ETF Detective: Vanguard Australian Property Securities Index ETF

Vanguard Australian Property Securities Index ETF

What is it and what is it invested in?

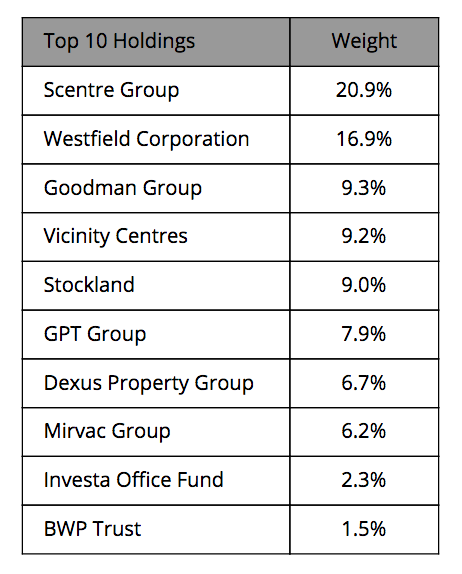

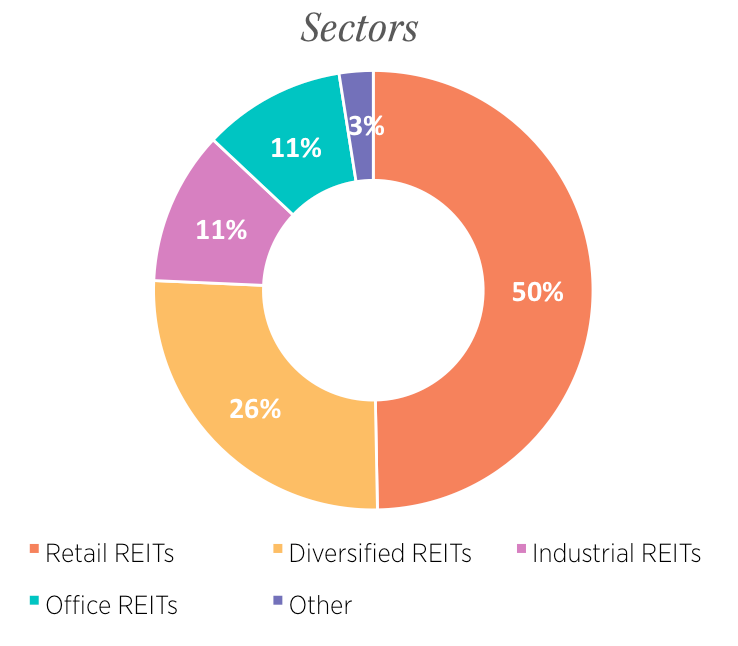

The Vanguard Australian Property Securities Index ETF (ASX Code: VAP) is an exchange traded fund that provides exposure to Australian real estate investment trusts (A-REITs) or more simply known as listed property. It invests in property securities listed on the Australian stock exchange across sectors such as retail, office, industrial, residential, health care and other specialised/diversified securities. The Vanguard Australian Property Securities Index ETF aims to track the S&P/ASX 300 A-REIT Index. There are other ETFs that provide a similar exposure to A-REITs such as the SPDR S&P/ASX 200 Listed Property Fund (ASX Code: SLF) and the VanEck Vectors Australian Property ETF (ASX Code: MVA), although it is worth noting that both these ETF track different indices.

The InvestSMART portfolios use the Vanguard Australian Property Securities Index ETF as it is one of the more liquid exposures and has the most competitive fees.

