ETFs: Winners and losers

Summary: A new book shows that momentum investing beats a buy and hold approach, and does so with less risk. This is especially the case when taking into account absolute momentum, not just relative strength momentum, which means measuring an ETF's 12 month percentage rate of change every month and switching to a bond or bill fund whenever this score turns negative. |

Key take out: The ETFs with the strongest annual momentum at present are US shares (IVV) and Australian commercial property (SLF). |

Key beneficiaries: General Investors. Category: Economics and investment strategy. |

I am a great fan of exchange traded funds (ETFs) becaue they are liquid (easily tradeable), inexpensive (have low management fees) and normally reflect their net asset value (thanks to being open ended funds supported by market makers). They are also suitable for market timing using either trend-following or momentum principles, the only two forms of trading with a proven pedigree.

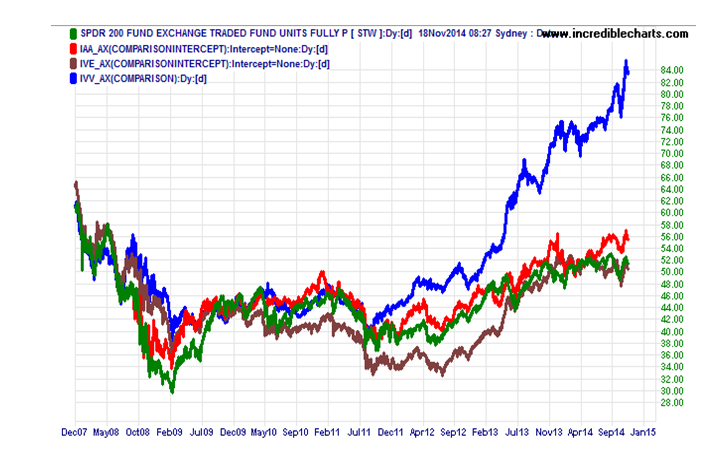

At the start of the GFC in late 2007, there were only a few ETFs to choose from. They included an American share fund (iShares Core S&P500 (IVV)), other developed markets share fund (iShares MSCI EAFE (IVE)), Asian share fund excluding Japan (iShares Asia 50 (IAA)) and Australian share fund (SPDR S&P/ASX200 Fund (STW)).

If you had invested in these equity funds how would they have performed up to now?

The answer is simple – only American shares would have given you a handsome capital gain. All the rest would still be below the price you bought them at seven years ago.

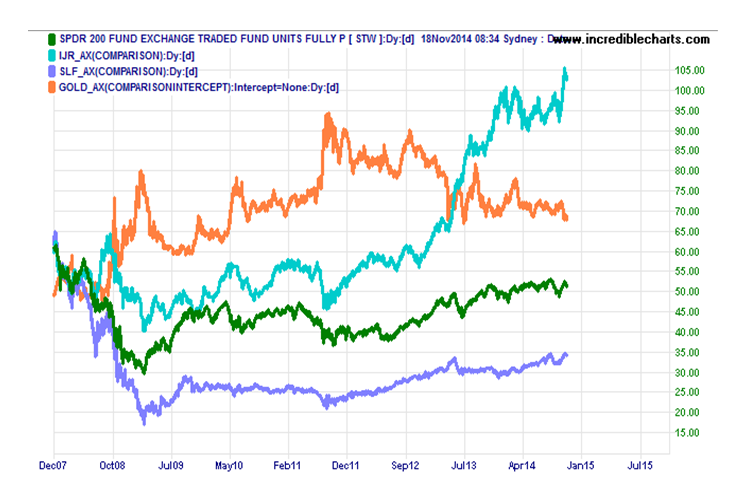

Of course you may have tried some additional ETFs such as Australian listed property trusts (SPDR S&P/ASX200 Listed Property Fund (SLF)), gold bullion (ETFS Physical Gold (GOLD)) and US small cap shares (iShares S&P SmallCap 600 (IJR)).

Gold was clearly a winner here until it bombed after August 2011, though its price would still be above what you bought it for in late 2007. The real champion was American small cap stocks (IJR) which did almost twice as well as IVV ( 72% versus 40%).

So what's the significance of all this?

A new book by Gary Antonacci (Dual Momentum Investing) confirms that momentum investing not only beats a buy and hold approach to shares, but does so with much less risk especially if absolute not just relative strength momentum is taken account of. What does that mean?

Antonacci confirms that measuring the 12 month percentage rate of change (i.e. momentum) of an ETF's unit price each month and then switching to a bond or bill fund whenever this momentum score goes negative is highly profitable. This differs from traditional relative strength momentum investing that sticks with the top two or three funds that are beating the rest (even if their absolute momentum is negative).

For example an equity fund representing the S&P500 index (US shares) if traded like this would have given a 14.4% average annual return between 1974 and 2013 with a maximum drawdown of 29.6% versus a buy and hold approach to the same fund which would have produced a 12.3% average annual return and a maximum loss of 51.0%.

The Sharpe ratio (a measure of return to risk) for this Momentum strategy was 0.69 whereas that for a Buy and Hold strategy was just 0.42. Furthermore the Momentum strategy would not have required a lot of attention since it involved only 31 trades over 40 years – typically one switch every 15 months or so.

But it meant doing a 12 month momentum check on an investor's favourite ETFs at the end of each month. The easiest way to do that is to load favourite ETFs on a free stock charting platform such as provided by Yahoo Finance or subscribe to a commercial charting software package like Incredible Charts as used in this article.

