Exploiting low rates 3: Debt recycling … a rare opportunity

Summary: A couple with a mortgage may be able to make extra loan repayments while interest rates are low. If they are comfortable with debt, they could then borrow money to invest in shares. Using this strategy, over time, their debt level stays constant, their mortgage reduces and they build a share portfolio. |

Key take-out: A debt recycling strategy might be a way to build an investment portfolio for an investor who is comfortable with risk. Simply making extra mortgage repayments may be more suitable for the more conservatively minded. |

Key beneficiaries: General investors. Category: Shares. |

As Adam Carr notes elsewhere today exceptionally low interest rates are defining the economy and changing the way investors behave across the market (See Exploiting low rates 1: Finding alternatives to cash). Today I also want to look at this issue, taking the perspective of an active investor. The question posed is this: Faced with the enviable choice of exploiting low rates is it better to pay down a mortgage or gear into the market?

Borrowing money to create wealth is neither new nor unique. During the Global Financial Crisis I did some reading on the Great Depression, and was fascinated to see the role that margin loans to households investing in shares had played in the market collapse in the US. In Australia the tax advantages of ‘negative gearing' and franking credits often combine to make borrowing to invest in shares a popular personal finance strategy.

This current low interest rate environment provides investors a unique opportunity to repay debt quickly. For many people this will mean making extra repayments to their mortgage to reduce it. For those more comfortable with debt, a ‘debt recycling' strategy includes tax benefits and building an investment portfolio as you pay off your mortgage.

Explaining debt recycling

Debt recycling refers to the process of making extra repayments to your standard mortgage to decrease this debt, while borrowing money for investment purposes. As an example, a couple with a $300,000 mortgage might be able to make extra repayments on their loan of $15,000 over the course of a year. At the end of the year they then borrow $15,000 from an investment loan to make additional investments – in this case let's assume that they invest that money into shares. They still have $300,000 worth of debt in total, however their non-tax deductible mortgage is now $285,000 and they have a tax deductible investment loan of $15,000. They also have a $15,000 share market investment.

The benefit of this strategy is threefold:

1. They are reducing their non-tax deductible mortgage

2. They are increasing their tax deductible debt and, if they invest in the share market, they benefit from franking credits reducing their tax owing

3. They are building a source of investment income/wealth – which they use to help them pay off their non-tax deductible debt faster.

A more subtle benefit of a debt recycling strategy is that you are building an investment portfolio over time, which makes a portfolio less exposed to a sharp market downturn. Most gearing strategies are based around a lump sum investment invested into growth assets (real estate or shares), which is great if you are investing at a time when subsequent market returns are good, but terrible if you invest before a period of poor returns. Evidence suggests that people with geared investments are not great at ‘timing' markets. According to RBA data, the highest cumulative value of margin loans in Australia occurred toward the end of 2007 – the market peak before the 50 per cent fall in share prices that occurred with the Global Financial Crisis.

A case study

To look at the benefits of this strategy, let's consider the following couple:

- They have a $300,000 mortgage

- They are making extra repayments (above the rate of inflation) of $15,000 per year

- They are comfortable keeping their debt at a level of $300,000 if they build more assets through a ‘debt recycling' strategy

- They pay the interest off their $300,000 loan/s each year, and continue to do so under the ‘debt recycling' strategy

Let's assume the following to help model the impact of the debt recycling strategy:

- The couple maintain their extra repayments of $15,000 per year

- The shares they invest in pay an average dividend income of 4 per cent per year, 90 per cent franked

- The value of the shares, and the dividend income, increases in line with inflation, which we assume to be 2.5 per cent per year. (It is worth noting that this is a crucial assumption – both share prices and dividends have increased by more than the rate of inflation over long periods of time, however they are volatile over shorter periods)

The strategy in action

In the first year the couple in our case study pay $15,000 off their mortgage. This reduces to $285,000 and they borrow $15,000 for a share market investment. This means that they now have 5 per cent of their $300,000 total loans as a tax deductible loan – as well as having a $15,000 share investment.

The second year starts to show how the strategy works in more detail. Once again the $15,000 in extra repayments are made to the $285,000 loan. However, there are a further $600 in repayments that can be made to the $285,000 loan, being the dividends received from the share portfolio. This, in turn, means $15,600 can be used to increase the investment portfolio of shares. There also starts to be some tax benefits evident – there are $231 in franking credits which directly reduce the tax someone has payable, and $750 as a tax deduction from the investment loan interest (assuming a 5 per cent interest rate).

Over time, the tax benefit of the increasing investment loan increases, as does the flow of investment income and franking credits.

This is clearly a long-term strategy – the question is how does it compare to the more conservative strategy of using the $15,000 extra per year to simply pay down the mortgage? If the extra $15,000 per year is put toward the mortgage, the mortgage will be repaid in 14 years and 3 months. The question is – what is the result, given the assumptions that we have made, for the debt recycling strategy?

The debt recycling strategy sees the mortgage reduced to $0 at almost the same time – in this case after 14 years and 6 months. At this point in time the couple has:

- A $300,000 investment loan

- An investment portfolio worth $362,700

- Over the 14.5 years they have also had tax benefits from $38,290 in total franking credits received and $124,000 in tax deductible interest payments made.

