Five companies to watch this reporting season

Reporting season is upon us and it’s set to get hectic. In August alone, over 150 companies are expected to divulge either full-year or half-year earnings to the market.

To help you navigate this frenzy, we’ve put together a list of the top five companies we’ll be keeping an eye on during the season.

We've based our list on newsworthiness. The companies mentioned have generated headlines throughout 2014 and they are set to make more of a splash when they report over the next couple of months.

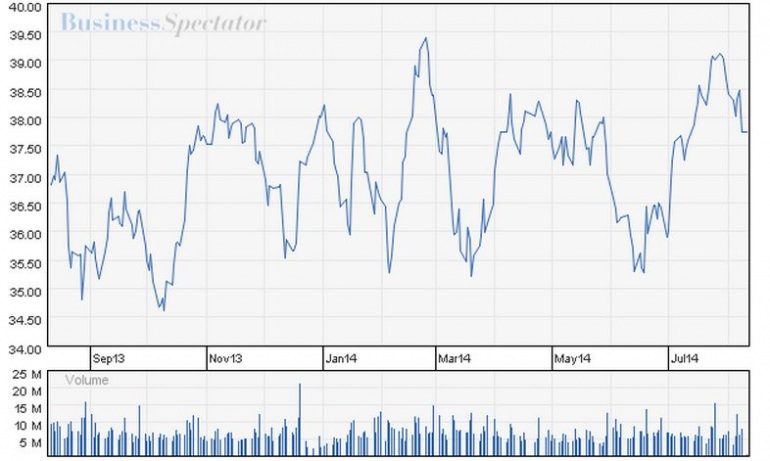

BHP Billiton

Reporting August 19

Rio Tinto’s bumper round of results last week will no doubt draw more attention to BHP Billiton’s in a fortnight’s time. The miner trashed profit expectations despite a significant decline in the iron ore price.

As Stephen Bartholomeusz previously explained, Rio, BHP and the other major miners are in a race to offset the declining iron ore price through reducing costs and ramping up exports to record levels. The strategy appears to be working for Rio, but will it have the same effect on BHP?

There's been much talk about the strategy could simplify BHP Billton’s mining portfolios. Some of its investments (like its iron ore and coking coal assets) are more profitable than others and the miner is looking at ways to neatly trim the fat off its operations.

Speculation is also swirling about a possible demerger of BHP and Billton and what that would look like for shareholders of the company. Chief executive Andrew Mackenzie has declined to comment on this in the past, so onlookers will no doubt be watching closely for any hints during the results presentation. Shareholders will also be keeping an eye on BHP Billton’s net debt: Mackenzie has promised a share buyback this year should its debt fall under $US25bn.

Bloomberg net profit consensus: $13.796bn.

Further reading:

- BHP's battle against a slumping ore price

- China's gloomy forecast for iron ore miners

- Iron ore miners brace for a structural shift

- Miners perform a cost-stripping tease

- The dramatic difference between BHP's current and past CEOs in one chart

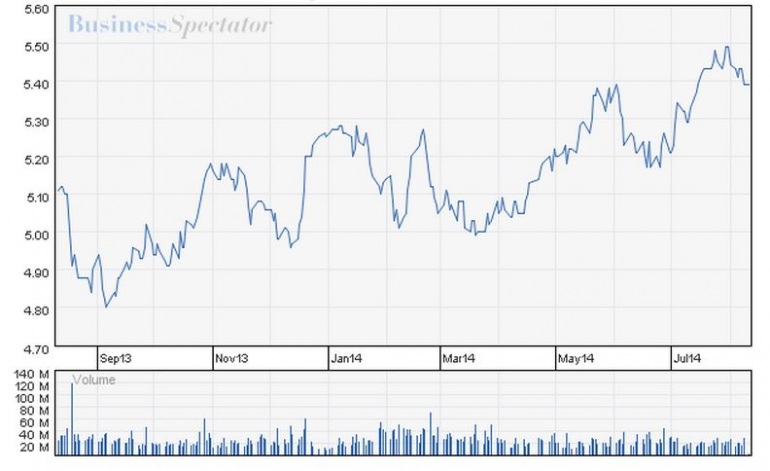

Telstra

Reporting August 14

Telstra shareholders will be listening for hints on how the telco intends to spend the billions it is set to receive from the government for its role in the NBN rollout. Alan Kohler reckons the telco should invest it in a huge takeover deal -- possibly Twitter -- to which David Thodey replied:

Thanks @AlanKohler for idea to buy twitter - I think we are a better user rather than owner..but appreciate the thought!

— David Thodey (@davidthodey) August 6, 2014Fund managers and shareholders would like to see part of that money poured into some kind of dividend or share buyback scheme.

Moving off the NBN, it’s also worth noting that Foxtel’s results will also be buried in Telstra’s report. Telstra holds a 50 per cent stake in Foxtel. News Corp (the publisher of Business Spectator) owns the other half. Its subscription numbers will be interesting, but the real prize will be any figures on the uptake of its Netflix rival, the Presto streaming service, which was launched earlier this year.

Bloomberg net profit consensus: $4.027bn.

Further reading:

- But what's Telstra going to do with the money?

- The NBN is now an acquisition

- Telstra's NBN Co fibre deal is more than just a trial

- IPTV State of the Nation: Where does Foxtel's Presto fit into the big picture?

