French lessons in dangerous QE seduction

It’s a common misconception that the recent Quantitative Easing experiments of northern hemisphere central banks, is unprecedented. That is not true. There have been many similar experiments throughout history. All end badly. One such period is now known as the French Revolution. At school we’re taught that revolution was about liberty, equality and fraternity; the rights of man and despotic monarchy. That is not even half the story. The French Revolution had some very modern and familiar problems; climate change and economic chaos amongst them.

Climate change

For eight months from June 1783, the Icelandic volcano Laki erupted. It was such a large event, temperatures dropped almost five degrees during the North American winter of 1783-84. The total northern hemisphere climate impact has been estimated at minus minus one degree celcius. This climate change impact was felt as far away as India. It’s been estimated Laki killed six million people globally – mostly due to failed harvests. France was particularly hard hit with a series of failed harvests during 1783-89. By 1789 famine stalked France.

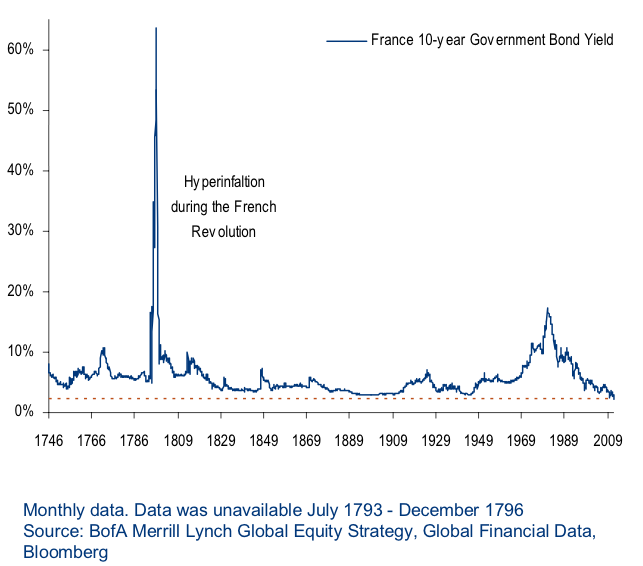

The French Revolution was as much economic as socio-political. Consider the following chart. During the revolution French Government 10-year bonds yielded as much as 60 per cent - per month!

Quantitative Easing – 1790 style

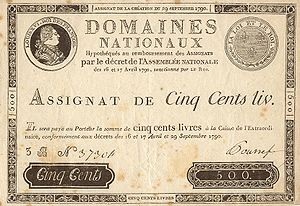

Turns out the Revolutionaries experimented with more than just new forms of governance. Under both external and internal threats and with revenues below expectations some wild eyed revolutionaries thought it would be a great idea to confiscate church lands and issue bonds against the value of said land. The new monetary instrument was called an assignat. 400 million were issued in April 1790. They even bore Louis XVI image. You might call this Quantitative Easing 1 (QE1).

That monetary experiment went so well another 800 million were issued in September 1790 (QE2) – again mostly (but not all) bore the kings image. To quell any cynics, an official limit of 1.2 billion assignats was decreed. Immediate monetary problem solved – back to debating good stuff like liberty, equality and fraternity.

But bills kept piling up; revenue collection was poor and those damned Assignats were falling in value ( down 15 per cent in 18 months). So in June 1791 QE3 was tried; 600 million assignats were issued. By this time King Louis had done a “runner”, so his portrait was dropped from the new “money”. QE4 (800 million) followed six months later. A new circulation limit of 1.6 billion assignats was decreed despite 2.6 billion already being issued or 6.5 times the original issue.

It was about then that the game was up. QE4 was “QE too far”. Assignat’s value were plunging (down 45 per cent). Adding to the woes external powers declared war against France in April 1792. Tough times; bills to be paid; what do you do? QE5 to QE7 (back half of 1792) was the quick answer. By this stage 3.6 billion Assignats had been issued.

Reign of Terror – financial repression

By Jan 1793 things were serious. The infamous Committee of Public Safety and Finance began secretly issuing more assignats (QE8), secured against confiscated land of those who’d left France after July 14, 1789. By mid year assignat’s were down 70 per cent. Doing wonders for financial confidence, all 580 million assignats with the kings portrait were repudiated. In August revolutionaries brought out their financial bazooka and took the meaning of “whatever it takes” to a whole new level. They issued a further 3 billion assignats (QE9)!

It’s no coincidence the Reign of Terror followed within weeks. Financial trust had been shattered with an explosion in paper currency, and the arbitrary repudiation of prior assignat issues. On September 8, 1793 it was decreed economic criminals were to be guillotined. On September 9 paramilitaries were formed to force farmers to hand over their produce. At month’s end the infamous “Law of the Maximum” was passed with a few basic rules:

1. The price of necessities was fixed at 1.3 times its 1790 price.

2. Transport costs were added at a fixed mileage rate.

3. Wholesalers were allowed a 5 per cent profit.

4. Retailers got a 10 per cent profit.

5. Violators were guillotined!

In November all precious metal trading was suppressed. In May 1794, the death penalty was decreed for anyone convicted of "having asked, before a bargain was concluded, in what money payment was to be made!" It’s estimated up to 70 per cent of the “Terror’s” 40,000 victims, committed economic crimes!

