ETF Detective: BetaShares Australian High Interest Cash ETF

What is it and where is it invested?

The BetaShares Australian High Interest Cash ETF (ASX code: AAA) is an exchange-traded fund that provides exposure to Australian dollar-denominated cash invested in deposit accounts with major Australian banks. For example, at the moment AAA holds deposits with Westpac, Bankwest, Bank of Queensland, Rabobank and ME Bank.

The fund can be expected to provide returns in line with some of the most attractive term deposit rates but with the benefit of daily liquidity. Like all ETFs, AAA can be bought and sold during the ASX hours of operation.

The InvestSMART portfolios use the BetaShares Australian High Interest Cash ETF, which is the only cash ETF available in Australia.

Be aware any decision to add to or reduce holdings in AAA will incur the same brokerage costs as any other ETF, so investors shouldn’t think of it as a cash transaction account. Neither is it a collection point for dividends.

With cash rates at historical lows, why invest in cash?

The Reserve Bank of Australia recently lowered its cash rate to 1.75%, an historical low. Term deposit rates tend to follow the RBA cash rate and are therefore at historical lows as well. The BetaShares Australian High Interest Cash ETF returned 2.54% for the year ended April 30 and will most likely return less in the year ahead. Faced with such grim return prospects, what is the rationale for holding AAA as part of a diversified portfolio?

It all depends on how you look at cash.

A new lesson from the Oracle

Alice Schroeder is the author of The Snowball: Warren Buffett and the Business of Life and an avid follower of the “Oracle from Omaha”. She once said about Mr Buffett: “He thinks of cash differently than the conventional investors. This is one of the most important things I learned from him: the optionality of cash. He thinks of cash as a call option with no expiration date, an option on every asset class, with no strike price.”

A call option is a contract that gives you the right to buy a particular asset at a set "strike" price before or at a defined date. If the asset price rises above the strike price the value of the option will also rise.

In Mr Buffett’s opinion, holding cash is a sound active investment decision, stemming from the belief that one or several assets will lose value in the future and become attractive investments.

By holding cash instead of other assets that are about to depreciate one can limit losses, wait for a better entry point and then participate in the upside. The key to this thinking is that cash, unlike a real option, doesn’t have an expiry date, and that ultimately it will be deployed when the right opportunity arises.

Opportunity cost of cash

If we follow that logic, what is the cost of a cash call option? A sensible valuation method could be to deduct the return on cash from the opportunity cost; that is, the difference between cash and how much I am missing out on by not investing elsewhere. For the sake of simplification, let’s agree that this “elsewhere” is the next most defensive asset in my portfolio: government bonds.

The cost of holding cash for a period of time is therefore equal to the return on government bonds over this time minus the return on cash.

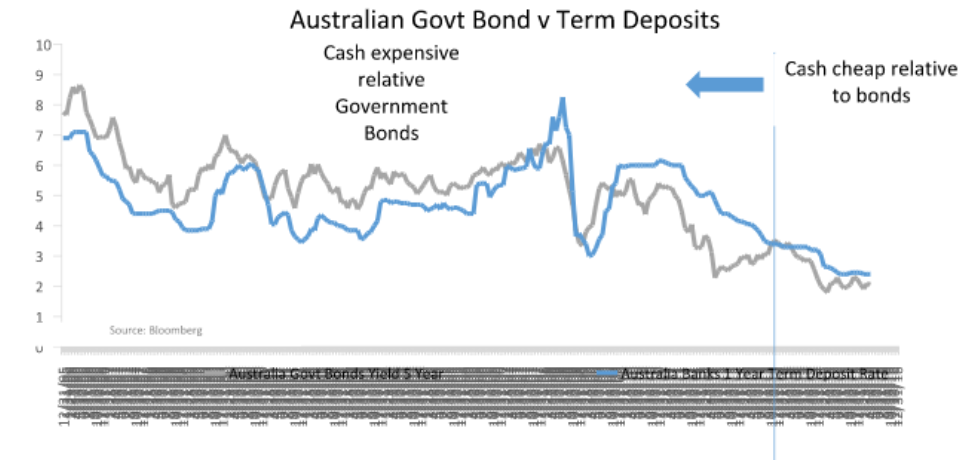

The first conclusion we can immediately draw from this equation is that the price of holding cash will change over time, and that certain market environments will render cash “cheap” or “expensive”. The following chart shows that since the GFC cash has been quite cheap relative to bonds. Even though the gap has narrowed this remains the case.

Keeping the dry powder

Second, let’s consider the expected return from holding cash. Following this line of thinking one driver of this return could be the expected drop in price for the assets I will be buying later on, or the amount I’m not losing now. In other words, cash isn’t just a defensive positioning, it’s also a way to access higher returns at a later date.

Therefore the need to put cash to work should not be prompted simply by low deposit rates but either by the long-term return available elsewhere or one’s short-term view about other markets.

Although the latter is a lot more difficult to predict it can help to focus one’s mind thinking this way, especially when you combine both the long-term and short-term perspectives.

For instance, we think long-term expected returns for bonds and US equities in particular are quite low, so the opportunity cost of holding a bit more cash instead of those assets is not that high.

We also think there will be a better time to buy both those assets in the future – a fall in the price of either being the catalyst to reinvest.

Nothing lazy about cash

The fact that we think the risks associated with bonds and US equities are creeping up means that, while our cash holdings should be creeping up too, the opportunity to buy those assets is also getting closer. This puts a more optimistic slant on holding “lazy” low-yielding cash deposits. If we are wrong, the cost we paid for the option (the difference between future returns on cash and on US equities or bonds) will probably not be that high. In the case of bonds we think you might even get paid for having the option!

So even though cash rates are coming down, in Buffett’s words cash still looks cheap. We agree. That’s why we’ve positioned the InvestSMART portfolios to take advantage of the opportunities we think will come about.

Frequently Asked Questions about this Article…

The BetaShares Australian High Interest Cash ETF (ASX code: AAA) is an exchange-traded fund that provides exposure to Australian dollar-denominated cash invested in deposit accounts with major Australian banks.

The BetaShares Australian High Interest Cash ETF holds deposits with major Australian banks such as Westpac, Bankwest, Bank of Queensland, Rabobank, and ME Bank.

Investing in cash, even at historical low rates, can be a strategic decision. Cash acts as a call option with no expiration, allowing investors to limit losses and wait for better investment opportunities when other assets depreciate.

Warren Buffett views cash as a call option with no expiration date, providing the flexibility to invest in any asset class when the right opportunity arises, without the risk of depreciation.

The opportunity cost of holding cash is the difference between the return on cash and the return on the next most defensive asset, such as government bonds. This cost can vary over time depending on market conditions.

Yes, holding cash is considered a defensive investment strategy. It allows investors to avoid losses in depreciating assets and provides the potential to access higher returns when market conditions improve.

Since the Global Financial Crisis, cash has been relatively 'cheap' compared to bonds, meaning the opportunity cost of holding cash instead of bonds has been lower. This trend has continued, making cash an attractive option for some investors.

Holding cash in a diversified portfolio provides flexibility and optionality. It allows investors to take advantage of future investment opportunities and manage risk, especially when other asset classes, like bonds and equities, have low expected returns.