Flirting with a dicey NEM fix

Tomorrow the Standing Council on Energy and Resources is set to consider a rule change proposal, prepared over the past year by the Australian Energy Market Operator, that would subsequently go to the Australian Energy Market Commission for further consultation and possible approval.

The proposed rule change is to institute a formal demand response mechanism in the National Electricity Market.

This piece of work came out of the AEMC’s Power of Choice recommendations, which was subsequently considered by SCER and passed to AEMO to develop up the rule change proposal. The objective of the rule change is to stimulate, and reward, a demand side response in the NEM.

Delivering an effective demand side response in the NEM has long been an objective of policy makers. In fact, the original NEM market design included the concept of ‘negawatts’ and just on a decade ago the 2003 Council Of Australian Government’s Energy Market Review (Parer Review) found the demand side response in the NEM lacking, arguing that:

The benefits of an effective demand side response are clear – it promotes efficient investment in capital and infrastructure, it allows customers to adjust their consumption patterns and effectively participate in the market and it allows market participants, retailers and generators, an effective mechanism by which to manage their exposure to high pool prices.

The perceived lack of a demand side response in the NEM has been commonly attributed to a range of factors including:

– weak incentives to change behaviour, due to the lack of a financial reward for doing so or exposure to higher electricity prices;

– end-use demand inelasticity, due to issues associated with replacing installed capital and infrastructure, and;

– inflexible consumption patterns, due to impediments including, for example, that manufacturing firms may incur greater costs from having staff sit idle during periods of high electricity prices than the benefits of lower energy costs associated with having done so.

So will the proposed rule change set to be considered by SCER tomorrow deliver an effective and efficient demand side response in the NEM? In short, the answer is that it is unlikely to do so.

The following provides a short explanation as to why.

The rule change proposal framed by AEMO is aimed at facilitating the entry of a new entity into the NEM called the ‘demand response aggregator’ – the DRA. In an ideal world the DRA would enter the market, vacuum up as much possible demand response in the market – whether residential or commercial and industrial – and offer it into the market as a cap (a financial hedging contract) against exposure to the market price cap (currently at $13,100MWh). Competing on a level playing field, the DRA would be rewarded for its efforts in having accumulated the demand response through the value that it received from the cap payment – from whichever party was the actual beneficiary of the load reduction.

Quite simple really, and something that already occurs – but unfortunately this is not what is currently being proposed.

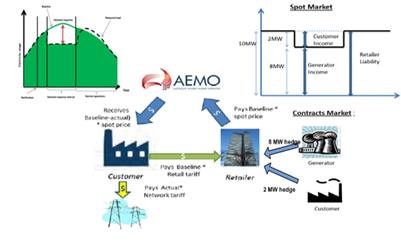

The saying ‘a picture tells a thousand words’ certainly does not hold true for the image below. Although the figure is an amalgamation of two diagrams contained in the final AEMC Power of Choice Report, it is a complicated task to decipher the complex flow of funds, incentives and impacts that occur from the inclusion of the proposed demand DRA in the NEM.

The operation of the proposed mechanism hinges on the volume of the users load reduction against its baseline energy consumption (the top left figure in green). The customer, at the request of the DRA, would reduce their load and subsequently be paid the difference between its baseline and actual consumption – with the DRA collecting some portion of these funds. This is the foundation stone of the demand response mechanism. A foundation stone that is substantially weakened by the fact that its existence creates a strong incentive to inflate the baseline energy consumption – in order to maximise the reward provided by load curtailment. Further, under the rule change proposal, the allowable error rating for this calculation is deemed to be plus or minus 20 per cent of the actual value of the variation in consumption. The distortionary impacts of this error margin could be significant and will end up being borne by other market participants – decreasing scheme efficiency.

Additionally, the baseline consumption component forces each retailer in the NEM to open up their billing systems to create a baseline value for their customers – at a cost estimated by retailers to be approximately $110 million dollars. On the issue of costs, it is also estimated that AEMO will incur costs in the vicinity of $8 to $12 million to set up this scheme. At a combined total cost to the NEM of approximately $122 million it is unclear whether the scheme would overcome the hurdles to demand response and hence what the overall benefits would be to the market. An early cost benefit analysis completed by Frontier Economics, on behalf of the AEMC and completed prior to the framing of the mechanism by AEMO, indicated benefits in the vicinity of $2.8 to $4.3 billion in delayed supply side investments (generation and network). A new cost benefit analysis, based on the proposed rule change, may see a significant shift in these numbers as greater clarity is now available as to the scheme design.

Other limiting features of the proposed mechanism are that the DRA would not be required to hold a retail licence, providing not only a competitive advantage to the DRA to the cost of incumbent retailers but also an additional cost to the overall market – as the end-use customer would still be required to have a host retailer.

The benefits of the participation of the demand side in promoting an efficient market outcome are widely recognised. This is not the issue in question. The question is, will the DRM to be considered by SCER promote an efficient and effective demand side participation or will it, given the scheme complexity and significant costs that will be incurred, diminish efficiency and add to participant costs for little benefit.

In the past 12 months AEMO has worked to develop a detailed DRM scheme design, as it was required to do so by SCER. This work has exposed the many flaws of the scheme; hopefully this will also be recognised by SCER tomorrow.

Simon Camroux is manager wholesale markets regulation at AGL and was also a member of the Council of Australian Governments Energy Market Review.