Fed bubble dangers in the bargain

Last night’s continuation of American quantitative easing means Australians are going to enjoy further share market rises and faster increases in dwelling prices.

However in the longer term a prolonged extension of American quantitative easing becomes a more dangerous game for the world because there are at least three global bubbles that could be created. One is our housing market.

New Treasurer Joe Hockey and Reserve Bank Governor Glenn Stevens have some hard thinking to do.

And Australian self-funded retirees’ hopes of better bank deposit rates have been smashed – they will be forced to go deeper into the equity markets to gain a living return.

But first let us understand why global markets completely misread the American scene and the attitude of Federal Reserve chief Ben Bernanke.

The veteran US economists Al Wojnilower was one of the few to understand what would drive the Federal Reserve so my commentary earlier this week was vital in understanding the forces affecting America (Fed nerves will extend past Summers, September 16).

In short, while QE is stimulating the US economy the American budget cuts are having the reverse effect and those budget cuts are going to be more severe. At the same time the rise in US Treasury bond interest rates, in anticipation of a tapering of QE, has curbed American home lending.

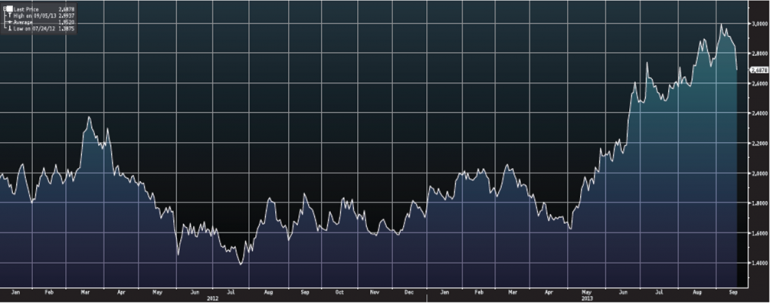

American home interest rates are tied to the long-term bonds. US government 10-year interest rates had risen from a low of 1.56 per cent last April/May to 3 per cent earlier this month – that’s a huge rise. Last night yields slumped to a low of 2.67 per cent.

US 10-year bond yield, January 2012 - September 2013. Source: Bloomberg

That rise in the 10-year bond rate has reduced American mortgage refinancing as well as stunting home-building growth in the US.

These two forces have been mainstays in the recent American economic upturn. In other words Bernanke saw what the end of QE pointed to and did not like it (The man with the golden gun, September 19).

To understand why the markets were wrong let’s go to the words of Wojnilower:

”All year long, many observers, including a majority of Federal Reserve officials, expected faster growth than has actually materialised. The data has dashed their hopes time and again, and probably will continue to do so. Despite optimistic readings by the media non-auto consumer outlays remain restrained, the rise in business capital spending seems to be decelerating rather than speeding up, and the surge in home building is slowing.

“Yet, all the same, longer-term interest rates keep on rising.

“Some market participants may be expecting a cresting of fiscal restraint, but it is more likely that fiscal austerity will intensify, narrowing the government deficit further. Additional sequestration is already in the law for next year, and there will probably be a compromise involving further spending cuts in order to avert the impending debt-limit confrontation.

“Spending will be reduced not only because of die-hard Republican insistence, but also because the president appears to view a tamed budget deficit as part of the legacy he wishes to leave behind.

“All in all, federal borrowing may shrink more than private sector borrowings expand, forestalling the faster rise in total credit required to speed up economic growth. Whatever the precise outcome, fiscal developments will tend to reduce rather than raise interest rates.

But prolonged American quantitative easing will have dangerous side-effects for the world:

– European banks will keep playing the yield game and stake their solvency on buying high-risk, high-yielding bonds in European economies. In time this banking bubble is likely to have a sad ending.

– Similarly high yield games will be played in emerging countries with similar long-term dangers.

– In Australia the prolonged QE will create a rush for equity assets including shares and housing. It is in housing where our prices are high by world standards and where there is most danger of a bubble – which Business Spectator documented yesterday with three commentaries:

How the cork was popped on property demand

– In Australia the higher dollar created by our interest rates and the QE driven rise in commodity prices will hollow out our employment creating industries. If the Reserve Bank lifts rates to stem housing the dollar will go through the roof, doubling the blows to employment.

But that’s down the track. It’s time to enjoy the equity rises.