Gottliebsen is wrong on renewables tax

Yesterday my fellow columnist, Robert Gottliebsen, made the rather provocative claim – based on an interview with Origin Energy’s CEO Grant King – that while the carbon tax was about to disappear, it would be replaced by a “renewables tax”.

Excusing the fact that labelling it a ‘tax’ is kind of strange given it raises no revenue for the government, are electricity consumers about to be hit by some huge new regulatory impost?

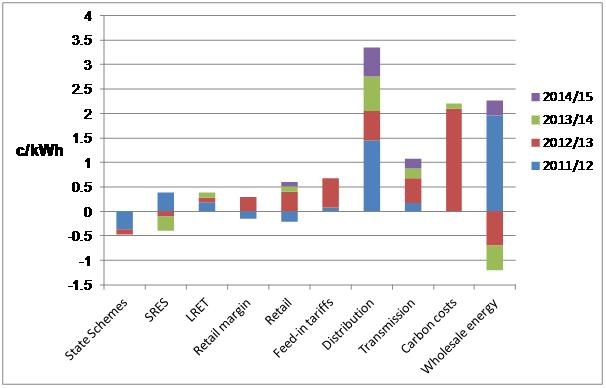

To help us with answering this question I need to resort to the chart below that was previously published back in March. This is based on data from an Australian Energy Market Commission report entitled, ‘Possible future retail electricity price movements’.

For those who think a great big renewables tax is headed your way you need to look at the bars with the labels ‘SRES’ and ‘LRET’. These represent the small-scale and large scale components of the Renewable Energy Target.

The SRES did add nearly half a cent to retail prices in 2011/12 due to a surge in the popularity of solar PV. But since then the cost of this scheme has reduced, meaning your electricity bill will not have risen all that much due to this scheme. With the LRET the cost is rising slowly but steadily. Yet if it constitutes a great big new tax, then I wonder what you make of the rise in retail costs and margins of companies like Origin Energy, let alone distribution networks.

Individual components driving changes in household electricity prices (2011/12 to 2014)

(negative values mean component reduced prices in that year)

Source: AEMC (2011) Possible Future Retail Electricity Price Movements: July 1 2011 to June 30 2014; and AEMC (2013) Possible future retail electricity price movements: July 1 2012 to June 30 2015

Now it is true that the cost of the LRET will be greater than shown above due to the expected drop in the carbon price as we move to trading. However the SRES will be largely unaffected by a lower carbon price. That’s because households installing solar are reacting to the delivered retail price of about 30 cents per kWh. The move to an ETS will mean this will drop to about 28.5 cents – likely to be lost in the noise of other factors increasing electricity prices.

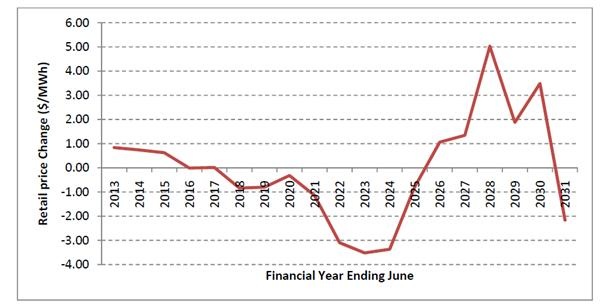

In terms of the lower carbon price impact on LRET, this has actually been analysed in detail by energy market analysts and engineering firm Sinclair Knight Merz. They assumed the fixed price would remain for a further year, but after this the carbon price would plummet to about $10 on July 2015 and stay below $15 until 2022.

While this isn’t a perfect representation of current circumstances, it should give us a feel for whether a great big renewables tax is headed our way.

The chart below illustrates the difference in retail prices under the current RET relative to Grant King’s proposal to reduce the target in line with a drop in electricity demand (what he calls a “real 20 per cent” target).

In the first few years the cost of keeping the current target is less than a dollar greater per MWh. To put in the same scale as the chart above it would mean an extra 0.1 cents per kilowatt-hour. After 2025 it adds up to an extra 0.5 cents at its peak. This is still well below the 2 cents associated with the carbon tax, and roughly equivalent to the retailers ‘tax’ if we insist on labelling everything with Abbott-style inflammatory language.

Interestingly, from 2018 until 2025 the cost of the larger RET is rather strangely cheaper than the smaller target.

Retail price difference between current RET and a “real 20%” target

(negative values mean current RET will result in lower prices)

Source: Sinclair Knight Merz-MMA (2012)

How on earth could the cost to consumers of more renewable energy be lower than the cost of less renewables?

To answer that it might help to also ask: why are incumbent electricity generators complaining so bitterly about the RET now that electricity demand has dropped away?

Maybe it’s just because they are kind hearted souls who care deeply about the welfare of consumers.

However the generators find themselves in a market that is now heavily oversupplied with generating capacity. And the RET is going to add even more generating capacity. Worse this capacity has no fuel costs and so bids into the market at very low prices.

The end result is that even though a proportion of your electricity bill is higher to pay for that 20 to say 25 per cent increment of your electricity coming from renewables; you pay slightly less for the remaining 75 to 80 per cent of electricity supply.

So that’s households, what about business?

Well according to ABS data electricity would struggle to get above 3 per cent of most industries’ costs. So this so called renewables tax at worst would add 0.06 per cent to costs.

For big energy users, such as aluminium smelters, they receive an exemption equal to around 90 per cent of the cost of the RET. As explained in an October article this means they actually end up saving money from the RET. That’s because they gain more from the reduction in wholesale electricity prices than they lose from having to pay for Renewable Energy Certificates.

Farewell carbon tax, welcome renewables tax? Not really.