Four reasons why dividends are set to rise

| Summary: Almost $100 billion in gross dividends are paid out to Australian investors every year. Historical evidence, reinvestment and economic growth point to higher payouts over the next decade. |

Key take-out: On average, dividends around the world have only slightly lagged inflation over long time periods of time. |

Key beneficiaries: General investors. Category: Shares. |

With record low interest rates, and shares still around 20 per cent below their 2007 highs (nine years ago now), investing seems to be a ‘damned if I do, damned if I don't challenge'.

It's either about avoiding volatility with the low income of cash investments, or accepting higher yield with the volatility of share-based investments.

Shares would be a lot more attractive if we felt comfortable that in 10-year time the dividends will be higher now than they are today. After all, the general increase in the value of dividends over time is a key reason for investing in shares, as an important buffer against inflation.

The focus of this article is to consider some of the evidence as to whether or not dividends are likely to increase over the next 10 years – an outcome that might leave us more confident in shares as an investment.

The starting point for Australian dividends

As at the end of August, the value of listed companies on the ASX was $1.7 trillion (source: asx.com.au). Assuming a market average yield of 4.4 per cent (source: https://www.spdrs.com.au) this equates to total cash dividends in Australian of $74.8 billion. Add in franking credits, assuming a market average franking level of 70 per cent, and gross dividends paid over the past 12 months in Australia equal an impressive $97.2 billion.

The current share market yield of 4.4 per cent is well above the cash rate of 1.5 per cent, even before factoring in another 1.5 per cent or so for the value of franking credits.

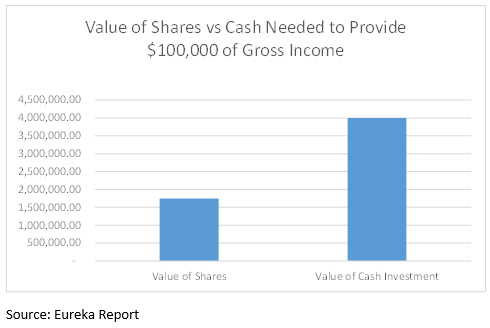

The following graph paints an interesting picture of dividends. It compares how much is needed currently in a cash investment or an Australia share investment (assuming 4.4 per cent dividend yield with 70 per cent franking) to generate $100,000 of income.

On face value the evidence is pretty compelling about the value of share dividends – and if we could be confident of dividend growth over the next 10 years, shares look even more compelling.

The historical evidence

Before looking at the historical evidence, it is worth emphasising that the last 100 or so years of Australian share market data has placed us as one of the best-performing share markets in the world – and therefore might overstate expectations for future returns.

That said, the long-term growth in Australian dividends has been strong. The 2014 Global Investment Returns Yearbook looked at long-term dividend income growth. It found that from 1900 to 2013 the average real (after inflation) growth in dividends in Australia was 1.13 per cent per year. This is a strong outcome for investors, meaning that even if they spent their dividends each year, dividends continued to grow in value at a rate greater than inflation.

A little more sobering is that for the group of 21 countries that the report looked at (including the USA, UK and Japan), dividend growth lagged inflation by 0.11 per cent. That said, this is not a terrible result – suggesting that, on average, dividends around the world have only slightly lagged inflation over long time periods.

This is our first piece of evidence that suggests dividends could be higher in 10 years' time – the long-run evidence from studying dividends across a variety of share markets, including Australia.

PE ratios and dividend yields – The power of reinvestment

Currently the PE ratio of the Australian share market is 16.7, with a dividend yield of 4.4 per cent (for the ASX200 index). The inverse of the PE ratio contains some interesting information (calculated by dividing 1 by 16.7), being the ‘earnings yield' of the market. The current earnings yield is 6.0 per cent. This means that for, say, $100,000 invested in the average company that company is earning $6,000 (i.e. 6 per cent) and paying dividends of $4,400 (i.e. 4.4 per cent).

