ETF Detective: Vanguard All-World ex-US Shares Index ETF

What is the Vanguard All-World ex-US Shares Index ETF and what is it invested in?

The Vanguard All-World ex-US Shares Index ETF (ASX Code: VEU) is an exchange-traded fund that provides exposure to some of the largest companies in the world apart from those domiciled in the US.

For a US investor this product gives exposure to all large overseas companies – many ETFs with overseas exposure were originated in the US and then brought over here.

However, this ETF could be one of the most important asset allocation tools in the Australian ETF investor’s arsenal over the next few years because we think one of the most important decisions today is how much to invest in US equities versus the rest of the world (including Australia) rather than Australia versus the rest of the world (which is the way we Aussies tend to think).

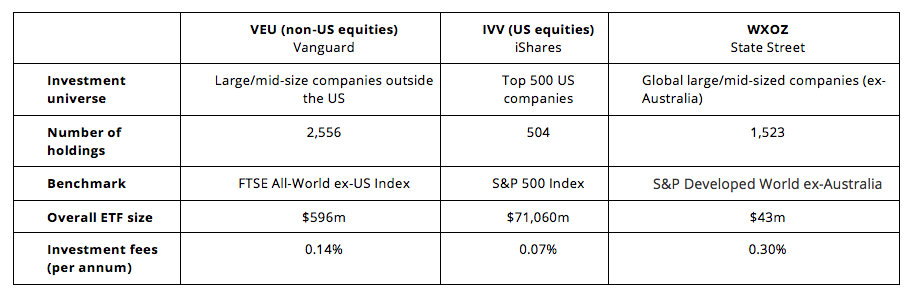

The following table illustrates some key facts about VEU and the US-only iShares ETF we use (IVV).

Quick Facts (as at 31 March 2016)

The fees are fairly minimal for each fund, and especially for the US-only fund (IVV). ETFs are a mostly low cost/high scale game for ETF providers, so the larger the ETF the lower its expenses are for individual investors.

Both ETFs in our portfolios (IVV and VEU) are built originally for the biggest ETF market in the world, the US, and of the two IVV is the largest and has many, many US-based competitors.

By contrast, State Street’s WXOZ is built specifically for the Australian investor and is a one-stop-shop for exposure to all overseas regions. There are some advantages to this approach, including the exclusion of the 5% of large Australian stocks that are in VEU, which is tidier from a portfolio construction perspective.

However, the fees for WXOZ are more than those charged for VEU or IVV. You may also have to fill in a form to avoid paying tax at 30% on dividends to the US government instead of 15%.

Why are the InvestSMART Diversified Portfolios invested in VEU?

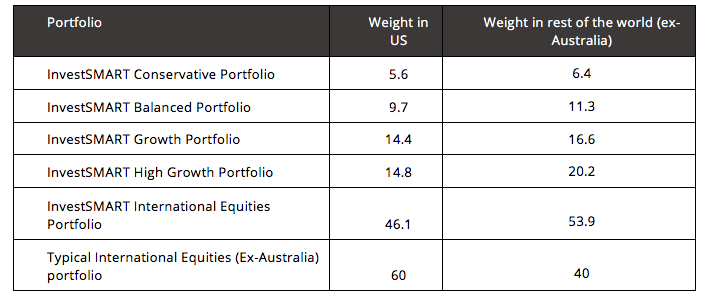

The cost savings of a combined US/ex-US approach (using VEU and IVV) alone are enough to recommend the strategy over using the world ex-Australia fund, especially if you use our SMA portfolios as we fill in the forms for you. But the real clincher is the ability to take a US versus the rest of the world asset allocation position using the two ETFs, which would be impossible with WXOZ.

Is it a good time to be overweight VEU vs IVV?

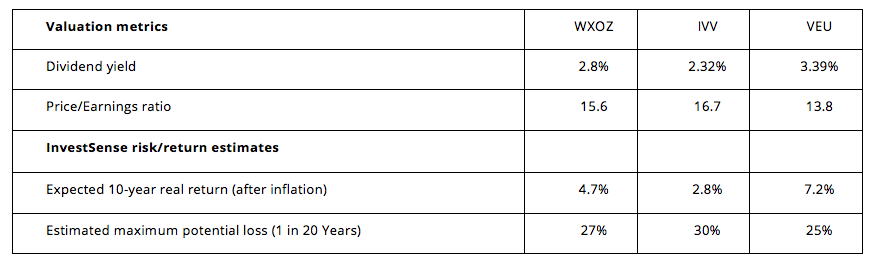

The following table shows some basic stock valuation metrics as well as our forward-looking view of long-term risk/return for each:

Our basic intuition for underweighting the US is that it looks expensive. Economies outside the US have been quite sluggish since the GFC and valuations for most regions are in line with historical averages. The US on the other hand has been the standout performer and every investor on the planet knows it. This means there is room for disappointment if growth for US companies struggles to satisfy optimistic investors.

While the recovery in the US has also been somewhat muted in terms of economic growth, the business cycle measured in terms of corporate return on equity is well advanced and may be turning downwards – there is simply a limit to how far US companies can cut costs and work their balance sheets.

Admittedly, 10 years seems like a long time to wait to see if our forecasts work out and you may ask if that is all a bit theoretical. In our experience when things look expensive over the long term the investment storm tends arrive in the very short term. The last two times US equities looked this expensive was in 2000 (before the “tech wreck”, where the Nasdaq index lost 50% value over two years) and 2007 (before the global financial crisis).

Diversification benefits of a two-ETF approach

While we think Australian equities look quite a bit cheaper than most overseas markets it is still worth holding shares in global markets given the concentrated economic, industry and company risk associated with the local market. To put this into context, our current long-term expected real (adjusted for inflation) return for Australian equities is over 7%; for international equities it is barely 5%, and even lower for US equities.

However, if there was a recession and/or a housing crisis in Australia we could fall well short of that 7% number. Global equities on the other hand may be resilient to a fall in fortunes of any one economy.

The one-stop-shop option of using State Street’s WXOZ fund places more than 60% of your overseas equity exposure in the US, which we think is quite a lot of eggs in one basket, even before you take into account our forward market valuation views.

The following table shows the target weighting of US and global equities in the InvestSMART portfolios (as at 31 March 2015):

We actually complicate things a bit more by adding specific exposure to Europe, emerging markets and smaller US companies (more about those ETFs in coming weeks) but you could certainly replicate this strategy using VEU and IVV.