EU sets CO2 challenge; China and Brazil score top marks

With the United Nations' global warming summit at the end of the year in sight, there have recently been important moves on climate and clean energy policy, some helpful to the cause of decarbonisation and some not.

Last week, the European Union agreed on the world's toughest emissions reduction goal, while Prime Minister Tony Abbott's government looked to ease Australia's renewable ambitions. Meanwhile, in the developing world, China and Brazil have caught the eye with their ability to attract capital for low-carbon energy sources.

A Bloomberg New Energy Finance report – ranking 55 developing countries in Africa, Latin America, and Asia and published this week – finds that Brazil is now promoting low-carbon energy investment almost as effectively as China.

Climatescope 2014, available to download here, scored China the highest of all the nations included in the report. The world's biggest emitter of carbon dioxide is also the largest manufacturer of wind turbines and solar panels, and has the most demand for wind and solar equipment.

Brazil, which finished a close second, has moved aggressively to facilitate greater clean energy development through a series of state-organised tenders for power contracts, according to the report. South Africa, Kenya and Uganda were also among the top scorers, as all of them have significant clean energy projects and programs. South Africa surged ahead of all other African nations with nearly $US10 billion of clean energy investment undertaken in the last two years, the report shows.

Representatives from both developed and developing world countries are preparing for a UN climate summit in Lima in December where delegates aim to lay the foundations for a worldwide deal to be clinched in 2015 in Paris.

As a way to crank up pressure on the US and China ahead of the talks, European Union leaders backed the most ambitious carbon emissions goal of any major economy last week.

Heads of government from the bloc's 28 nations endorsed a binding target to cut greenhouse gases by at least 40% from 1990 levels by 2030, at a summit in Brussels. Meeting that goal would cost about $US48 billion a year, according to EU estimates quoted by Bloomberg News. The EU is on track to meet its previous goal of a 20% reduction by 2020.

For the EU emissions trading system, the 40% emission reduction target translates into a 2.2% cap reduction factor from 2021 onwards, cutting 614Mt out of the market compared with current legislation (equivalent to around a third of covered annual emissions). While the mission reduction target is the only binding headline figure, it may end up having limited impact on the carbon price in Europe, as Bloomberg New Energy Finance notes in its analyst reaction: EU 2030 package – meaningful targets? The emissions target will likely be outweighed by the impact of the EU's planned stability reserve, according to Bloomberg New Energy Finance.

Elsewhere in the world, there was news earlier in the week that Prime Minister Abbott's government will negotiate with the opposition to cut Australia's renewable energy target and exempt industries such as aluminium and copper smelting.

Industry minister Ian Macfarlane said he was "reasonably confident" the target would be reduced from the current 41,000GWh of electricity from renewable projects, to between 26,000 and 28,000GWh.

Any changes to the RET – which requires electricity retailers to buy renewable certificates from wind and solar farms or generate clean power themselves – needs the support of opposition lawmakers in the upper house Senate to become law.

The uncertainty around the future of the RET has caused clean energy investment to languish in Australia. The country is on track to register its lowest level of asset financing since 2002, as policy uncertainty prevents any private investment in new large-scale assets.

Bloomberg New Energy Finance highlights in its note Investment freeze in Australia continues that only $193 million was invested in new large-scale renewable energy projects in the third quarter of 2014 in Australia, bringing year-to-date investment to $238 million.

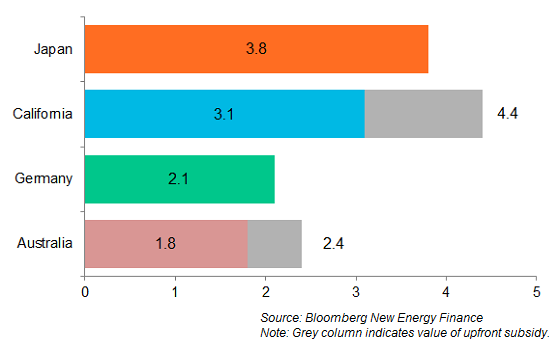

Graph of the week: Australia has arguably the most affordable residential PV in the world with a post-subsidy system price of about $US1.78/W

Originally published by Bloomberg New Energy Finance. Reproduced with permission.