This leaves the company with $1,600 per year to reinvest in the company for a variety of projects, from expanding the business to taking over other companies, to buying back shares, to paying down debt – all of which should, theoretically, increase company earnings and the capacity to pay higher future dividends.

This is the second piece of evidence suggesting dividends could be higher in 10 years' time – the fact that companies currently have earnings that are not paid out as dividends to use to increase profits over time.

The economy-wide factors - The role of inflation and economic growth

Along with record low interest rates, Australia is celebrating a record long period of uninterrupted economic growth. Greater economic growth provides a positive opportunity for companies to participate in an ever-growing economy.

The role of inflation is also important in growing dividends. Let's consider a company that sells $20 million of goods and has total costs (including tax) of $18 million. The company will have a profit after tax of $2 million.

Let's assume 3 per cent inflation in the following year, and nothing more than the fact that both sales and total costs increase by 3 per cent. Sales of $20.6 million and costs of $18.54 million mean an increased profit of $2.06 million, which means a bigger profit pool for the company to pay dividends from.

This is the third piece of evidence suggesting dividends could be higher in 10 years' time – the fact that inflation and economic growth provides positive support for them.

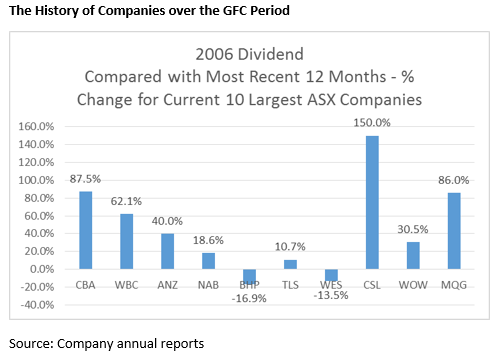

The graph above is the fourth piece of evidence to suggest that dividends could be higher in 10 years' time. It looks at the biggest 10 companies currently on the ASX, and compares their dividends from 2006 (before the global financial crisis began) to the most recent 12 months of dividends for each company. (The data excludes a 6 cent special dividend from Telstra in 2006). It shows that companies have tended to grow their dividends over that time, even over a time period that included the economic shock of the GFC.

Conclusion

Any discussion of ‘shares vs cash' is somewhat flawed, in that investors can choose to hold a mix of investments.

At the moment the income from shares is significantly more attractive than the income from holding cash, however the volatility from investing in shares provides challenges for investors.

The evidence that suggests (but does not guarantee) share income might be higher in 10 years may help in evaluating the quality of shares as a source of investment income over longer periods of time.

Frequently Asked Questions about this Article…

Dividends are expected to rise due to historical evidence of long-term growth, reinvestment of company earnings, economic growth, and inflation. These factors suggest that dividends could be higher in 10 years, making shares a more attractive investment.

Historically, Australian dividends have grown at an average real rate of 1.13% per year, outpacing inflation. This means that even if investors spend their dividends annually, the value of dividends continues to grow faster than inflation.

The current dividend yield of the Australian share market is 4.4%, which is significantly higher than the cash rate of 1.5%. This makes shares an attractive option for income-seeking investors.

Reinvestment of earnings allows companies to expand, acquire other businesses, buy back shares, or pay down debt. These activities can increase company earnings and the capacity to pay higher dividends in the future.

Economic growth provides companies with opportunities to participate in an expanding economy, which can lead to increased profits and, consequently, higher dividends.

Inflation can lead to increased sales and costs for companies. If a company's sales and costs both rise with inflation, the profit margin can increase, providing a larger pool of funds for dividend payments.

Evidence supporting higher future dividends includes historical growth rates, the ability of companies to reinvest earnings, economic growth, and inflation. Additionally, data from the biggest companies on the ASX shows dividend growth even through economic challenges like the GFC.

Shares currently offer a higher income yield compared to cash investments. While shares come with volatility, the potential for dividend growth over the next decade makes them an attractive option for long-term income.