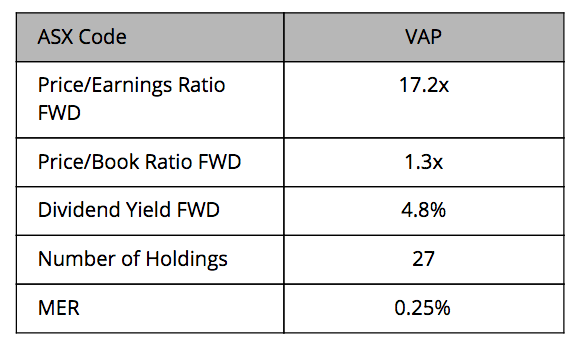

Quick facts as at 31 March 2016

Attractive income but buyer beware

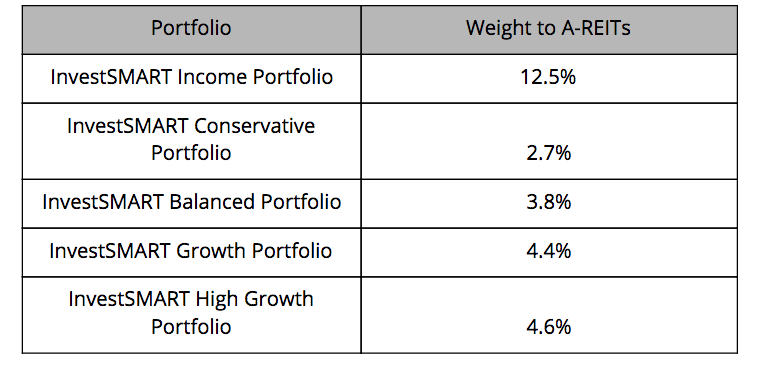

Across the InvestSMART portfolios we generally remain underweight A-REITs relative to similar type portfolios, with the exception of the InvestSMART Income Portfolio where we have a higher allocation in recognition of the portfolio’s income orientation.

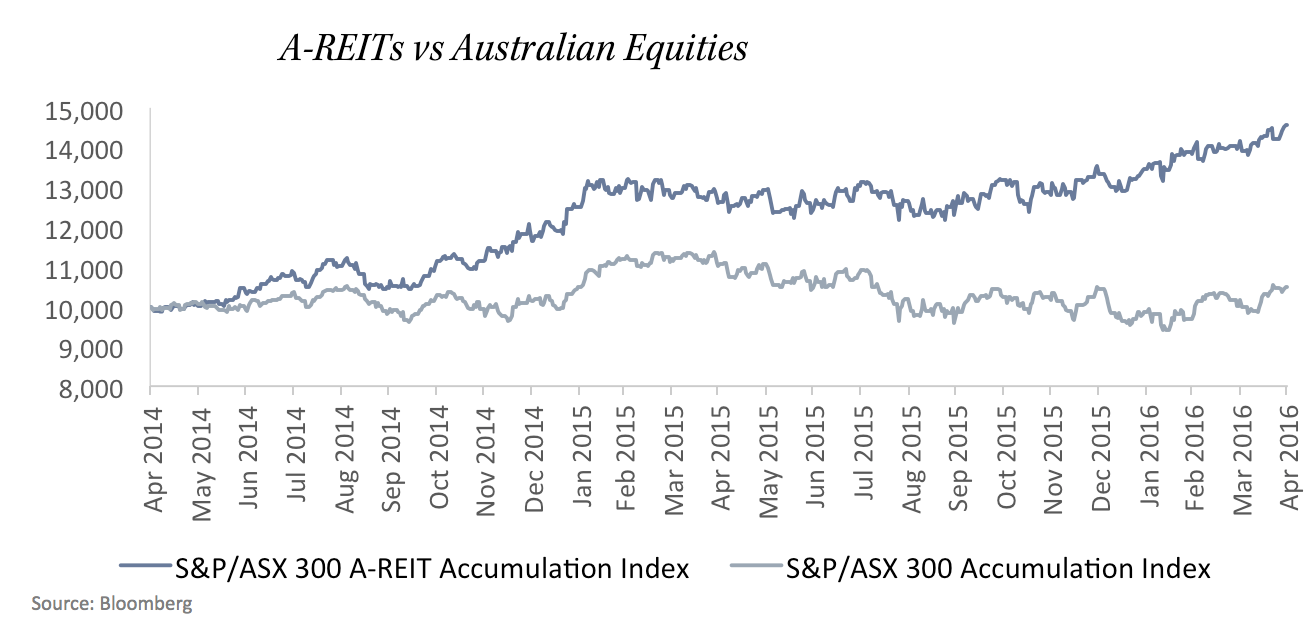

With cuts to interest rates to historically low levels over the last few years investors have been drawn to those types of securities with appearance of stable income and “safe” underlying assets. As such the performance of those types of assets, such as A-REITs, has been quite spectacular relative to the broader market in recent years (see Figure 1).

