Europe: Is this the bottom?

Summary: European stocks followed other markets to rally last week, but investors are concerned as to how sustainable growth will be in the face of the latest disappointing macroeconomic signals. Whether the economy has bottomed relies on the tensions with Russia being sorted – and we can't know this for certain. For European equities, however, it's a different story. |

Key take-out: Europe remains attractive as an investment destination. While Russian tensions have created uncertainty on a macroeconomic basis, equities have shown they don't need strong economic growth outcomes – and the structural foundations are there. |

Key beneficiaries: General investors. Category: Shares |

Europe has been in the headlines again, for all the wrong reasons as usual. There is a growing sense that Europe may even be the new Japan – destined for weak and fragile growth for the next decade.

Notwithstanding the recent rally, European stocks are underperforming US markets – off about 8.4% since a peak in June (the DAX index is off 10%).

Elsewhere, the euro is down 6 US cents (almost 5%) since August and the German 10-year bund yield is down over 1% to 0.87% so far this year. Incredible isn't it. Germany can borrow money for 10yrs at 0.87% - 0.07% excluding inflation.

Now, while European stocks have joined the global rally and rebounded recently, most notably on Friday night, there is a reasonable degree of concern as to how sustainable that is. If Europe is the new Japan, it won't be.

It has to be said that on the macro side the answer isn't entirely clear. Up until say July to August, the key signals were that the European economy was on the mend, if slowly. The main engine of growth. Germany, was doing very well indeed – unemployment was at a record low (post-unification), economic growth was at a two-year high and business confidence was high – well above average and only about 3-4% of its record peak.

Then the downturn hit – exports fell, industrial production dropped, GDP fell and confidence indicators in particular came down.

On the one hand, the timing of the downturn isn't coincidence, as it corresponds with the ramp up in US lead sanctions against Russia. Others suggest, however, that this is only a part of the story - the bigger issue is that Europe itself is weak, still weighed down by high levels of debt and structural rigidities (inflexible labour markets, etc.). That the latter is still an issue is almost certain and I don't dispute that. Yet I'm not convinced that it lay at the heart of this apparent downturn.

For a start it's actually not accurate to say that Europe - or the eurozone - as a whole is especially fragile. Certain counties absolutely are. Yet others such as Germany, the Netherlands, Austria and Finland are in very strong positions with stability metrics much stronger than the G20 average (top 20 largest economies).

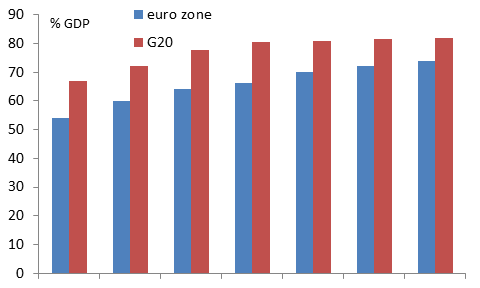

Chart 1: Budget deficits of eurozone

Chart 1 shows that the eurozone as a whole runs small budget deficits, currently around 3%. This is 1% less than the US and quite a bit lower than the 4.5% rate for the G20 countries.

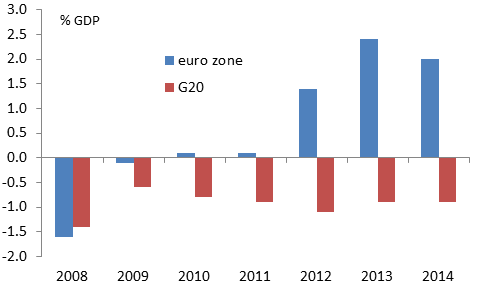

Chart 2: Net govern debt position

Chart 2 shows that the eurozone net government debt is also lower than the G20 average. At 73.9% of GDP, net government debt is unthreatening to the broader economy.

Finally, chart 3 below shows that the eurozone runs a current account surplus. Put simply, the eurozone sells more than it buys and the economic region lives within its means – Europeans effectively lend money for other nations to spend.

Chart 3: Net govern debt position

Growth is lower in the eurozone than say the US and the UK, sure. Yet what growth they do have is arguably more sustainable. I know that sounds ridiculous - no growth as being more sustainable. But mirth aside, it is important when you are talking about whether an economy is deteriorating or not. The above metrics suggest is that there is no reason to expect the economy of the eurozone, overall, to deteriorate.

Noting this, it's important that we don't downplay the impact Russian sanctions have had on the growth trajectory. In particular it's a fairly serious drawback to Europe's growth engine, Germany, given Russia ranks as a top 10 trading partner. For Europe as a whole, Russia is the third largest trading partner – with €325 billion worth of trade in 2013.

The impact has been swift so far with German exports to Russia slumping about 26% in the year to August. Year-to date exports are about €16 billion lower than they were last year, while Germany's Committee on Eastern European Economic Relations goes so far to suggest that the 300,000 German jobs that rely on trade with Russia could be at risk.

To my mind, that and the fact that even in a 'good year' European GDP growth is comparatively low, combined with the usual statistical volatility suggests we shouldn't, as a base case scenario, be concerned about the ability of Europe to grow at business as usual rates. Growth in Europe is generally always lower; there isn't anything usual about that and the world gets on just fine.

Whether Europe grows at business as usual rates in the near term comes down to how tensions with Russia are sorted and we just can't know this for certain. On a macro basis then we just can't know whether this is the bottom for Europe. If the Russian situation stabilises then it will be.

On European equities it's a different situation. European equities don't need strong economic growth outcomes. We've seen that since the GFC when European growth has been weak – averaging 0.6% per year since the GFC, while European equities have surged to new records. The DAX, for instance, was up nearly 200% from its 2009 low to a peak in 2014, which was itself roughly 25% above the pre-GFC peak.

Two things are important in this regard: the health of Europe's banks and deflation.

On the first issue this latest round of stress tests really should shore up confidence. Only 13 banks were found to be wanting in terms of capital shortfalls – in a dire economic situation. In each case the amount was comparatively small at a little over €2.3 billion per bank, which is tiny for the financial system. Since that date the European bank index is up 5% or so which is in line with the broader market. That's a good vote of confidence.

To the second issue, there is no question that European inflation is low – at 0.3% it's the least in about five years. Having said that, Euro-Stat (the European statistics agency) estimates that a good chunk of that low inflation print is the result of past exchange rate appreciation and the fall in crude prices. It wasn't so long ago (around two years) that eurozone inflation was above target. Deflationary forces simply don't build that quickly so it's not something I think we need to worry about. The only real implication of low inflation is that it will encourage the ECB to print more money - which of course is a positive for the market. Just look at how global markets responded to the Bank of Japan decision to print more!

The way I see things is that the European economy isn't going wow anyone nor be a driver of global growth. But then again it never is. This doesn't matter too much for European equities though.

Europe is in a strong structural position – that's what matters, and it's because of that, I'm not overly concerned about any 'unusual' deterioration that stems from tension with Russia. Maybe there is worse to come, maybe there isn't. Either way it shouldn't matter too much for the market - it never does. On that basis I think Europe remain attractive as an investment destination.