Five common mistakes by income investors

| Summary: Earning a yield that matches income needs requires careful portfolio planning, especially to meet long-term investment objectives. But there are quite a few pitfalls, and income investors need to avoid the typical mistakes that are made in the search for yield. |

| Key take-out: The low yield environment is a difficult investment scenario, but it does not mean investors should ignore their investment objectives or portfolio strategy in the search for yield. Low income from investments can be boosted with other strategies that can raise cash. |

| Key beneficiaries: General investors. Category: Fixed interest. |

The yield theme continues to play out, and is likely to continue to be around for a while longer. But the focus on earning a return from the assets that pay the highest yield may not support long-term portfolio returns. Maintaining and/or implementing a portfolio strategy is the best way to meet long-term investment objectives.

The importance of income cannot be ignored, especially to investors depending on income for living expenses. But if an investor’s portfolio income is not meeting their cash needs, then other strategies may need to be considered. And buying yield at any price is not intuitive when there may be other ways of addressing cash flow requirements.

An investment strategy such as allocating a large portion of a portfolio to cash may seem risk adverse. For example, earning a term deposit rate of about 4% for five years may sounds optimal, if protecting capital is the main objective. But being trapped in a term deposit with inflexible exit conditions can result in an opportunity cost when interest rates move up or other investment options become attractive.

Below are five common mistakes investors make in the quest to earn a yield that matches their income needs:

1. Investment objectives and portfolio strategy do not match

Many investors do not understand risk and what it means to their portfolio. Being too conservative and not taking on enough risk can be just as detrimental as taking on too much risk.

Risk can be good if you can take a long-term view, as more risk can be taken on over the long term to boost portfolio returns.

Focusing on short-term volatility by investing a large amount of your portfolio in term deposits can impact the achievement of long-term return objectives and lead to underperformance. Taking on more risk may mean reducing your cash balance and increasing your investment into shares or into bonds.

The effects of the global financial crisis continue to haunt many investors, and some are more concerned with preserving their capital than growing it. There was no place to hide during the GFC, as most asset classes experienced severe losses.

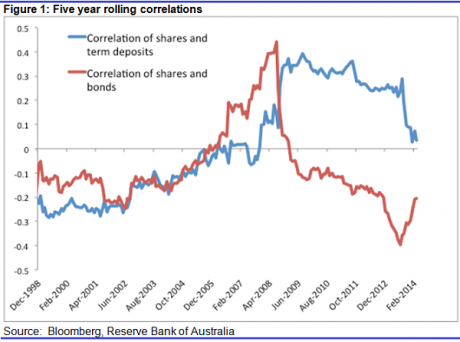

But if the reason for holding large balances in term deposits is to be risk adverse, then it may not be the best strategy. That’s because term deposit returns tend to be positively correlated with shares – and bonds are general negatively correlated with shares (see Figure 1). During market downturns over the last 20 years, a portfolio weighted 50% to shares and 50% to term deposits fared the worst in three out of four times, relative to a portfolio invested in shares and bonds (see Figure 2).

The high levels of cash held by investors will eventually flow back into assets (see Why investors should discount the policymakers) and there may be a boom in assets prices – so do not miss the boat by staying on the sidelines.

2. Income needs versus cash flow

Cash flow is the amount of funds required to live on, while income is the return from your investments with respect to dividends and interest. Cash flow comes from income, but if your income is not sufficient to cover cash flow needs there is no reason not to sell some of your investments to increase your cash flow.

Rebalancing of your portfolio regularly (quarterly at least) enables you to take profits on outperformers and reinvest into other securities, at the same time as leaving some residual cash in the bank for cash flow requirements.

The yield play has been the overriding focus since interest rates have bottomed. In the past, investors have been able to receive a solid return from term deposits – remember 7% being paid on term deposits before the GFC. But yield has become expensive, and it is harder to achieve a superior income return from investments. So a better strategy potentially is to sell down some of the “yield plays” that have done well from a price perspective (high dividend paying shares), rather than remaining in overpriced securities that will one day fall when the interest rate cycle reverts.

