From tailwinds to headwinds but I'm still in this market

Summary: In April, bond prices and perhaps high yielding shares hit a peak. Outstanding headwinds include a looming rise in interest rates, an end to QE, a commodity bust and a falling Australian dollar. Maybe investors have to weather lower returns for a while. |

Key take-out: The wrong answer for most is not to take on more risk. Perhaps in our local market there is now more value than offshore. It's also worth thinking about equity income strategies, currency hedging and inflation linked bonds. |

Key beneficiaries: General investors. Category: Strategy |

They say no one ever rings a bell to signal the top of the market has been reached. However my guess is the bell rang around April 1 this year.

The first day of April signalled a peak in bond prices – perhaps even one that might not be reached again in our lifetime. Fittingly being April Fools' Day, that was when the local bond market suggested Australian bond investors would be fairly rewarded locking into a 2.3 per cent annual yield, for 10 years lending to the Federal Government, or for 5 years lending also to higher risk companies. These yields have lifted off those extreme lows and are now closer to 3 per cent.

Some evidence suggests the tradition of playing pranks on this date originated in Germany, which is fitting as there the promised 10-year Government bond yield at that time had hit a low of 0.3 per cent – “Jemanden in den April schicken” (April Fools!/Send someone into April!). They are now at least double that and still a joke.

This date may also prove to be a local peak in the price of high yielding shares and other bond substitutes. New investors then had to believe that CBA was good value at $96 per share – it is now priced in the low $80s (and is currently in a trading halt after announcing an equity raising to offer existing shareholders one new share for every 23 existing shares at $71.50).

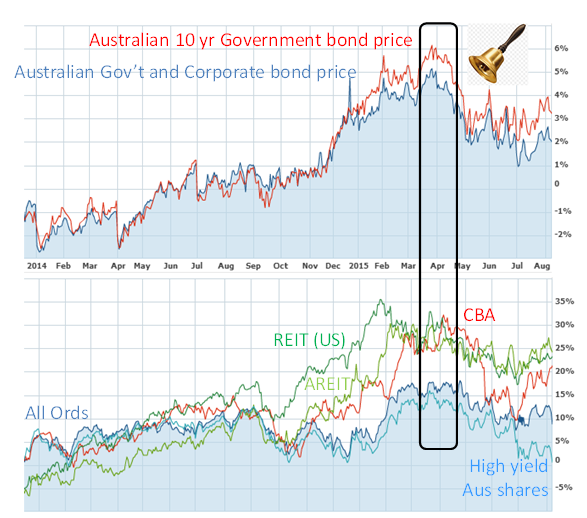

While the broader share market has fallen about 7 per cent since April 1, bank shares and also a broader basket of high yield shares (including bank stocks) are down about 15 per cent and local and overseas listed property trusts are down 5 and 15 per cent (Figure 1).

That's the bond and share markets... with reports of James Packer selling his Sydney home for a record $70 million, I wonder if we have also just heard the gong marking a peak in overheated parts of the residential property market?

Figure 1: Price change since January 1, 2014 of Australian bonds (above) and the All Ordinaries broad share market index, an index for local high yielding shares, CBA, US and local REITs (below).

From tailwinds to headwinds

Putting this into a broader strategic perspective, I believe the brief but sharp fall in the local share market we saw in early August is just part of a transition where tailwinds that propelled investor portfolios to above average returns are turning around and becoming headwinds, destined to slow future returns.

Forgive me if I prove to be wrong but I think the investment climate has changed.

