ETF Detective: iShares Europe ETF

Most SMSFs are underweight in international equities, and one of the easy ways to correct that is to invest in a global ETF. But which one? We think that European equities are better value than the US equities at this point in the investment cycle. There is an ETF that gives you exposure to Europe

iShares Europe ETF

A few weeks ago we suggested that you should split your international equities allocation between an ETF that invests in the US (IVV) and one that invests in everywhere but the US (VEU). This is a sharper tool than just using an international equities fund which probably has more than 50% invested in US equities. However, VEU still remains a somewhat blunt tool in that it assumes you would like to allocate the rest of your international equity exposure across the rest of the world, in proportion to each countries market value. There are country and region specific ETF's you can use to finesse this decision which we use when managing the InvestSMART Diversified Portfolios. This week we are going to have a look at the ETF which covers Europe, IEU.

What is it, what is it invested in and why should I use it?

The iShares Europe ETF (ASX Code: IEU) is an exchange traded fund that provides diversified exposure to European companies (including UK companies) in proportion to their market value in the S&P Europe index.

Quick Facts (as at 31 April 2016)

|

|

IEU (European Equities) |

IVV (US Equities) |

|

Investment Universe |

Top European Companies |

Top 500 US companies |

|

Number of Holdings |

364 |

504 |

|

Benchmark |

S&P Europe 350 |

S&P 500 Index |

|

Overall ETF size |

$3,571m |

$71,060m |

|

Investment Fees |

0.6% |

0.07% |

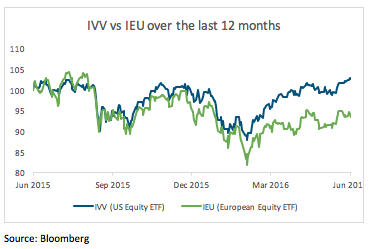

This ETF has underperformed the US Equities ETF largely because of the possible impact of Brexit as shown in the following chart over the last year.

We think most the bad news about Brexit is already ‘in the price’. That is to say if markets already suspect the worse then there might be considerable upside if the news were to improve even slightly. Here are the key reasons we think you should have European Equities in your portfolio:

- European equities don't look particularly cheap on the basis of current or next year’s expected earnings. However, if you look through the cycle (using normalised earnings) they do look quite cheap.

- We think long term expected returns from European equities are likely to be higher than the US based on two simple things:

- Economic growth will at least be comparable with the US and so corporate earnings will catch-up one day

- Confidence will return to European investors at some point just as US investors might have cause to become more sceptical at some point.

- We think long term returns of 7% or more per annum are possible from European equities, versus the sub 5% per annum returns we expect from the US.

The Risks

If markets have cause to fall, with much of the good and bad news for US and Europe respectively already priced in, then the fall for both markets will be quite similar, as happened in January when we last saw a market setback. On the other hand, should the economic outlook improve then the European equity portfolio might well do much better. The last time we saw a significant improvement in expectations for world economic growth was at the end of 2014 and in the period from September 2014 to March 2015, European equities outperformed US Equities by over 10%.

Future Expectations

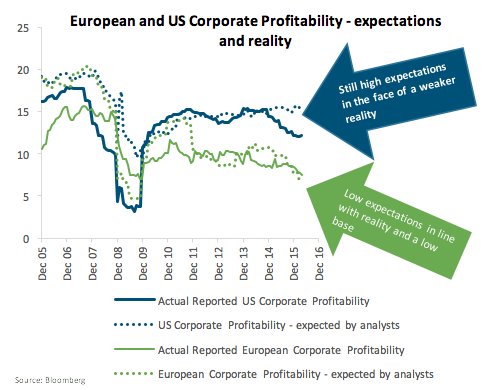

Much of this is hinges on current expectations of corporate profitability and how that might change. The following chart demonstrates the different expectations of corporate profitability in the US and Europe. We think the market has been over-confident of the US market profitability and will wake up with a rude shock one day. European expectations have generally been in line with reality, so less risk of disappointment (and more chance of a surprise to the upside).

Corporate profitability – how do we measure it?

Return on common equity (ROE) is the most widely used measure which is simply earnings (revenue minus production costs, interest and tax) divided by the amount invested by equity investors. This gives you a sense of how efficiently companies are investing your money. High levels of ROE are of course a good thing but it also matters a great deal how much you pay for the privilege which is why you might also look at the multiple of the share price to earnings. Though this ignores the amount of debt used. Corporate debt levels are usually similar in the US and Europe. However, they have been rising recently in the US. Higher debt levels mean you should expect higher levels of ROE.

What about Brexit?

This is a big unknown that could have an outsized impact on performance IEU. We think that all available information about the risks of Brexit has already been factored into share prices and there might be some upside from here as there is so much uncertainty around Brexit is already priced into markets. Uncertainty reduces the price investors will pay for an investment so as things become more certain, that usually means higher prices.

So when should you invest in IEU?

So while there is no categorical answer as to whether IEU is a great investment right now, the InvestSMART International Equities Portfolio has just increased its European equity weighting and now has just over 25% of the portfolio in Europe.

One thing to also bear in mind though is that the fees of 0.6% are high for this type of index tracking ETF. Hopefully fees will fall in the near future but in the meantime we think the upside is more than enough to outweigh this drawback.

Frequently Asked Questions about this Article…

The iShares Europe ETF (ASX Code: IEU) is an exchange-traded fund that provides diversified exposure to European companies, including those in the UK, based on their market value in the S&P Europe index.

Investing in European equities through the iShares Europe ETF can be beneficial because European equities are currently considered better value than US equities. Long-term expected returns from European equities are likely to be higher, with potential returns of 7% or more per annum.

The iShares Europe ETF has underperformed compared to US equities, largely due to the impact of Brexit. However, much of the bad news about Brexit is already priced in, suggesting potential upside if the economic outlook improves.

The risks include market volatility and the impact of economic changes. If markets fall, both US and European equities might experience similar declines. However, if the economic outlook improves, European equities could outperform.

Corporate profitability expectations in the US have been overconfident, while European expectations have been more aligned with reality. This suggests less risk of disappointment and more potential for positive surprises in Europe.

Brexit introduces uncertainty, which has been factored into share prices. As uncertainty decreases, there could be upside potential for the iShares Europe ETF as prices may rise with increased certainty.

While there's no definitive answer, the InvestSMART International Equities Portfolio recently increased its European equity weighting, suggesting confidence in the potential upside of European equities despite the current high fees.

The investment fees for the iShares Europe ETF are 0.6% per annum, which is considered high for an index-tracking ETF. However, the potential upside of European equities may outweigh this drawback.