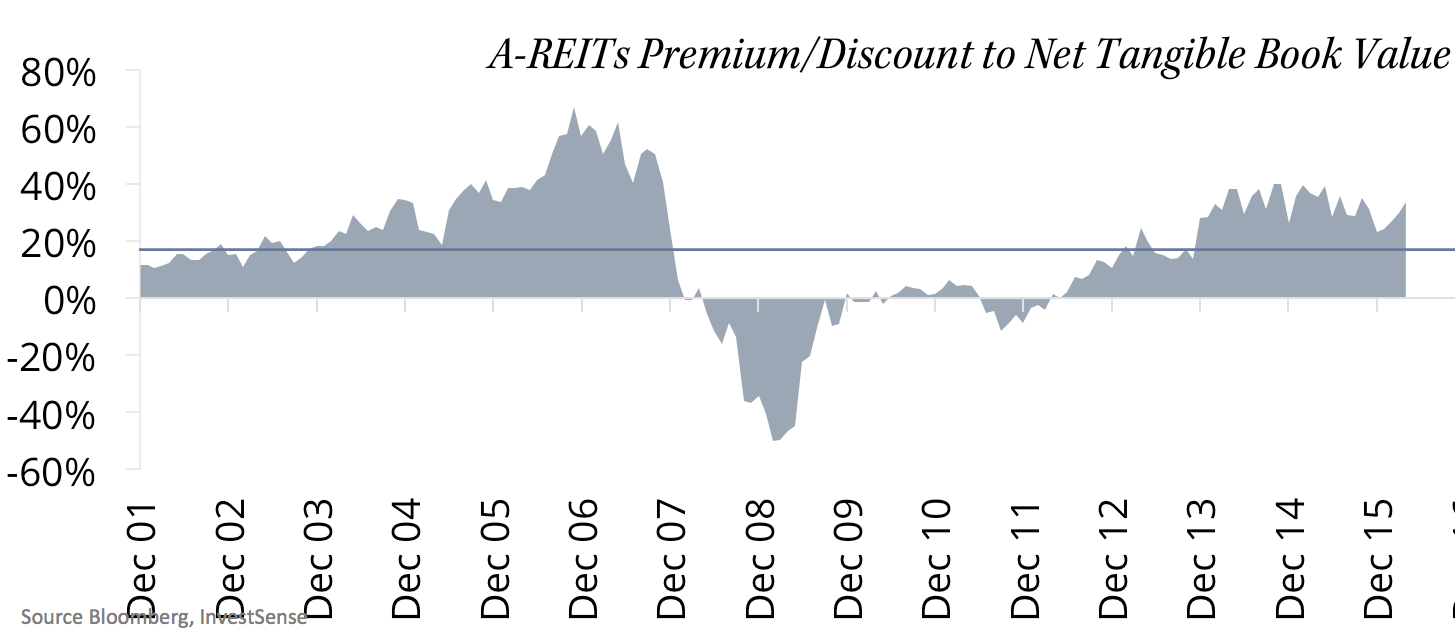

With such spectacular performance we begin to question how sustainable that relative outperformance might be in the future, particularly when you take in to context the valuation A-REITs currently trade at. Figure 2 outlines the price of A-REITs relative to the underlying value of the actual assets they hold (that is the value of the bricks and mortar less debt), at the moment A-REIT prices trade at around a 30% premium to the underlying net tangible asset value. Even if you believe the value of the underlying assets are going to “catch-up” to the price, why pay for something now where the price already reflects the fact that that thing might occur. The difficulty in using such a measure is that things can continue to get more expensive relative to their underlying value, certainly prior to the GFC A-REITs traded at much higher premiums and this might occur again. All we would say is that at current valuations the odds aren’t in your favour, like they were in early 2009 where they were trading at a discount. It would have made a lot of sense to be overweight at that time, as uncomfortable as it might have been.

