Exchange-traded flyers

| Summary: Investors in exchange-traded funds have achieved exceptional returns over the past year. The four ASX-listed high dividend yield ETFs delivered incredibly strong returns in the 12 months to June 30, with the weakest still coming in above 24%. |

| Key take-out: The lower Australian dollar has also been great news for investors who were exposed to the US dollar through unhedged ETFs. The fall in the $A has delivered an added bonus. |

| Key beneficiaries: General investors. Category: Portfolio management. |

You know that old iPhone ad where the answer to every question is: there’s an app for that?

Well, if you’re confused by exchange-traded funds (ETFs), just think along those same lines. Want broad exposure to an index? There’s an ETF for that. Looking for a way to invest overseas? There’s an ETF for that. Keen to track commodities like oil or, dare I say it, gold? There’s an ETF for that. There are ETFs for small caps, currencies, bonds and pretty much everything else you can think of. There are even ETFs that don’t actually act like ETFs – “actively-managed” ETFs.

Having all these options available is obviously a good thing; it means you have more of a chance of getting exactly what you want. But it also means the ETF universe has become a labyrinth that can be difficult to navigate.

ETFs, as the name suggests, are open-ended, index-based funds that can be bought and sold like ordinary shares on a stock exchange. They’re popular because they’re cost effective, tax efficient and transparent. They also offer a very high level of diversification, with most made up of a basket of between 30 and 50 stocks.

Overseas, ETFs have been going strong for a couple of decades, allowing investors time to learn their various intricacies. In contrast, their popularity here has really only come through in the last few years. So we’re playing catch-up.

At the moment there are about 80 ETFs available in Australia from 10 issuers across six asset classes.

Assets under management (AUM) are estimated at about $8 billion. To put this into perspective, globally ETF and ETP (exchange-traded product) assets reached a record $2.16 trillion at the end of July 2013, according to new data from London-based ETF consultancy, ETFGI.

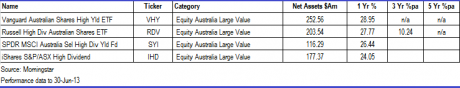

One of the stand-out groups in the Australian equity ETF market last year was that focused on dividends. The four ASX-listed high dividend yield ETFs delivered incredibly strong returns in the 12 months to June 30, with the weakest still coming in above 24%, as detailed in the table below.

The returns vary for each ETF because they all track different indexes. Mark Oliver, head of retail for BlackRock (which operates iShares ETFs), says the key with these is for investors to do their homework on the underlying indices of the funds, as they often comprise very different exposures and risk profiles.

The iShares high dividend ETF is designed to generate yield in a diversified and sustainable manner through a range of rules including maximum sector and stock weighting limits, Oliver says.

From a relatively low base, ETFs have become more widely accepted here as investors increasingly see their value.

The industry grew roughly 35% per annum from about 2006 until last year, according to industry specialists ETF Consulting. This year the growth rate rose to about 40%.

Experts are bullish for the medium term.

Tim Bradbury, managing director of ETF Consulting, expects AUM to jump to $17 billion by the end of 2015 – implying a growth rate of close to 45% p.a.

Oliver, while not quite as bullish, is still forecasting 25-30% growth per year over the next 3-5 years.

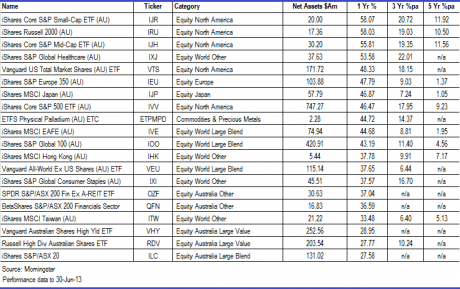

The returns have also been quite impressive. The chart below shows the returns for the top 20 ETFs in Australia as of June 30. Notably absent from the top 10 for the one-year returns are Australian equity ETFs. US equity ETFs take the lion’s share.

“In the last six months especially, there’s been a lot of money flowing into international equities ETFs, particularly US equities and emerging markets,” says Bradbury.

