Euro inflation enters the danger zone

Euro inflation tumbled to its lowest level in four-and-a-half years in March and is unlikely to recover significantly in the near future.

The European Central Bank needs to do more, but is unlikely to announce anything new when it meets on Thursday.

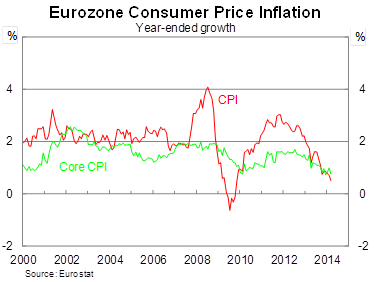

Inflation across the eurozone rose by 0.5 per cent over the year to March, according to advance estimates from Eurostat. The core measure -- which removes volatile items such as food, energy, alcohol and tobacco -- has climbed by just 0.8 per cent over the year.

Both measures of inflation remain well below the European Central Bank’s target for inflation of around 2 per cent and are firmly within the danger zone: where inflation comes perilously close to deflation.

A late Easter may have held prices down a bit in March. Easter has traditionally been associated with rising hotel and travel costs during a busy period for inter-Europe travel. But to dwell on this temporary issue distracts us from the fact that eurozone inflation is in a bad way.

To address how bad, we only need to consider the two driving forces of ongoing and temporary inflation: wage growth and the exchange rate. Neither of these factors is likely to contribute materially to inflation during 2014.

Wage pressures are driven by a greater demand for labour than there is an available supply of workers. When the unemployment rate is low, firms will effectively compete for the best available candidates and push wage rates up.

But with the eurozone unemployment rate remaining at around 12 per cent -- and not improving for over a year -- there is unfortunately a massive shortfall of domestic demand. In other words, there is insufficient demand for labour.

It is remarkable that the eurozone hasn’t suffered from persistent deflation over the past seven years, which is likely due to sticky nominal wages resulting from Europe’s strong labour market protections.

Even if growth across the eurozone improves significantly, the region is still years away from wage demands boosting inflation. Even the US -- whose recovery is far more advanced than Europe -- has yet to see genuine wage pressures (Four reasons the Fed won’t raise rates any time soon, April 1).

A depreciation in the euro is also unlikely to contribute materially to inflation because most euro trade occurs internally. Its exposure to other currencies is relatively unimportant compared with many other countries.

The lack of inflation in the eurozone is creating three important problems.

First, it is failing to reduce the real burden of debt. Inflation is lowest in those countries with crushing levels of public debt.

Second, in an environment where nominal wages are sticky, low inflation means that it takes longer for real wages to adjust. The result is that it has taken longer for countries in the eurozone to improve their competitiveness and reduce real wages to the point where employment can take off.

Third, inflation matters not only in an absolute sense but also in a relative one. Differences in relative inflation across eurozone countries, if persistent, replace the exchange rate within the eurozone as a source of currency devaluation.

If Germany runs inflation that is much higher than inflation in Spain, then over time Spanish goods will become cheaper relative to German goods and that will improve their competitiveness and trade balance. But when inflation is low everywhere, this process takes longer and prolongs the pain for people in poorly performing countries.

It has become increasingly clear that the ECB should do more to support the eurozone recovery. But that appears an unlikely outcome for its Thursday meeting.

Unfortunately, the ECB is not as dynamic as the Federal Reserve -- though that isn’t entirely its own fault -- and the politics of Europe often get in the way of measures to boost growth and employment.

Politicians and decision-makers in Europe have lost track of what is truly important. The crisis isn’t just about banks or government debt; it is really about people and the collective failure of institutions across the world to safeguard the economic and social interests of their citizenry.

Unless the ECB and European governments change tack, they are looking at a crisis that will persist into the next decade. Millions of people have lost their jobs; many have plunged into poverty. With every passing day, the human cost of this crisis grows larger. It is time for the ECB to get together and make up for its previous failures by doing more to support the recovery and getting Europe back on track.