Powerful tailwinds that have propelled forward investor returns include:

• Falling interest rates which rewarded bond investors and long duration depositors

• … and fuelled the interest in high yielding bond substitutes

• Declining credit spreads rewarding those who lent to lower credit quality companies

• Money printing which further drove up the prices of bonds

• A commodity boom which especially helped Australian investors in materials and energy

• Falling Australian dollar which inflated international equity returns (but sadly only to compensate you for your more expensive overseas holiday)

• High corporate profit margins especially in the jobless-recovery US

• Increased dividend payout ratios especially in yield obsessed Australia

• Cheap lending plus foreign buying adding to earlier property tailwinds including more multi-income families, high LVR lending, various tax incentives…

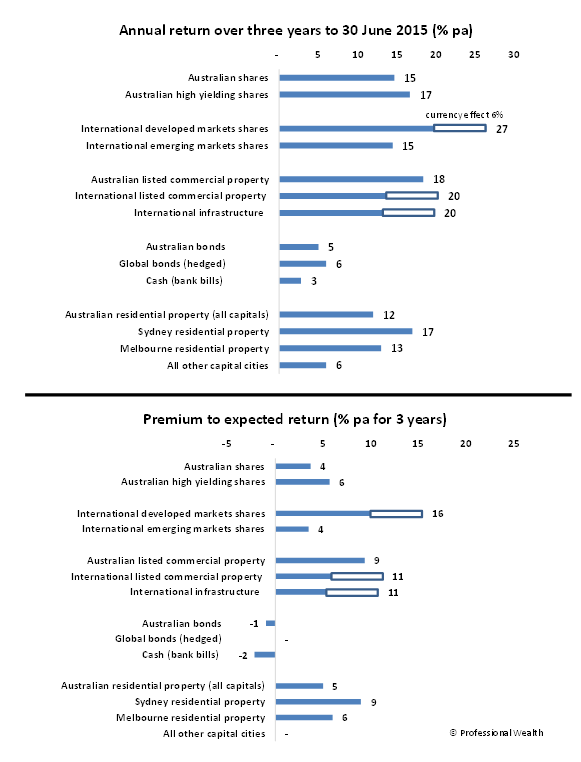

As shown in Figure 2, these factors delivered above average returns in nearly all asset classes, with cash and Australian bond returns the only material exception. Roughly speaking, shares for three years in a row returned about 5 per cent more than expected locally and 10 per cent in offshore developed markets (plus 2 per cent more if you measure to March 31, not June 30). This was because the price investors were willing to pay for earnings inflated, themselves possibly inflated through high margins and low debt costs.

Commercial and residential asset prices took off despite fundamental rental income growing only at the rate of inflation. You would have noticed also your utilities and toll road charges didn't go up 20 per cent annually for three years in a row … but returns in those companies did.

Figure 2: Actual (above) and premium to long term expected (below) total annual returns (price income) from investing in various asset classes for the three years ending 30 June 2015.

The investment climate is now changing and many of these tailwinds are turning around... here's what I regard as the outstanding headwinds:

• Rising interest rates soon in the US and UK

• An end to quantitative easing in the US and one day also in Japan and Europe

• A commodity bust including both in materials and energy – which is particularly problematic for Australian share investors, though stimulatory to others

• Perhaps now a nearly bottomed Australian dollar … or if not, at least not a further 40 cent fall from its peak

• An eventual return to inflation, now that so many inputs may have bottomed (low finance interest rates, low energy costs, strong buying-power-currency gone…)

• Rising rates and tightening investment property lending conditions

• Uncertainties around foreign buyer demand following a slowdown in Chinese markets and regulatory crackdowns.

Over the last three years an equal share and bond diversified portfolio would have delivered an annual return of 12 per cent. That's about 4 per cent more than expected based on long-term returns. Over the next three or five years, it wouldn't be unreasonable to expect a similar portfolio returning a below average 6 per cent annual return… say 4 per cent from cash and bonds and 8 per cent from shares. The latter assumes a 10 per cent premium in P/E ratio reverses (say from 15.5 to 14). The former is what an investment grade bond delivers in the absence of a rapid rise in interest rate or inflation expectations.

Of course it is likely such a return won't be delivered smoothly. Mathematically you can get the same return if such a portfolio turns down first 10 per cent (from shares and/or bonds) then recovers 15 per cent for each of the next two years. A negative return could easily arise if there was a recession in Australia, a correction to the now pricey US share and global bond markets (see Percy Allan's article today: US shares looking peaky). Overseas experts believe that Australia not having had a recession in a quarter century is a reason to worry, not celebrate.

