Gasping in Krugman's ocean of theory

A sudden eruption, and the surprise of realising that the world he understands is not the one he actually inhabits. – Paolo Bacigalupi, The Windup Girl

This time really is different.

Stock markets are crashing after a runaway boom. Again. And the financial sector is peddling complex derivative products. Again. (Check out the US satirical rag The Onion’s brilliant take on this: “Financial Sector Thinks It’s About Ready To Ruin World Again”)

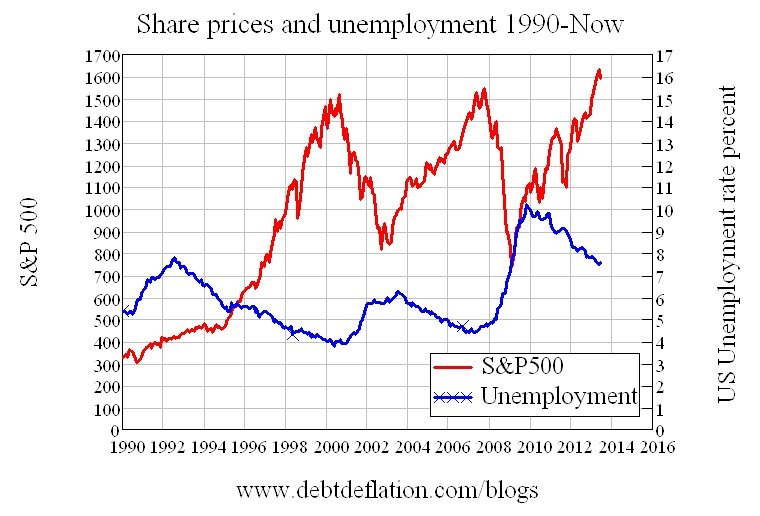

But whereas previous periods of Wall Street mayhem have been preceded by a Main Street boom, this one hasn’t. We’ve re-entered a period of financial market volatility with unemployment still within cooee of its peak during the 1990s recession (see figure 1– which doesn’t factor in the changes in the definition of unemployment since 1990, and the fall in the participation rate during this downturn).

Figure 1: Wall Street versus Main Street

The extent to which this time really is different appears to be causing some thawing in the extreme hostility between economists of different ilks. But there’s still incomprehension because, when economists of different ilks argue, they try to understand their rivals’ perspectives from their own point of view. This is a bit like a bird trying to comprehend how a fish can live in the ocean – “OK, I have to admit that they exist, but why don’t they drown instead, since their lungs must fill up with water?”

This duality – acknowledgement that positions you don’t understand still deserve to be taken seriously, combined with incredulity about those positions – turns up in Paul Krugman’s recent comments on Richard Koo. In a New York Times article earlier this month, he firstly acknowledges that Koo’s analysis has to be considered, even if he doesn’t understand it:

“Second, I’m surprised that Garcia doesn’t mention Richard Koo, who would seem to be the prime candidate on the fiscalist side for someone who is adamant that we not try monetary policy on the side. I’ve written about my puzzlement over Koo’s position.

“The main thing, I think, is to recognise that while we have our differences, the important thing is to try everything that might help. The greatest intellectual sin here is to care more about protecting your turf — my answer is the only answer! — than about the real economy that desperately needs every form of help we can deliver.”

But he also, in the same week, emphasises that from his point of view, Koo’s position makes no sense:

“Maybe part of the problem is that Koo envisages an economy in which everyone is balance-sheet constrained, as opposed to one in which lots of people are balance-sheet constrained. I’d say that his vision makes no sense: where there are debtors, there must also be creditors, so there have to be at least some people who can respond to lower real interest rates even in a balance-sheet recession.”

I happily salute Krugman’s willingness to acknowledge positions he doesn’t understand on their track record alone – and Richard Koo definitely has a good track record. I’m going to attempt here to explain Koo’s position in a manner that might at least help Krugman to realise where the differences emanate from, even if I don’t convince him that Koo is in fact correct.