Also, remember that there may be a tax advantage if you have losses in your portfolio, as it may make sense to use those losses to offset capital gains – at the same time as boosting your cash flow.

3. Taking an unintentional risk

SMSFs have traditionally held large amount of cash, especially since the GFC – although this has fallen in the last year from 30% weight to 28% (according to data from the Australian Tax Office).

Having nearly one third of your portfolio in cash or term deposits increases the risk of your portfolio with respect to long-term returns. The opportunity cost from achieving higher returns elsewhere could be material, especially if other asset classes rally or, in the case of bonds, interest rates move up (term deposits rates will move too, but you can only take advantage of this if you are not already committed to a term deposit).

Market timing can be difficult and most investors will miss the bottom of the cycle and the top – either way resulting in lost returns. It makes sense to diversify your investments now rather than waiting for the right time – as long as you can take a longer-term view and do not require the funds in the near term.

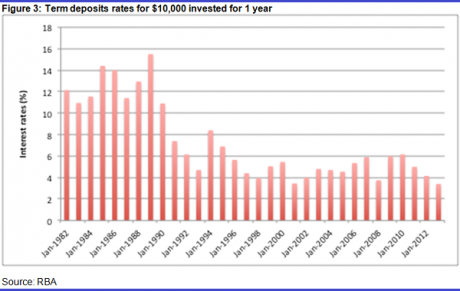

Term deposit rates (one-year term deposit rate in this case) have been quite volatile since 1982 (see Figure 3), surprisingly with a standard deviation of more than 12, not unlike that of shares, which are about 13. The high returns of the late 1980s have not been seen since, mostly due to the introduction of an inflation target by the Reserve Bank of Australia (RBA) leading to less volatility in interest rates.

The average term deposit rate since 1991 is 5.2% (ignoring the abnormally higher interest rates of the 1980s). In fact, if you had invested $100,000 in 1991 in an one-year term deposit, the income return by the end of 2013 would be $119,250. But once you factor in inflation, the real return falls to $61,150. Expecting term deposits to provide enough income over the long term is very dependent on interest rates being consistently above the inflation level – and this situation has not been the case over the longer term (Figure 4).

4. Public information is already priced in

Many investors read the same newspaper, see the same news on television, access similar brokers’ research and may follow similar online internet advice. But by the time that information is in the public arena, markets have mostly discounted this into the prices of securities – markets are usually forward looking by at least one year. The efficiency of markets has been well documented and fund managers that offer index funds do so on the back of the premise that markets are fully informed – their belief is that it is hard to beat the market.

But using different sources of research that are not publicly available or being a contrarian investor may be beneficial. But it takes a brave investor to change behavior and go against the pack – such as selling yield plays when others are buying.

5. Over-confidence can lead to excessive investment risk

Being a successful investor is not just about having a few wins. It is great if you make some successful investment decisions and are rewarded with some solid returns. But detaching your investment decisions from your emotions is likely to lead to not just a few wins but investment returns that are sustainable over time. Creating an environment based on objective information and impartial analysis, alongside experience and discipline, will reap the most rewards.

Successful investors like Warren Buffett are contrarian, focusing on the long term, diversification and dividend paying companies; and Jack Bogle, who promoted “stay the course” also by focusing on the long term, diversification, ignoring volatility, and a strong belief that risk is good.

Conclusion

The low yield environment is a difficult investment scenario, but it does not mean investors should ignore their investment objectives or portfolio strategy in the search for yield.

Low income from investments can be boosted with other strategies that can raise cash – using capital as a source of income is not the worst-case scenario, and boosting income from profits or taking losses can be a disciplined way of achieving your objective and following your portfolio strategy.

Term deposit investments should be for the short-term investment of cash (less than two years) and an investor should be seeking alternatives to achieve long-term returns above inflation.