ETFs: Has "high yield" been hyped?

Summary: A spate of high yield ETF launches aim to cater to investors wanting high yields in an environment where defensive investments are not returning what they used to. However, investors should be aware than while the income generated by these funds might be higher than an ETF tracking the ASX200, overall returns have been lower than vanilla ETFs over the past year. |

Key take-out:High yield ETFs are relatively new, so it's difficult to think about long term performance. Be careful not to be won over by marketing speak and look at the actual returns on offer first. |

Key beneficiaries: General investors. Category: ETFs. |

Are high yield ETFs any good? They have to be, surely, or they wouldn't exist. They're more expensive than regular index funds, and investors would have to hope that higher fees pay for bigger income.

Trawling the share market to find companies that pay above-average dividends has been the obsession for many investors, while returns from defensive asset classes have fallen to all-time lows. Providers of ETFs have picked up on the trend and launched funds that track indices constructed with the hope of including high yield businesses.

It figures, however, that if everyone has the same idea then those high-dividend stocks would be bid upwards. If that were the case then an index built for yield would underperform the regular index. And that's what's happened. This chart shows the S&P/ASX200 index and S&P/ASX Dividend Opportunities index, without including income from dividends:

But let's forget about income levels for a moment and look at total returns for some high dividend funds, where changes in unit price are included with income. There isn't really much point getting excited about high yield if the capital value of your investment is slowly eroded.

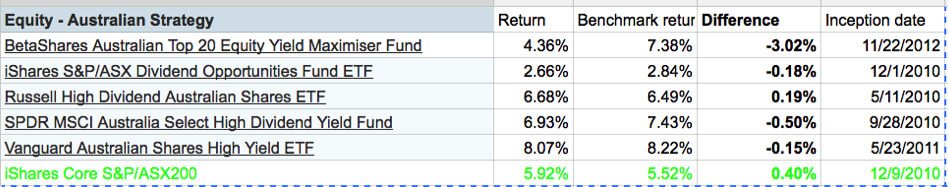

The table shows returns for five high yield ETFs available on the ASX, alongside their benchmarks, compared with a vanilla variety ETF that tracks the ASX200.

Returns shown are annualised results since the inception date of each fund, which all vary. What first hits you is the scope of performance between the benchmarks — there is a more than five percentage point difference between the Vanguard Australian Shares High Yield fund and the iShares S&P/ASX Dividend Opportunities fund. If you're looking for a culprit you have to blame the architects of the indices themselves, as an ETFs' duty is to track them.

The iShares fund, for instance, tracks the S&P/ASX Dividend Opportunities index, while the Vanguard Australian Shares High Yield ETF tracks the FTSE ASFA Australian High Dividend Yield Index.

In fact, the five ETFs track five separate indices.

Apples with apples

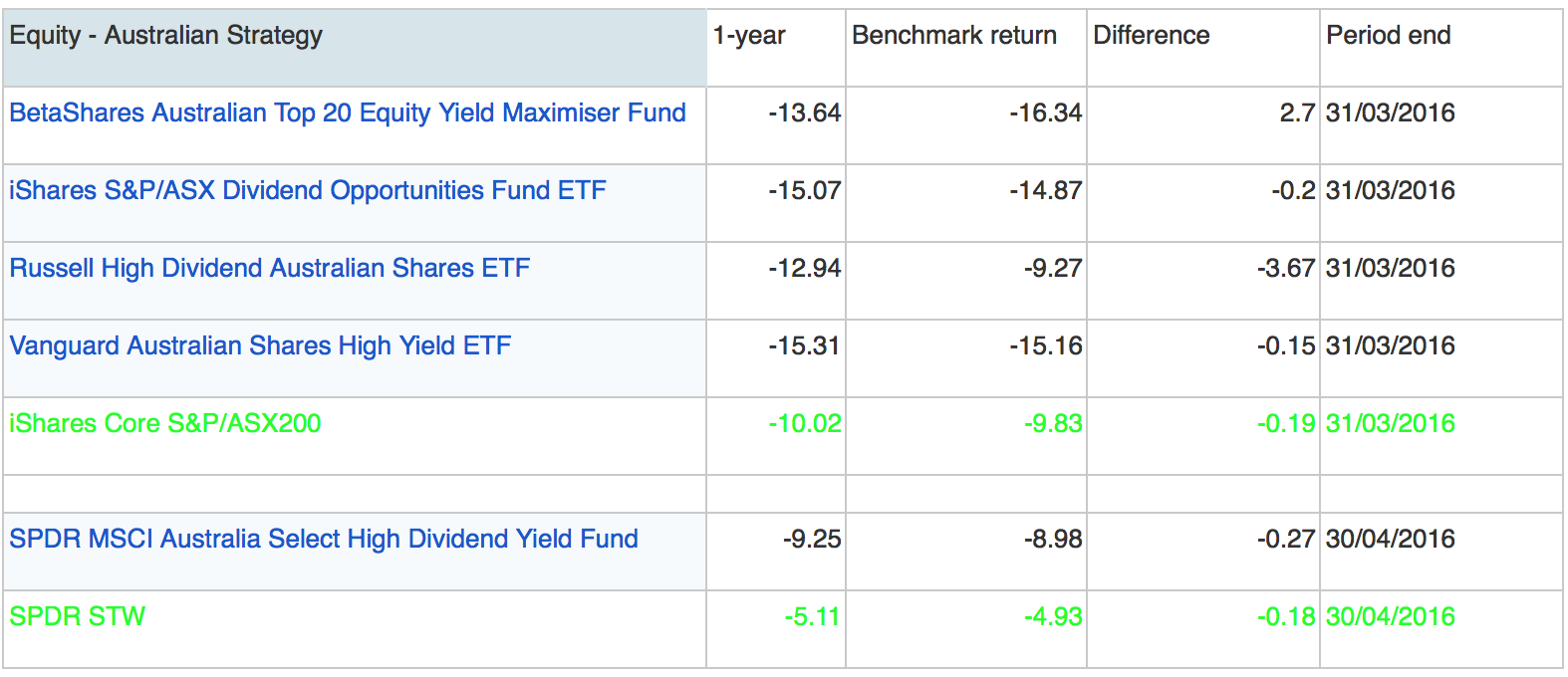

When comparing investment funds it's usually best to look at long-term performance, but the realm of high-yield ETFs is relatively new, with launches staggered over three years. A comparison over one year provides a clearer picture.

It's been a terrible 12 months for the indices concocted to deliver high yield; investors in all the ETFs would have been better off in a fund which simply tracked the ASX200. The returns shown include all of that “extra” yield, along with changes to the unit prices.

Data for some of the funds is for the 12 months to March 31 and for others to April 30, but the story is the same — there is no guarantee the high yield indices will outperform the regular benchmark.

Designer labels

Investors are not a homogenous bunch. Some people out there might not be worried that the capital value of their investment is underperforming the benchmark so long as they are earning higher income than the benchmark pays. But for everyone else one truth that cannot be avoided is that total returns include change in capital value and income earned. The two should not be separated, unless income from an investment is reinvested elsewhere as part of some special strategy.

If the recent spate of launches of high-yield ETFs tells investors anything it is that they we are all as prone to “marketing speak” as consumers in any other sector. Shoppers can't help but be attracted to labels that declare the contents of a tub to be “97 per cent fat free”, even as they would surely be put off if the sticker said “3 per cent saturated fat”. But the two are the same thing.

The fashion for high-yield ETFs could turn out to be just that — a fashion — especially when investors eventually check the mirror and see that their pants have shrunk in the wash.