To me, Krugman’s inability to comprehend Koo is a classic “bird and fish” problem: the bird doesn’t understand the fish, because the bird knows about lungs, but doesn’t know about gills. In this economic case, the Krugman bird knows a ‘loanable funds’ model of the world in which banks don’t matter, while the Koo fish inhabits an ‘endogenous money’ world in which banks are essential and in which, because of bank lending, the entire economy can indeed be ‘balance sheet constrained’.

In the interests of helping the bird understand the fish (and also to show off my INET and Kickstarter funded Open Source Minsky software, which is finally at the stage where I'd like others to start using it), I've constructed a model of Krugman's vision of lending that, with a few quick mouse flicks, can be turned into a model of Koo's vision of lending (and mine). These are the files (to download them, right click and choose "Save As" otherwise your screen will suddenly fill with XML gibberish):

Krugman set out his model of lending in his comments on me in the New York Times last year, and in his book End This Depression Now! Firstly, banks aren’t important, he says:

“Keen … asserts that putting banks in the story is essential. Now, I’m all for including the banking sector in stories where it’s relevant; but why is it so crucial to a story about debt and leverage?”

Secondly, lending is just a transfer of money from patient people to impatient people:

“Keen then goes on to assert that lending is, by definition (at least as I understand it), an addition to aggregate demand. I guess I don’t get that at all. If I decide to cut back on my spending and stash the funds in a bank, which lends them out to someone else, this doesn’t have to represent a net increase in demand."

And also:

“Think of it this way: when debt is rising, it’s not the economy as a whole borrowing more money. It is, rather, a case of less patient people – people who for whatever reason want to spend sooner rather than later – borrowing from more patient people.”

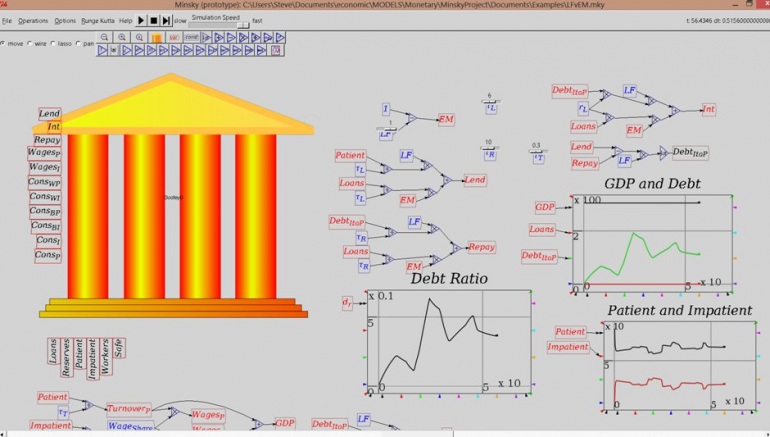

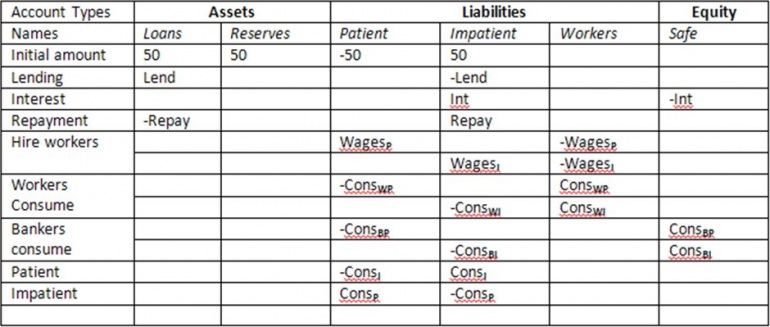

This treats banks as mere intermediaries in lending: they enable ‘patient agents’ to lend to ‘impatient agents’, but you can otherwise ignore them in macroeconomics. This is modelled by the table in figure 2, which has banks storing money for both patient and impatient agents, but they are just intermediaries: the actual lending is from the patient to the impatient agents, and banks play no active role in the model.

The table uses the accounting-like conventions of Minsky: Assets are shown as positive while liabilities are shown as negative (as is equity), while the source of any flow is shown as positive and its destination as negative. These conventions ensure that all rows sum to zero, which in turn ensures that there are no accounting errors in the table. I also assume that both ‘Patient’ and ‘Impatient’ are capitalists who use money to hire workers who then produce output that is sold to all and sundry.

