last six to 12 months are having a tougher time. It is difficult to sell because that lowers income levels, given the current rates.

For what it is worth I don't think the world is about to fall in but the markets are alerting us to greater dangers. The current earnings season in the US will be important because I still believe the US is the best prospect of driving the world out of its current problems.

I have not followed Nevsky and Royal Bank of Scotland and exited but, particularly in the light of Nevsky, I have slightly trimmed my equity exposure.

With this volley of warnings, if you take no action at all and they prove to be even half right you will feel bad. But there are a couple of bull points that will become more apparent in coming months. There is very little prospect of the US further increasing interest rates in the next few months. That means the value of dividend yields that have been created by this market fall becomes even greater, provided companies can maintain their dividend rates.

There is no doubt that the market pricing of resources companies, and to some extent banks, is based on the expectation that dividends will be reduced. But in the case of banks there is no certainty of that.

Finally, given that China has become totally unpredictable, the great danger for Australia is that the current flow of money out of China into Australian property may be turned off. Certainly that is not what Chinese investors out here are expecting and they have every intention of completing investments that they have entered into and perhaps go for more. But for any country like China, where there is turmoil there can be no certainties.

Readings & Viewings

Crude reckoning: what will the oil price slump mean for the global economy?

Mohamed A. El-Erian: The Chinese Economy's Great Wall.

How the Fed could find a new foe on Wall Street.

RBS cries 'sell everything' as deflationary crisis nears.

Yet another unattractive dimension of the foreign student education boom.

Shaping the Fourth Industrial Revolution

Essendon CAS verdict: No winners - or are there?

Edward Luttwak, a man worth reading at least once.

Class act Helen McCabe steps down after six years editing Australian Women's Weekly.

Any winners in the US Powerball's $1.5 billion draw should take the annuity.

Star Wars: will the force finally awaken in China?

What GoPro can teach us about investing in fads.

The true reach of Netflix.

Searching for oil in North Korea.

China's Legendary Hollywood studio buy.

Stunning images from the Harbin ice festival in China

RIP David Bowie: What a wonderful, long-distance artist he was. You might know plenty of Bowie material, but maybe … just maybe, you have not seen him do Comfortably Numb with David Gilmour at the Royal Albert Hall. Either way this is a treat.

David Bowie: The man who sold the world ... and bonds. ($)

How David Bowie turned his own death into a piece of art.

Last Week

By Shane Oliver, AMP Capital

Investment markets and key developments over the past week

It's been more of the same over the last week with worries about China, global growth and falling commodity prices led by oil continuing to rattle investors. So share markets have remained under pressure, commodity prices continued to slump with oil hitting $US30/barrel for the first time since 2003 and bond yields fell further helped by safe haven buying and falling inflation expectations. Fortunately it hasn't all been one way for shares and there have been a few up days. So while most share markets are down for the week led by China again, the losses are more constrained than last week.

With worries about global growth likely to linger we could still see more downside in share markets in the short term that could see developed markets including Australian shares follow emerging markets into a bear market (defined as a 20 per cent decline – as measured against last year's highs). However, there are some positive signs:

First, economic data over the last week has been mostly okay.

Second, the Chinese Renminbi appears to have stabilised for now albeit helped by jawboning by Chinese officials and People's Bank of China intervention.

Third, sentiment is starting to get very negative as highlighted by all the coverage given to the “RBS tells investors to sell everything” story. This is a sign we may be getting closer to the capitulation that usually presages market bottoms

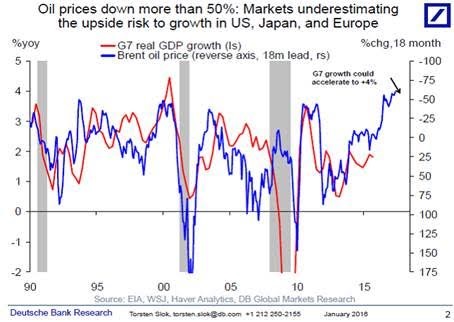

Fourth, while the ongoing plunge in commodity prices, and particularly oil prices is bad news for producers its great news for consumers. I don't normally do cut and paste jobs here but ran out of time and this chart from Deutsche Bank, highlighting that normal lags suggest that the bulk of the boost to G7 GDP growth from lower oil prices is ahead of us, caught my eye. I am not in the 4 per cent growth camp for the G7, but it is a significant growth boost operating in the other direction to all the gloom and doom now building up.

