GDP joy rings hollow for the RBA

Growth was stronger than the market expected in the December quarter but the economic outlook is still fraught with challenges. The Reserve Bank of Australia will be reluctant to make a commitment on interest rates until it has a better grasp of the mining investment collapse and the Coalition’s budget intentions.

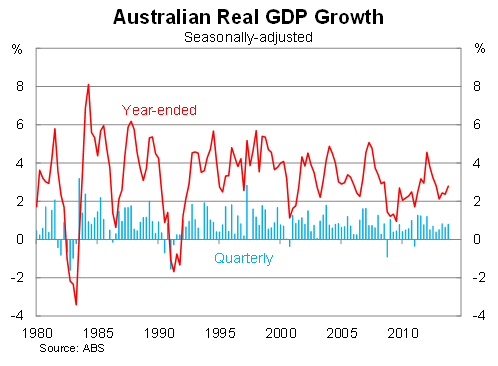

Real Gross Domestic Product rose by 0.8 per cent in the December quarter, beating market expectations to be 2.8 per cent higher over the year. Annual growth remains below trend but has picked up over the past three quarters.

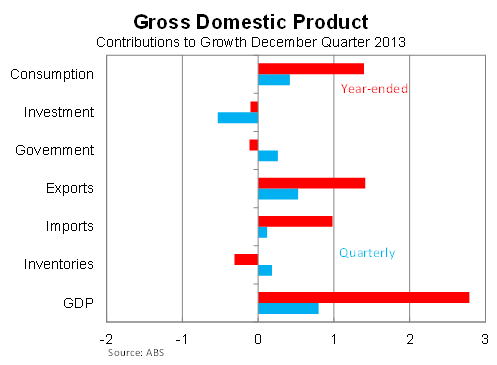

The RBA will be pleased to note that growth has been concentrated among the interest rate sensitive areas where they have targeted rate cuts. Consumption growth was solid in the December quarter, while the fall in the Australian dollar over the second half of 2013 spurred exports while cutting imports.

Non-residential investment fell by 1.9 per cent but is actually up 7.4 per cent over the year. By comparison, residential investment rose in the December quarter but remains remarkably subdued given the number of building approvals. Nevertheless I still expect residential investment to pick up throughout 2014, though perhaps not as much as some are expecting (Why the high rise is not a tower of strength, March 4).

Government spending rose by 1.2 per cent in the December quarter, following strong growth in the September quarter. This was largely driven by state and local governments, with the federal government making a modest but positive contribution.

Net exports continue to be a driving force for the Australian economy and that is expected to remain the case over 2014. Exports have benefited from a lower Australian dollar, which fell significantly over the second half of 2013. However, the dollar has shown resilience in 2014 and that might slow the momentum of exports a little in the coming quarter.

Although the RBA will certainly be pleased with today’s outcome it’s unlikely to waver much from its point of view. Remember, this GDP data is from the December quarter -- by March it will be positively ancient. The Reserve Bank will have already refocused on more timely measures such as retail sales, employment and housing activity.

Sometimes, as analysts, we can get fixated on the present -- which in economic terms means we are fixated on the often irrelevant past. But given the lengthy lags with which interest rates affect growth this is not a luxury afforded to the central bank. Instead it must focus on the outlook, and unfortunately that remains challenging.

The most problematic forward-looking indicator -- and the one that will be giving the Reserve Bank the most headaches -- is the impending collapse of business investment. In fact, business investment has already started falling, with machinery and equipment spending down almost 9 per cent in the quarter.

Business investment intentions indicate that the decline will be sharp but certainly not short. The rise in mining investment throughout the boom was largely unprecedented but don’t be surprised if the eventual decline is without precedent as well. The RBA will certainly want to have a better read on investment before making a commitment to raising rates.

In addition, investment has implications for job creation, which is problematic since the economy is already failing to generate sufficient jobs. A failure to create jobs will inevitably have implications for household incomes and spending.

Finally, the Coalition has stated a clear desire to cut spending and that will certainly weigh on growth over the next few years. The budget poses a great deal of uncertainty for the Australian economy and the outlook for the Reserve Bank.

Although today’s data looks great, it’s the more timely indicators that should receive our attention. The Australian economy still faces some significant challenges -- none greater than the collapse in business investment -- and the RBA will be reluctant to commit to higher rates until it has a better feel for how the economy will progress in 2014 and 2015. Under the circumstances it is no surprise that it has signalled a lengthy period of unchanged rates.