The financial operations are simple: Patient lends to Impatient, Impatient pays interest to Patient and repays debts over time.

Figure 2: Loanable Funds lending with a banking sector

In additional, all social classes spend based on their current bank account balances, and GDP is the turnover of money through the accounts of Patient and Impatient, who together constitute the firm sector of this toy model of a monetary economy.

When this model is simulated, radical variations to the rates of lending and repayment have absolutely no effect upon GDP: the debt ratio can go sky-high or crash, and the economy sails on regardless: the aggregate level of debt, and changes in the level and rate of growth of debt, are truly macroeconomically irrelevant.

Figure 3: Debt is macroeconomically irrelevant in Loanable Funds. Click here to see a YouTube movie of this model.

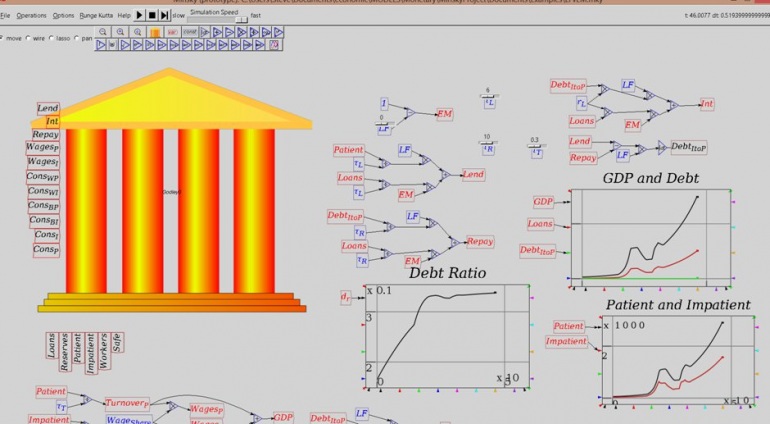

Now let’s change over to the ‘endogenous money’ view of lending that I have, which is compatible with Richard Koo’s approach (and Richard, if you want to correct me on this claim, please do so!). All it takes is four changes to figure 2: the initial 100 is now shown to be half due to the deposit by Patient and half due to loans by the bank to Impatient; lending is now from the banking sector to Impatient, interest payments now go to the banking sector’s income account (“Safe”), and Impatient’s repayments go to the banking sector’ loan account, not to Patient’s deposit account.

Figure 4: From Loanable Funds to Endogenous Money in four mouse swipes

Though the changes to the table are minor, the change in the behaviour of the model is dramatic. Variations in the rate of lending and the rate of repayment now have a drastic impact upon GDP, because they vary the amount of money in circulation. GDP rises if lending occurs more rapidly, and falls if lending slows down or the rate of repayment rises.

Figure 5: Changing lending and repaying drastically alters GDP. Click here to see a YouTube movie of this model.

The reason for this drastic change in behaviour is that in both these models – and roughly speaking, in the real world too – money is the sum of the banking sector’s liabilities to the rest of society. In loanable funds, lending simply changes who holds these liabilities, and the level of debt doesn’t matter at all in macroeconomics – just as Krugman says. Only changes in the velocity of circulation can affect aggregate economic activity. But in endogenous money, lending increases the sum of liabilities in circulation, and repayment of debt reduces them, so that changing the sum in circulation can and does alter aggregate economic activity. So while we haven’t “suddenly become strict monetarists while [Paul] wasn’t looking?”, changing the volume of money in circulation by bank lending and repayment is a significant aspect of lending that the loanable funds model ignores.

Though I don’t demonstrate it in this simple model, it is also quite possible for the entire economy to take on too much debt, and to cause a crisis like the one we’re in (as I’ll illustrate in the last of my instability series shortly).

So it comes down to which world do we actually inhabit? Are we airborne with the birds in a loanable funds world, where banks, debt and money are macroeconomic irrelevances, or are we underwater with the fish in an endogenous money one where banks are – like gills on a fish – crucial? No prizes for guessing my answer. Glug glug.