Exploiting low rates 4: Playing the listed bond market

Summary: ASX listed bonds have been popular among investors searching for yield, with many trading at prices above their face value. But returns vary across different types of bonds. An empirical assessment of relative value showed that at the end of February, almost two thirds of the bonds were relatively cheap and one third were relatively expensive. |

Key take out: A trading strategy of buying one of each of the cheap bonds and selling one of each of the expensive bonds would have returned 6.25 per cent annualised, at least for March. |

Key beneficiaries: General investors. Category: Investment bonds. |

Imagine an app that could be downloaded onto your mobile phone that would allow you to pick the winners at the races on Saturday, at Caulfield or Randwick. What would such an app be worth?

What it would be worth would depend on the returns made from picking the winners, and whether it could be reliably used week after week.

Imagine a similar app that could be used for picking winners among the bonds (interest rate securities) listed on the ASX. The bonds have been popular among investors looking for higher yields in a very low interest rate environment.

There are senior ranking bonds on offer with a relatively low yield that reflects the risk profile of the bonds. But there are also simple subordinated bonds (if such a term can be used), there are more complex subordinated bonds, and then there is the Additional Tier 1 capital notes that have been issued by financial institutions, primarily the four major banks.

The yields offered on these bonds increase with their risk profile.

But many of these bonds are now trading at prices above the $100 face value at which they were originally offered. This is a result of investors bidding up the price of the bonds as market interest rates have declined.

If you are not a buy and hold to maturity investor, or if you benchmark the performance of your bond portfolio to a market index, the returns from the market now can be quite thin. Although this depends on whether the market is assessed as a whole or the performance of individual sectors is measured.

An accumulation index compiled by your correspondent shows that the return from the ASX listed bond market (excluding Commonwealth Government bonds) for the month of March was just 0.1 per cent, or 1.18 per cent on an annualised basis. However, if your portfolio was concentrated in just certain types of bonds, the returns could have been better, or worse.

The annualised return to senior ranking bonds for the month of March was a healthier 3.13 per cent. If your portfolio was focused on simple subordinated bonds then the return was just a modest 0.9 per cent but if your focus was more complex subordinated bonds, then returns varied from negative 3 per cent to 6.93 per cent as the degree of complexity increased.

Additional Tier 1 capital notes returned 3.23 per cent on a weighted average basis.

But let's return to that app for picking winners in the bond market.

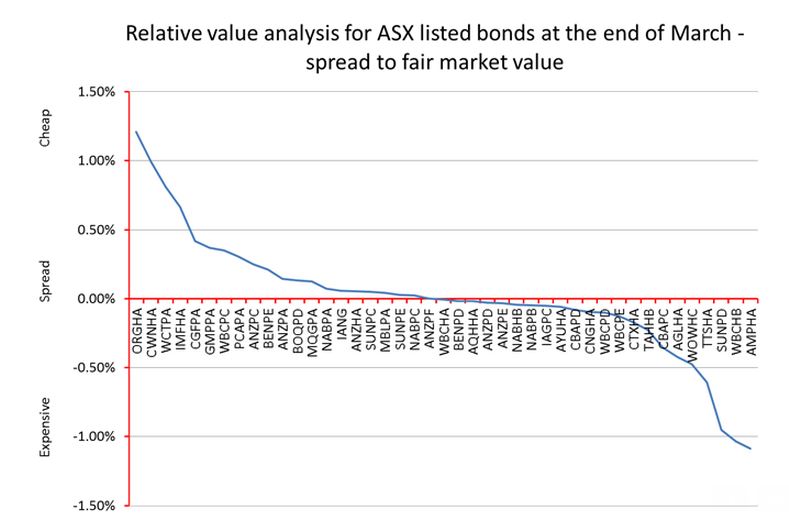

The app can't be downloaded onto your mobile phone but it does exist: It is quite simply an empirical assessment of relative value among ASX listed bonds (excluding Commonwealth Government bonds). So for example, at the end of February the assessment showed that almost two thirds of the bonds were relatively cheap compared with the remaining one third, which by definition were relatively expensive.

If a trading strategy of buying one of each of the cheap bonds and selling one of each of the expensive bonds had been initiated at that time, a net investment of $1,175 would have been required. If that trade had been unwound at the end of March and allowance is made for the distributions received and foregone during the month, the trade would have yielded a profit of $5.95.

This may not sound like much but to put it into perspective, it represents an annualised return of 6.25 per cent. This compares with the market return over the same period, of just 1.18 per cent for the Australian bond market as represent by my own accumulation index.

This picking winners strategy correctly identified the relative value changes in almost two out of three bonds. This is the sort of strategy that hedge funds try to implement.

Now for the icing on the cake.

If further research had been undertaken on each of the relatively cheap and expensive bonds and it had been possible to accurately identify each cheap bond that would become more expensive, and each expensive bond that would become cheaper, the trade would have yielded an assumed annualised return of more than 16 per cent on a similarly sized investment.

This app may not generate the sort of returns that can be made at the racetrack but it can pick winners among ASX listed bonds.

At least, it did in March. Now it remains to be seen whether the performance can be repeated.

The chart below shows relative value for ASX listed bonds at the end of March.

Philip Bayley is a former director of Standard & Poor's and now works as an independent consultant to debt capital market participants. He also writes on matters concerning debt capital markets and banking for various publications and is associated with Australia Ratings.