The lower dollar has also been great news for investors who were exposed to the US dollar through unhedged ETFs. As the $A weakens, that manifests as an improved return for Australian investors. As the currency weakens (say it falls 10%,)that’s a 10% return for an Australian investor holding that type of product.

The next wave

As more investors jump on board the ETF train, the market will no doubt continue to evolve. Even now, these one-time passive, beta-indexing tools are transforming before our very eyes.

The next generation is the “actively-managed” ETF. To an ETF purist, the very notion of an actively-managed ETF makes little sense. The whole point of ETFs is that they are low-cost, passive investments that track say, an index, commodity or currency. Actively-managed ETFs, in contrast, are very similar to managed or mutual funds, but are seen to be more transparent and tax efficient and provide investors with intra-day liquidity.

There are now more than 60 actively managed ETFs in the US, with about $14.3 billion in assets. This compares with just under 1,500 US-listed ETFs, with $1.5 trillion in assets.

So actively managed funds make up a tiny proportion of the lot, but further growth is certain.

More and more managers are getting on board. A number of the big players, including Fidelity Investments, iShares and Franklin Templeton, are waiting for the all clear from the Securities and Exchange Commission in the US on new actively managed ETFs.

“The reason they’re becoming more popular in the US is because traditional active managers are moving onto the exchange,” Bradbury says. “If there’s a clear demand for active investments in the market, I can’t see why active ETFs can’t meet that need.”

One of the most talked about of these funds is the PIMCO Total Return Bond ETF (BOND). The largest actively-managed ETF, it has attracted $4 billion in assets since it began trading just over a year ago. With bond king Bill Gross at the helm, there was little doubt this ETF would get its fair share of attention.

Essentially, it’s a cheaper alternative to the flagship Total Return Fund, with an expense ratio of 0.55% compared to the PIMCO Total Return A Shares (PTTAX), which has an expense ratio of 0.85%.

The ETF also offers investors more transparency than the flagship fund, since positions are disclosed on a daily basis. But while this may be a significant advantage from a transparency perspective, and isn’t seen as a major issue for fixed-income funds, for equity managers there are obvious drawbacks to competitors seeing what positions are taken on a daily basis.

There have been rumblings of a new wave of actively-managed ETFs that may withhold this kind of information in a bid to combat this perceived drawback.

State Street Global Advisors recently filed with the SEC to launch three actively managed ETFs under a so-called “blind trust”, whereby they will not have to disclose holdings and trading activity on a daily basis.

Another significant development in the ETF market occurred late last year, when the SEC lifted its moratorium on derivatives in active ETF products, increasing the risk factor through the use of these complex financial products.

Actively-managed ETFs are effectively a middle ground between managed funds and ETFs, so while they are cheaper and more transparent than managed funds, they fall down in both of these respects when compared to passive ETFs. An active ETF doesn’t just track an index. It involves a hands-on approach, with managers able to deviate from an index as they see fit.

Bradbury sees actively-managed ETFs coming to Australia, but not for a while.

“The market needs to continue to grow and gain momentum before we go down the active path,” he says.

Actively managed ETFs may be cheaper and more transparent option managed funds, but for those looking for a vanilla investment product, a plain old index-tracking ETF would be a better call.

Yield

As mentioned earlier, high dividend yield ETFs have performed exceptionally well. This is a space that has recorded strong inflows this year.

“Over 25% of the money going into ETFs [this year] has gone into Australian equity-income ETFs,” says Oliver.

These high dividend yield ETFs are essentially “quasi active”, Bradbury says. They have a passive benchmark they track, but it gets re-rated every three to six months and then the portfolio is reallocated. So stock picking plays a much bigger part.

As with actively-managed ETFs, high dividend yield ETFs haven’t been around long enough to produce any meaningful track record. The one-year returns look impressive, but it will be some time before we see if that can be repeated over the long term.

Actively-managed ETFs and high dividend yield ETFs are just two examples of how rapidly the landscape is changing. ETFs may have become the go-to investment for retail investors, but the new wave of ETFs are very different to the first generation. Investors are advised to tread cautiously when considering the new breed.

To read more on the outlook for high dividend paying ASX stocks, see today’s video Yield chase ... the next phase.