- The regulatory hurdle that could thwart the NBN rollout

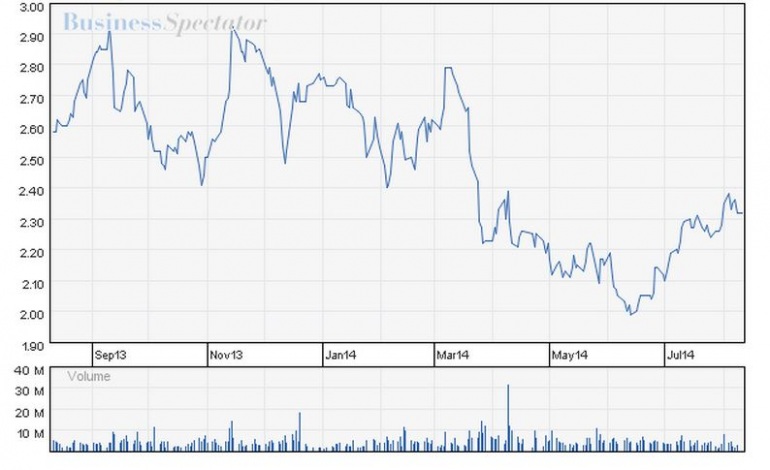

Myer

Reporting September 12

Aside from being a bellwether for other retail-related stocks, Myer’s results will be fascinating in light of the recent takeover of its nemesis, David Jones. The impact of global retailers like H&M and Sephora (which is slated to open in Sydney in December) is another likely talking point. It will also be interesting to see how much attention Myer gives to the threat of online retail and its transformation into an ‘omnichannel’ retailer.

In the past, chief executive Bernie Brookes has brashly shrugged off these challenges. In fact, the retailer has vowed to return to profit growth next year.

Any strategy adjustments for the new financial year given the current retail climate and new and emerging threats will be worth listening out for. A cashed-up Solomon Lew will certainly be paying attention given the flurry of retail M&A activity.

Bloomberg net profit consensus: $102.313m.

Further reading:

- Expert on DJs is more than generous

- Eschewing merger, Myer focuses on its strategic plan

- How Woolworths snatched DJs from Myer's grasp

- The major retailer that’s now thrashing Myer and DJs

- Throwing cold water on Myer’s ‘merger of equals’

Treasury Wine

Reporting August 21

After failing to provide any revised guidance since its results last year, investors can only suspect that Treasury Wine is set to meet expectations. A potentially surprising result given the company made headlines in the past year for tipping cases of perfectly good wine down the sink.

The real interest in Treasury Wine comes from Kohlberg Kravis Roberts & Co and Rhone Capital’s takeover bid for the company. This process has now evolved into a bidding war thanks to an offer from an anonymous private equity firm. It’s likely that both parties are after the real prize of the Treasury Wine stable, its Penfolds brand -- and not simply because it’s the wine that cost former NSW premier Barry O’Farrell his job. As Stephen Bartholomeusz notes, that brand still has a way to run and could nearly double its current earnings with the right marketing support.

Bloomberg net profit consensus: $87.818m.

Further reading:

- Why KKR didn't play the waiting game with Treasury Wine

- Price the final question in TWE sale

- Treasury Wine drinks a bitter cup

- Treasury Wine toasts America for the long haul

- Treasury's US plans could improve with age

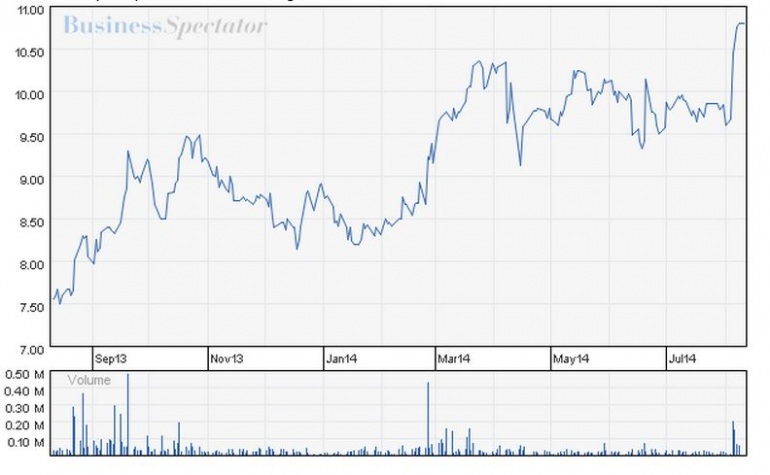

Qantas

Reporting August 28

With the flying kangaroo firmly in a nosedive, investors and analysts will be bracing for the impact of Qantas’ next round of results. The real question on everyone’s lips is just how bad the figures will be.

Macquarie Bank kickstarted the speculation earlier this month, issuing expectations of a $1bn writedown. That’s a significant departure from the $750m writedown expected by the market and the $252m loss it reported last year. Though the bank predicts that this huge loss will be a once-off, the lion's share can be attributed to two factors: a $350m bill to retire part of its fleet and $350m of redundancy payouts.

Bloomberg net profit consensus: -$531.636m.

Further reading:

- A new Asian flight menu for Qantas

- Qantas buys some breathing space

- Airlines are running themselves into the ground

- Joyce coy on frequent flyer sale

- Has the Flying Kangaroo finally broken its glass ceiling? A timeline of the Qantas Sale Act

Got a question? Let us know in the comments below or contact the reporter @HarrisonPolites on Twitter.