The blood lust ended on July 28, 1794 when Robespierre was guillotined. On Xmas Eve the Maximum Law was repealed. By this time 7 billion assignats were in circulation – 17.5 times the original issue. Little wonder their value was down about 80 per cent.

But once your hooked on easy money it’s very difficult to walk away. Echoing the exponential growth of the Weimar Republic’s money supply a century later, the issue of assignats exploded. QE10 boosted circulation to 10,000 by May 1795. In July QE11 added another 4 billion. By Xmas 1795 QE12 had put a further 26,000 Assignats on the street. This economic madness only stopped on 18 Feb 1796 when the assignats printing plates were publicly destroyed. By this stage assignats had lost 99.9 per cent of their value, so the destruction was a symbolic gesture.

Fast forward to 2013

There would appear to be some parallels (and differences) between French monetary experiments over two centuries ago, and the post GFC world. First some differences. The French issued assignats directly to market with their value backed by land. Today government bonds are backed by a “trust me I’m from the government, promise”! The big difference is that 21st century QE locks up the bonds within central bank vaults. To date the market has been convinced those bonds will be sold back into the market (raising interest rates in the process) once economic growth returns to pre GFC levels. This “sterilises” QE.

But doubts are emerging about this critical step. It is increasingly difficult to believe the Fed could reverse its balance sheet size without crushing markets via rapidly rising interest rates. In response the US Fed has said it might hold its bonds to maturity. But without significantly higher revenue, government’s would have to issue fresh bonds to cover that redemption. Renowned US bond guru Jeff Gundlach believes “there’s a better chance Bernanke buys every Treasury bond in existence, before he ever sells a single one”. Some voices are calling for central banks to simply destroy the bonds at maturity. That would destroy the Fed’s equity so it would need to be re-capitalised – through the issue of more government bonds no doubt. And that would effectively monetise (rather than sterilise) government debt and be very inflationary.

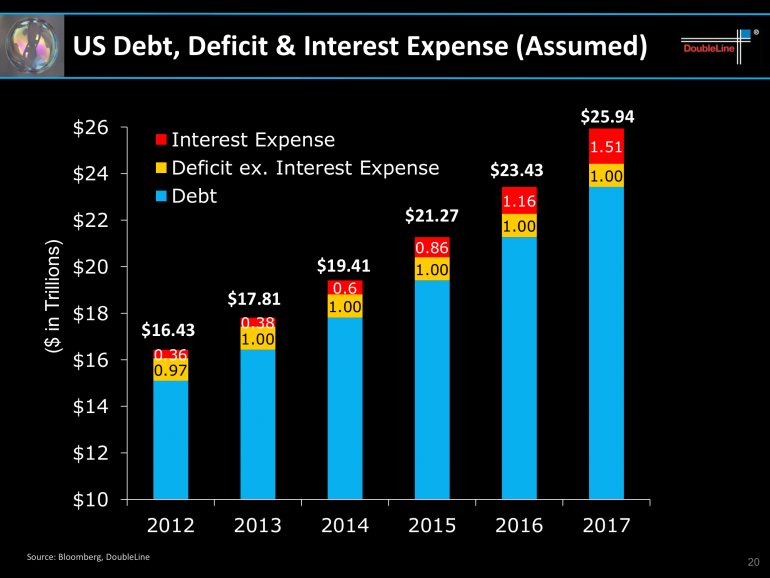

Post GFC, the Fed is not faced with war and political upheaval. Effectively the Fed’s only problem is financing US government spending. My critics will argue modern QE is merely facilitating full employment. But the effect of QE is to remove financial discipline from government and allow it to run huge and ever growing deficits for minimal interest cost as shown below.

Now some similarities. Though climate change is in the mix, the hapless French were faced with a far more significant climate cooling than today’s climate warming. You could put that one down to bad luck. Like 1790 France, modern democracies are struggling with raising enough revenue to cover outgoings. Constant bickering and partisanship in Washington also raises some similarities with 1790 France.

In both periods, QE was deployed and both were initially viewed as “one-offs”. But democracies have many constituencies to please. And easy money is highly addictive. By the time the show was over in 1796, the French were up to QE11 and had issued 100 times more assignats than originally planned.

By contrast the Fed is printing at a far more measured pace. In a similar time period that covers the entire French experiment, the Fed is only up to QE3, which some cynics have described as “QE Eternity”. The Fed has only grown its balance sheet 6 times from $US500 million to US$3.2 billion. That puts the US somewhere around where the French were with their own QE4 (Dec 1791).

Despite being backed by a land bank, the assignat took less than six years to lose its entire value. But the long-term US dollar trend is not that dissimilar. Since the creation of the Federal Reserve in 1914, US dollar purchasing power is down 95 per cent as shown below. That’s even before QE was introduced. So what took the French only six years to achieve, has taken the American’s a century. I and many others expect QE to only accelerate this erosion of US dollar purchasing power.

History is full of monetary experiments. The French revolution is but one. The Weimar Republic is another. No two are exactly alike. But they all have one thing in common. They are implemented when government revenues persistently fall short of outlays. At that point paper IOU’s are quite seductive.

The famous French philosopher Voltaire said “Paper money eventually returns to its intrinsic value - zero.” Oh, that’s another common feature of monetary experiments.