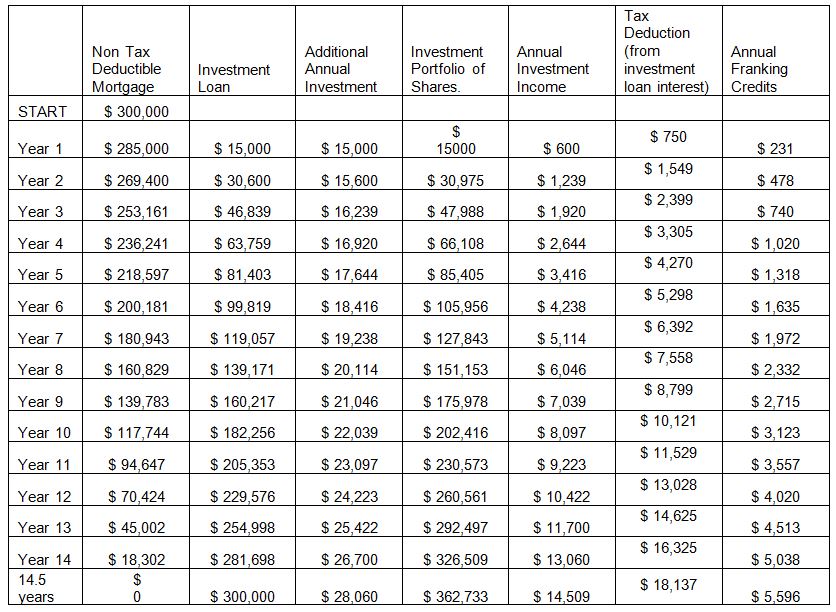

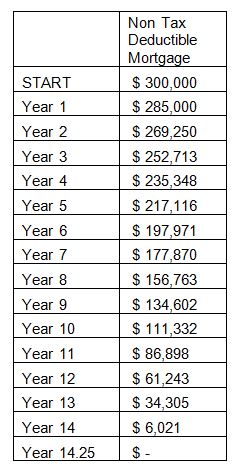

The following two tables set out the two outcomes – the first is the debt recycling strategy, the second shows the extra home loan repayments.

Table 1 – Debt recycling strategy over 15 years

Table 2 – Outcome for someone who pays off the mortgage using the extra $15,000 per year as extra repayments (assuming interest rate of 5 per cent pa and no fees)

The risks

There are certainly circumstances where a debt recycling strategy may not be profitable. If share market returns are poor, then the results of this strategy for an investor will also be poor. If the couple in the case study had their portfolio halve in value in the 15th year, consistent with the biggest share market downturns in Australia, and the portfolio value was only $180,000, then it is almost certain that they would have preferred a simple mortgage repayment strategy. If there was a sharp rise in interest rates – something that happened at the start of both the 1980s and 1990s – that will also put pressure on the strategy because the interest repayments of the outstanding loans will increase. If there was a sharp rise in interest rates which led to a fall in share market values, clearly this would be very bad for this strategy.

There is always legislative risk as well. This strategy relies on the tax benefits of negative gearing and franking credits. If those were ever changed, the strategy would become less effective.

Conclusion

For an investor who is comfortable with risk and having some borrowed money, a debt recycling strategy might be a way of gradually building an investment portfolio while also paying down non-tax deductible mortgage debt. For the more conservatively minded, simply making extra mortgage repayments is a lower risk way of getting ahead financially.

Scott Francis is a personal finance commentator, and previously worked as an independent financial adviser. The comments published are not financial product recommendations and may not represent the views of Eureka Report. To the extent that it contains general advice it has been prepared without taking into account your objectives, financial situation or needs. Before acting on it you should consider its appropriateness, having regard to your objectives, financial situation and needs.

Frequently Asked Questions about this Article…

Debt recycling is a strategy where you make extra repayments on your mortgage to reduce non-tax deductible debt while borrowing money to invest in shares. This approach can help you build an investment portfolio over time, benefit from tax deductions, and potentially increase your wealth while keeping your overall debt level constant.

Debt recycling allows you to build an investment portfolio while reducing your mortgage. Over time, this strategy can offer tax benefits and investment income, potentially leading to greater financial growth compared to just paying down a mortgage. However, it involves more risk and is suitable for those comfortable with borrowing to invest.

The tax benefits of debt recycling include the ability to deduct interest on investment loans and benefit from franking credits if you invest in shares. These can reduce your taxable income and enhance the overall returns from your investment portfolio.

Investors should be aware of market risks, such as poor share market returns, which can negatively impact the strategy. Additionally, rising interest rates can increase loan costs, and changes in tax legislation could reduce the effectiveness of debt recycling.

Debt recycling is generally more suitable for investors who are comfortable with risk and borrowing to invest. Conservative investors might prefer to focus on making extra mortgage repayments, which is a lower-risk strategy for financial growth.

The current low interest rate environment makes debt recycling more attractive by reducing the cost of borrowing. This allows investors to repay debt more quickly and potentially achieve greater returns on their investments.

Debt recycling can help build a diversified investment portfolio over time, which may reduce exposure to sharp market downturns. However, it still carries risks, especially if market conditions worsen significantly.

Investors should consider their risk tolerance, financial goals, and the potential impact of interest rate changes and tax legislation. It's important to assess whether the strategy aligns with their financial situation and long-term objectives.