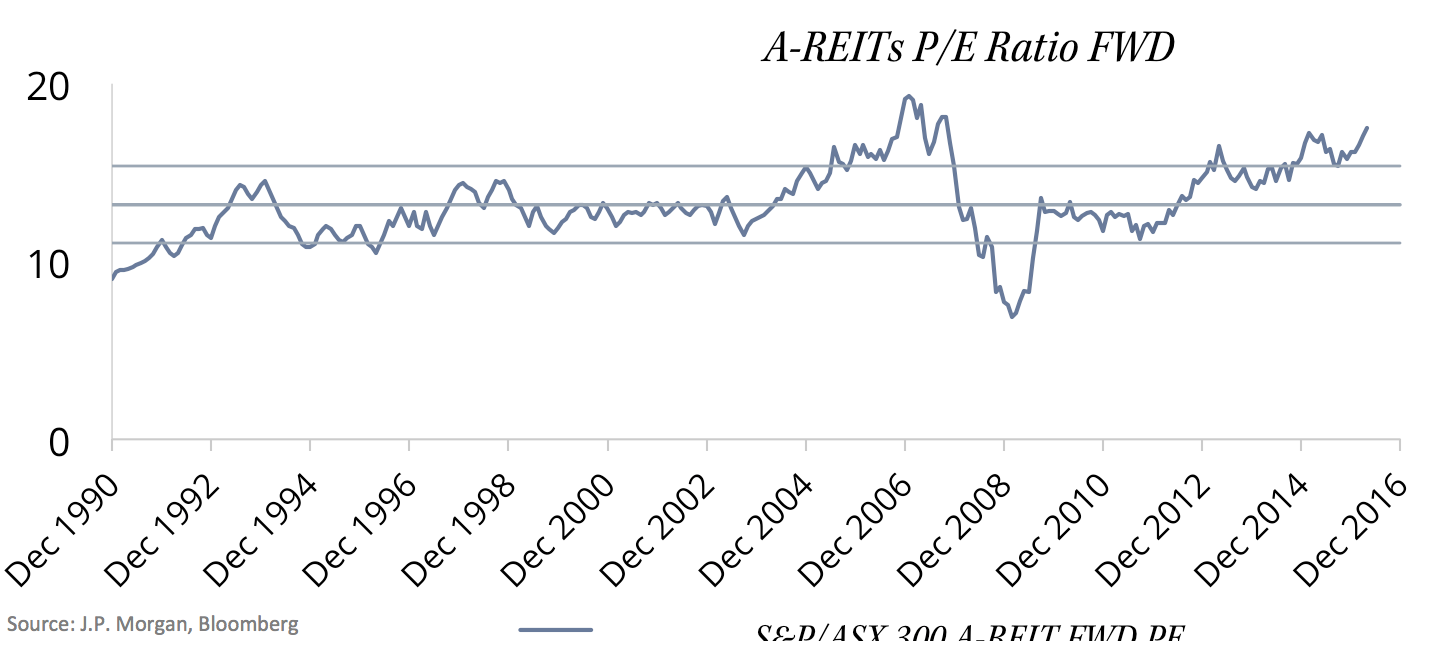

Looking at another valuation metric, on a price-to-earnings basis, relative to their own history A-REITs look overvalued (see Figure 3). Trading at levels not seen since pre the GFC (see Figure 3). Some might argue that you would expect A-REITs to trade at higher multiples in a low interest rate environment and that it is not such a big problem if the earnings growth comes through. However, we would argue that it appears the easy gains have been made in the sector, and that you are relying on a lot more things to “go right” relative to the number of things that could possibly go wrong.