Now what?

Were funding retirement likeable to sailing across the ocean, then an obvious response isn't to put up more sail simply because headwinds will likely cause you to progress slower. Since I doubt you dropped sail worrying you were travelling too fast the last few years, maybe you just have to weather lower returns for a while.

Certainly, the wrong answer for most is not to take on more risk. In the bond/credit markets it could prove especially unrewarding … like it did in 2008 when yield hungry US investors embraced CDOs. Now many worry about high yield bonds held in overseas ETFs which maybe aren't as liquid as some think.

As far as “battening down the hatches” and investing solely in cash and bonds, it is only justifiable if you can clearly see a storm immediately ahead. On current yields returns from them will only help you keep up with the tidal current of inflation. Know the impressive relative yield on shares over cash is the opposite of a sell signal.

Perhaps in our local market after recent falls there is now more value than offshore, and perhaps now in bank shares yielding 6-8 per cent with franking at reduced prices. Hopefully by adopting my often recommended strategy of having per cent target allocations and rebalancing, investors took profits from a portfolio overweight resource and bank shares earlier, rather than have had them taken from them. If so, now investors could put some back.

This applies to the property market too. If investors' portfolio of properties fattened up on substantial price gains, don't forget the Wall Street saying: “Bulls make money, bears make money, but pigs get slaughtered.”

If you believe the share market will trade sideways then perhaps selling to another the right to buy them at a higher price for extra income might help returns (research for instance: YMAX and UMAX and other equity income strategies). (To read more on protected and hedged investment products you can read our recent piece by Tony Rumble Correction protection: The scorecard, July 22.)

If you have nerves of steel and are a great chartist or have other powers of clairvoyance, perhaps you need to routinely buy in the dips and sell into the recovery. This might help you make money in flat markets like we had from 2008-2012, 2000-2004, 1989-1993 and a very depressing period from my birth year of 1965 to the early 1980s. During that period the market P/E fell from an above average 20 to a below average 10 (in the US) which completely counteracted earnings growth.

If you think the Australian dollar has fallen as much as it will, then now's the time to think about hedging some of your international equity exposure. Until recently you couldn't do that with most offshore cross-listed ETFs but you can now investing in Australian domiciled international equity ETFs offered by State Street – research WXHG and also say goodbye to the tedious business of giving the IRS W-8BEN forms when you buy offshore (cross) listed stocks.

Many don't realise that while the Australian cash rate is about 2 per cent higher than in most developed countries you earn about 2 per cent extra income when currency hedging (as discussed earlier: Hedging's little extra, February 24, 2012). This yield top up is how investing in lower yielding international bonds offers more returns than investing in higher coupon Australian bonds – the difference you may have noticed earlier looking at Figure 2.

I still maintain inflation linked bonds deserve a role in most portfolios if anything to desensitise you from central bank interest rate manipulation – and yes I'm still on my campaign to point out to others your needs aren't represented (It's time central bankers considered citizens, March 18). Because the price of these bonds rallied as interest rates fell, it can be expected that their prices might fall as interest rates rise and fixed rate bonds become attractive again – this all regardless of any changes in inflation. If you can't mentally discount ongoing bond market repricing superimposed on your fixed capital growth and income return, you could look into buying and holding these bonds directly rather than in a daily repriced fund.

Big spenders should be more careful now exceeding the benchmarks I shared earlier (How much is enough?, November 19, 2008) for what might be a safe withdrawal limit in retirement. Those were based on a 90 per cent success rate and indeed you might need all that safety margin if lean times linger. I should say many investors and Eureka Report subscribers I meet are case studies in private wealth building “survivorship bias”. They often need to be coaxed into spending more, after living a virtuously frugal and/or high income earning life. If you are one of them, don't let me worry you.

Dr Douglas Turek is principal adviser of independently owned and licensed, family wealth advisory and money management firm Professional Wealth (www.professionalwealth.com.au).