Europe struggles to get back to work

The fragile euro recovery gathered some momentum towards the end of 2013, but with unemployment remaining at an elevated level, there remains significant weakness across the region.

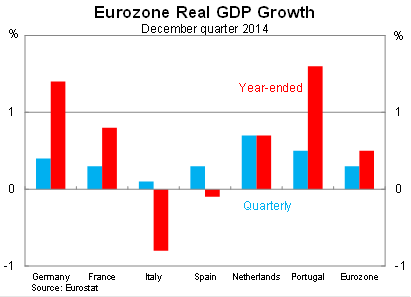

According to Eurostat, eurozone real GDP rose by 0.3 per cent in the December quarter, slightly higher than expectations, to be 0.5 per cent higher over the year. This follows growth of 0.1 per cent in the September quarter.

By the narrow definition of success known as beating market expectations, this was a positive sign. But by any other measure, the eurozone remains incredibly weak and the recovery frustratingly slow. Expectations for the eurozone are so low right now that anything that even looks like growth will be celebrated by analysts.

Growth in Germany, France and Spain was between 0.3 and 0.4 per cent in the December quarter, while growth turned positive in Italy for the first time since the June quarter 2011. Germany remains the strongest of the core euro economies – though by any reasonable measure the economy is doing poorly.

The German economy expanded by 1.4 per cent over the year to the December quarter. However, reluctance by the German government to promote growth and objections by the Bundesbank and the constitutional court to the ‘whatever it takes’ approach taken by the European Central Bank to boost inflation and growth suggests that further weakness in the eurozone is never too far away.

Greece continues to contract on an annual basis – albeit at a slowing pace – while Portugal seems to genuinely be gaining some momentum, though it follows a massive austerity-driven contraction.

The recovery to date has resulted in little job creation, with the unemployment rate remaining at around 12 per cent across the eurozone. Almost one quarter of people under the age of 25 are regarded as unemployed.

The unemployment rate in Spain is still near 26 per cent (almost 55 per cent for under 25s), while unemployment for France and Italy is 10.8 and 12.7 per cent respectively. Germany, on the other hand, has an unemployment rate of just 5.1 per cent, which makes their subdued growth all the more concerning. How fast can their recovery be with so little slack in the labour market?

Globally, it appears as though 2014 might just be the year when the eurozone stops being a hindrance to global economic growth. However, modest growth in the eurozone may not be enough to offset the declining fortunes of developing economies, which are set to slow following the decision to taper by the US Federal Reserve.

At the same time the recovery remains undeniably fragile and slow. It will take years before the weaker eurozone economies approach their pre-crisis peaks and unemployment will remain at devastating levels for years to come. When the recovery is complete, the eurozone will have suffered more than just a lost decade of growth.

For Australia, a modest eurozone recovery is a positive for the local economy. However, if growth slows through developing Asian economies and China, a stronger eurozone will be of little comfort. If the recovery persists, the main effect is unlikely to be direct (through higher exports to eurozone economies) but indirect, through a stronger eurozone boosting growth in Australia’s other trading partners.

The eurozone gathered momentum in the last quarter of 2013 but there remain some significant challenges for policymakers. Growth remains fragile and that can be seen only too well in the unemployment data and the sharp declines in retail sales volumes and industrial production throughout the region in December. The recovery might have picked up but it is still too soon to say that the eurozone is out of the woods just yet.