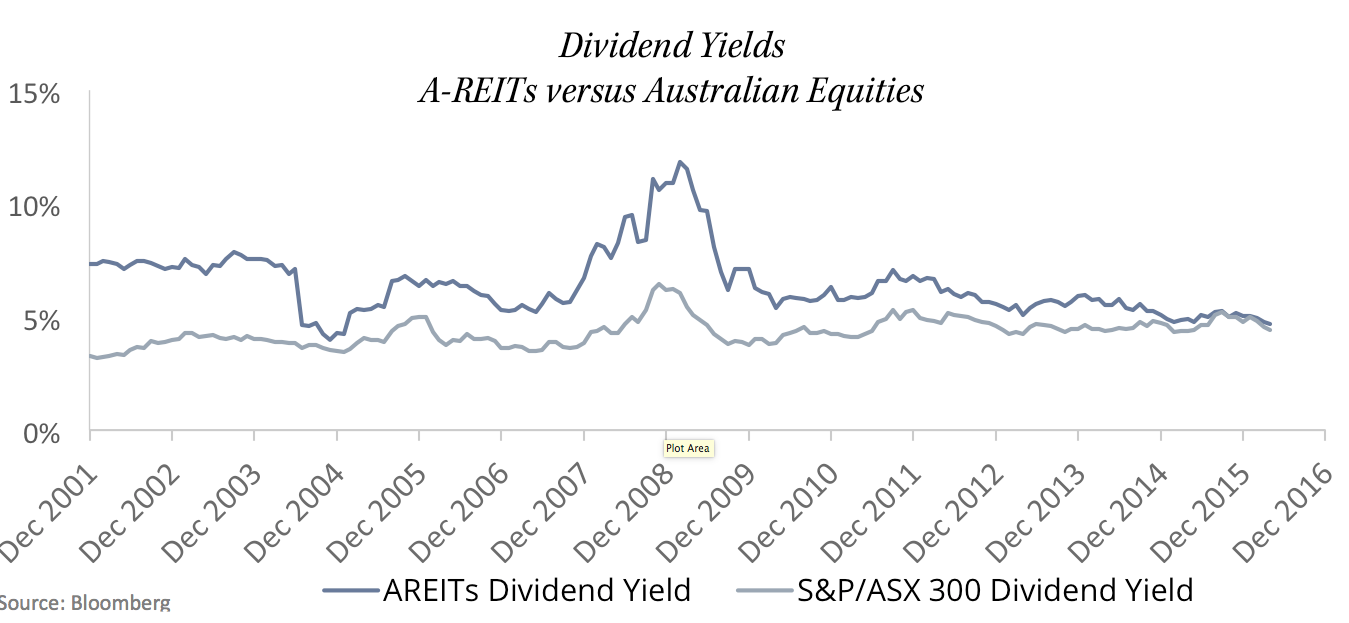

The third point we would make about valuations is this, if you are buying A-REITs for their “attractive” yield characteristics then you can currently get a similar unfranked yield from the broader market but with the potential for better or at the very least more diversified sources of growth (see Figure 4). If one were to then factor in the franking credits from the broader market then the fully franked yield is better than that provided by A-REITs. That is part of the reason why we have a preference to be overweight Australian equities in the InvestSMART Diversified portfolios and underweight REITs.

We continue to maintain a small portion to A-REITs in the portfolios on the basis that they still offer a relatively attractive yield to bonds and cash and may provide some diversification benefit to the portfolio relative to broader equities. In addition, A-REITs may continue to be supported in the short-term if they continue to deliver “some” income growth and there is also some evidence of or potential for M&A in the sector (although we would point out that this is by no means a sole reason to hold the sector or any security for that matter). While we continue to maintain a portion of the portfolio in A-REITs, if valuations become any more stretched there could be a scenario where we hold no exposure at all. We will continue to monitor the exposure and communicate any change in the future.

Target weighting of the Vanguard Australian Property Securities Index ETF in the InvestSMART portfolios (as at 30 April 2015)

Frequently Asked Questions about this Article…

The Vanguard Australian Property Securities Index ETF (ASX Code: VAP) is an exchange traded fund that provides exposure to Australian real estate investment trusts (A-REITs), investing in property securities listed on the Australian stock exchange across various sectors.

The Vanguard Australian Property Securities Index ETF aims to track the S&P/ASX 300 A-REIT Index. Other ETFs like the SPDR S&P/ASX 200 Listed Property Fund (ASX Code: SLF) and the VanEck Vectors Australian Property ETF (ASX Code: MVA) provide similar exposure but track different indices.

InvestSMART uses the Vanguard Australian Property Securities Index ETF because it offers one of the more liquid exposures to A-REITs and has competitive fees, making it a cost-effective choice for investors.

Investing in A-REITs through the Vanguard ETF carries risks such as potential overvaluation, as A-REITs currently trade at a premium to their net tangible asset value. Additionally, the sector's past spectacular performance may not be sustainable in the future.

While A-REITs offer attractive yield characteristics, similar unfranked yields can be obtained from the broader market, which also offers potential for better or more diversified growth. Factoring in franking credits, the broader market may provide a better yield.

A-REITs are currently considered overvalued on a price-to-earnings basis relative to their historical levels. They are trading at levels not seen since before the Global Financial Crisis, suggesting that the easy gains in the sector may have already been realized.

Investors might consider holding A-REITs for their relatively attractive yield compared to bonds and cash, and for potential diversification benefits. Additionally, short-term support may come from income growth and potential M&A activity in the sector.

InvestSMART maintains a small portion of A-REITs in its portfolios for yield and diversification benefits. However, if valuations become more stretched, they may reduce or eliminate exposure. They continuously monitor and communicate any changes in their exposure.