Finally, I suspect we are getting close to the point where developed central banks start to act, not necessarily by easing but by sounding more dovish. This may already be starting at the Fed with St Louis Fed President Bullard expressing concern that the latest fall in oil prices will delay a return in inflation to target at a time when inflation expectations are falling. Bullard is often seen as a bellwether at the Fed so his new-found dovishness may reflect similar views from key Fed officials. A March Fed rate hike is starting to look less likely and I remain of the view that the Fed will struggle to put through the four rate hikes for this year shown in its “dot plot”. Two at best but the risk is one or none – a bit like last year.

The Bank of Japan is also likely to be under renewed pressure to step up its easing as the rising Yen and plunging oil will make it even harder to head towards its inflation target.

For those worried that the run down in China's foreign exchange reserves will push up US bond yields – don't. At least not now anyway. Despite a $US500bn fall in China's FX reserves last year, US bond yields were little change and so far this year they are falling. Clearly other investors are filling any gap. The time to worry would be when global investors are confident (so not buying bonds) and China is still selling FX reserves.

Major global economic events and implications

US economic data was mostly okay with a slight rise in small business optimism, solid readings for job openings and hiring and the Fed's Beige Book of anecdotal evidence pointing to “modest” to “moderate” growth.

Japanese data was mixed with stronger economic confidence but weaker machinery orders.

Chinese data for exports and imports surprised on the upside in December and vehicle sales continued to surge helped by tax incentives. While strong trade with Hong Kong may warn of over invoicing and disguised capital outflows the overall picture is consistent with Chinese growth stabilising as opposed to collapsing.

Australian economic events and implications

Australian jobs data yet again surprised on the upside with employment falling just fractionally after two exceptionally strong months of jobs growth and unemployment remained down at 5.8 per cent. It's hard to believe that jobs growth is really running at 2.6 per cent year on year – or a whopping 4.6 per cent year on year in NSW – at a time when economic growth is just 2.5 per cent. Statistical distortions appear to be at work here rather than an economic boom. By the same token underlying jobs growth is still likely to be solid as low wages growth and growth in low wage jobs in industries like retail and construction in NSW and Victoria make up for the slump in mining related jobs in WA. Incidentally, various labour surveys (eg, ANZ job ads, ABS job vacancies and the NAB business survey employment component) are all at levels consistent with reasonable jobs growth. Maybe not just as strong as the official figures show. While we still see the case for more RBA rate cuts and a lower $A, the bottom line though is that the economy is a long way from the collapse many fear.

Housing finance rose more than expected in November, but mainly due to owner piers. Finance to property investors rose slightly but this followed sharp falls in previous months indicating that APRA measures designed to cool lending to property investors are still working.

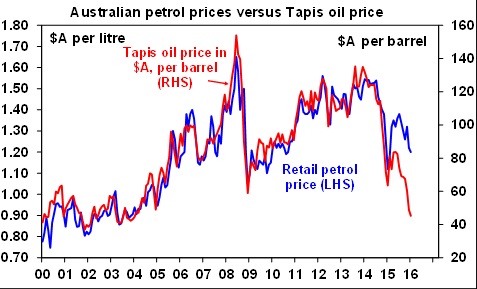

Meanwhile back to petrol prices (a favourite topic given my car). Given the crash in oil prices including Asian Tapis grade oil in Australian dollars, petrol prices in Australian cities should be pushing down to 90 cents a litre. High refinery margins based on Singapore refined petrol prices seem to be the main issue here.