So based on Antonacci's dual momentum strategy what ETFs stand out now? Fortunately there is a larger menu of ETFs to choose from than seven years ago. Indeed there are almost 100! But let's confine ourselves to just a few and lump them into meaningful categories.

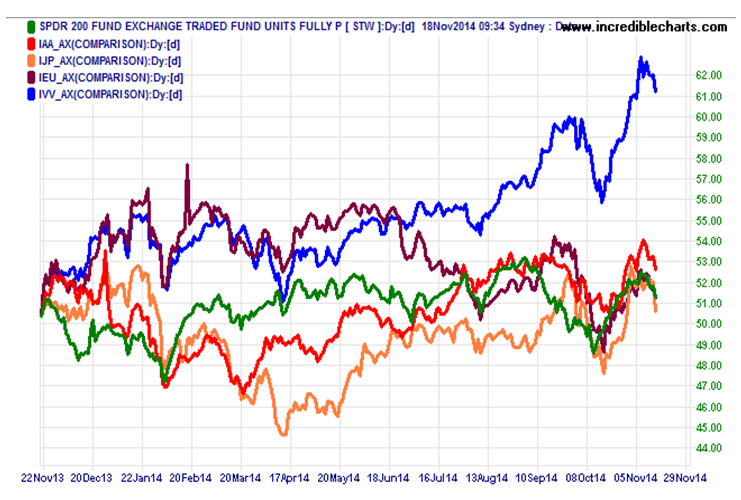

The first lot are global equity funds for the major economic blocks of America (IVV), Europe (iShares Europe (IEU)), Japan (iShares MSCI Japan (IJP)) and Asia (IAA). Again we have used an Australian share fund (STW) as the benchmark ETF for comparison purposes.

As you can see in the following chart only US shares stand out as having strong 12 month momentum at this point in time. The rest are all bunched together with little or no momentum over the last year.

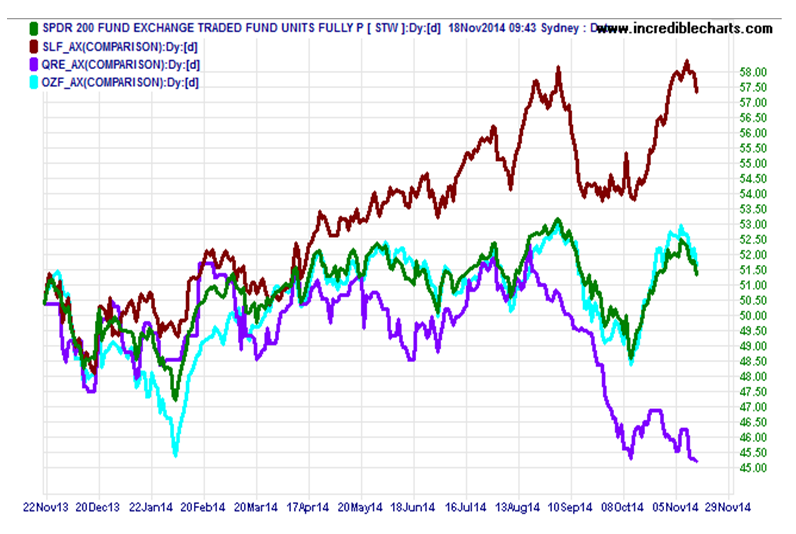

Next let's test some prominent Australian industry sector funds for their annual momentum scores. They are finance excluding property (SPDR S&P/ASX200 Financials Ex A-REIT Fund (OZF)), resources (Betashares S&P/ASX200 Resources Sector (QRE)) and listed property trusts (SLF). The only one with strong momentum is commercial property (SLF).

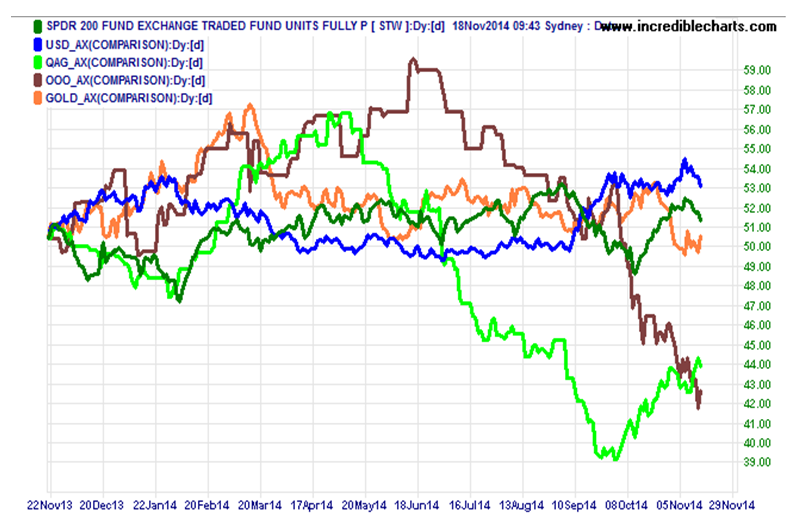

Finally, let's examine the more exotic ETFs covering currency, precious metals and commodities. Popular ones are the US dollar (Betashares US Dollar (USD)), gold (GOLD), oil (Betashares Crude Oil Index (OOO)) and agriculture (Betashares agriculture (QAG)). As you can see none of these offer any comfort, notwithstanding the strengthening of the US dollar against our own currency in recent times.

So there you have it: the ETFs with the strongest annual momentum as we reach the end of 2014 are US shares (IVV) and Australian commercial property (SLF).

Percy Allan is a director of MarketTiming.com.au. For a free three week trial of its newsletter and trend-trading strategies for listed ETF funds, see www.markettiming.com.au.