Four reasons the Fed won't raise rates any time soon

Janet Yellen said that there remains considerable slack in the US labour market, based on four broad statistics, implying that the Fed would maintain exceptionally low interest rates for the foreseeable future. But don’t expect her comments to delay the Fed’s taper.

In a surprisingly personal speech from the new Fed chair, Yellen shared the plight of three workers from Chicago who had either suffered long-term unemployment, lower wages or were forced to work part-time. They were stories that would resonate with the experiences of millions of Americans over the past seven years.

The central premise of her speech was that there remains considerable slack in the US economy. Yellen cited four reasons why she believes this is the case.

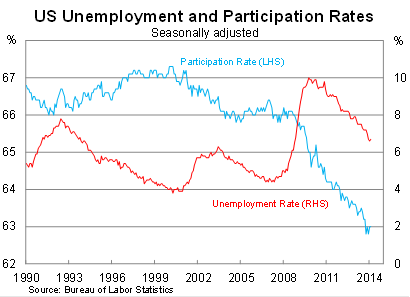

First: “the seven million people who are working part time but would like a full-time job”. Historically, this is much higher than is typical during periods where the unemployment rate is around 6.5 to 7 per cent.

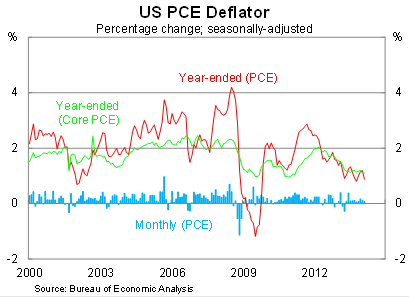

Second: “the decline in unemployment has not helped raise wages for workers as in past recoveries”. The rise in employment has so far not lead to any wage pressures and most measures of inflation remain well below the Fed’s long-term target of around 2 per cent. This implies that employment has yet to reach that critical point where there are more jobs than there are people trying to find them.

Third: “the extraordinarily large share of the unemployed who have been out of work for six months or more”. These workers have found it exceptionally difficult to find and maintain regular work and appear to be at a severe competitive disadvantage compared with those who have been unemployed briefly (A foreign warning on long-term unemployment, March 25).

Yellen obviously doesn’t prescribe to the notion that the long-term unemployed are fundamentally different -- that they simply do not matter to employers. She says that they “look basically the same as other unemployed people in terms of their occupations, educational attainment, and other characteristics”.

Furthermore, she said that it is not clear that the short-term unemployed are finding it much easier to find work relative to the long-term unemployed. As a result, Yellen is hopeful “that a significant share of the long-term unemployed will ultimately benefit from a stronger labour market”.

Finally, the declining participation rate suggests that the unemployment rate is actually overstating the improvement in labour market conditions. An increasingly large share of the monthly decline in participation is being driven by America’s ageing population, but Yellen is right to say that it may partially reflect involuntary retirements and people leaving the workforce who would re-enter if opportunities presented themselves.

It is hard to deny Yellen’s contention that there remains considerable slack in the US labour market. If there wasn’t, then inflation wouldn’t be stuck in such a rut.

But utilising this slack will prove problematic for the US, regardless of how long they keep interest rates at around zero.

For example, to return the level of long-term unemployed to normal levels could take another three to four years based on current job growth. By the time that is achieved, it will be 10 since the global financial crisis began.

In addition, America’s ageing population will continue to weigh on labour market participation. Those who might have retired involuntarily may find it difficult to re-enter the workforce as they approach the official retirement age. The recovery might boost participation to some extent, but I still believe that the participation rate five years from now will be a little lower than it is today.

The comments by Yellen indicate a clear preference by the new chair to keep interest rates at exceptionally low levels for the foreseeable future. Wage growth will be the key here; until that picks up we will not see a sustainable rise in inflation.

Despite the dovish comments, there was no indication that the steady taper of the Fed’s asset purchasing program would be delayed. In that regard, the Fed seems as determined as ever. But it does call into question the Fed’s belief that rates would rise by 100 basis points during 2015 -- and markets reacted favourably to the possibility of lower rates for longer.