Next Week

By Craig James, CommSec

Jobs and lending in focus

A mixed bag of Australian economic indicators is scheduled over the coming week including gauges of inflation and consumer confidence and lending.

The week kicks off on Monday with the release of the monthly inflation gauge and new vehicle sales data.

The monthly inflation gauge should confirm inflationary pressures are contained with headline inflation still below 2 per cent.

The new vehicle sales data is the Bureau of Statistics' take on the industry data that has already been released. Vehicle sales stood at record highs in the year to December.

On Tuesday, the ABS releases data on both the imports of goods as well as lending finance. Sadly the December publication on imports is the last to be published.

The lending finance data shows the value of new loans taken out across housing, personal, lease and business loan categories. In October, total new loans eased from 7½-year highs, down by 0.7 per cent to $74.6 billion.

Also on Tuesday, the ANZ/Roy Morgan consumer sentiment survey is released. Recent declines in the Aussie dollar and sharemarket have dented consumer optimism.

On Wednesday the ABS releases the Building Activity publication for the December quarter. Not only does the data show the work done on commercial building, it also includes figures on the commencement of work on new houses and apartments — the next stage of the housing pipeline after building approval (approval by local councils). Starts fell by 3.2 per cent in the June quarter.

Also on Wednesday, Westpac and the Melbourne Institute provide the monthly variant of consumer confidence. Confidence levels have been up and down over the past month but the monthly survey will be based on interviews conducted over the weekend of January 16-17.

On Thursday the ABS releases detailed job market data include dissections of data on a regional or demographic basis. And on the same day, the Housing Industry Association will release the data on new home sales for November.

Chinese economic growth in focus

Chinese economic data dominates the early part of the week while US economic data is a mixed bag of leading indicators and surveys and data on housing activity.

The week kicks off in China on Monday with the release of home price data for December. Prices are up 0.9 per cent over the year.

On Tuesday, China releases economic growth data for the December quarter as well as activity data for the December month. Economists expect that the economy grew 6.8 per cent in the year to December.

After a holiday on Monday, in the US the week kicks off on Tuesday with the Housing Market index, data on capital flows and the usual weekly data on chain store sales.

On Wednesday the all-important data on consumer prices is released — timely, given that the figures are one week out from the first Federal Reserve meeting of 2016. Core (underlying) inflation is up 2 per cent over the year. Data on housing starts is also released on Wednesday with weekly mortgage data.

On Thursday the influential Philadelphia Federal Reserve survey is issued together with the weekly data on new claims for unemployment insurance (jobless claims).

And on Friday the leading index is released together with data on existing home sales. The leading index may have lifted 0.2 per cent in December while existing home sales may have clawed back 9 per cent of the 10.5 per cent lost in November. The ‘flash' or preliminary purchasing manager indexes for January are released in the US and Europe.

Sharemarkets, interest rates, exchange rates and commodities

The US earnings season cranks up a notch over the coming week with around 130 companies scheduled to report. On Tuesday, earnings are expected from Bank of America, Morgan Stanley, IBM, Advanced Micro Devices and Netflix.

On Wednesday, 27 companies are scheduled to report their results including Goldman Sachs.

On Thursday as many as 63 companies are to report. Included are Travelers, ResMed, E*TRADE, American Express and Verizon. And on Friday General Electric is among those to report.

Commodities

Commodity prices are largely in retreat. But the CRB Textiles index (cotton, wool, print cotton & burlap) has been a rare exception. Since the lows in late September, the CRB Textiles index has lifted by around 4 per cent. In good news for the Australian economy, the wool price is up 19 per cent over the year with cotton up around 1 per cent.

* You will note below that there are fewer articles than usual. We published just one edition this week but will resume normal publication from Monday.