ER international fund manager series: Legg Mason Global Equity Trust

Summary: The Legg Mason QS Global Equity Trust (SSB0126AU) has a strict investment mandate and aims to beat the MSCI World ex-Australia Index by 2.5 per cent on a rolling three-year time frame. This time period lets the management team consistently re-evaluate to find the best performing companies in each sector, and its performance is impressive when compared to similar funds out there. |

Key take out: The investment aims will ideally give a better return than an ETF tracking the index, making the fund worth considering for those wanting to add international exposure to their portfolios. |

Key beneficiaries: General investors. Category: Managed funds. |

The first two managed funds presented to you in this series – IFP Global Franchise Fund and BT Wholesale European Shares Fund – offered flexible mandates, affording the portfolio managers the luxury of investing funds as they please irrespective of the composition of their underlying benchmark. Of course, though formal rules were not in place, each manager had an investment thesis to pursue and a process to achieve this.

In contrast this week's fund, the Legg Mason Global Equity Trust (SSB0126AU), has a stringent investment mandate to stick closely to the underlying benchmark of the MSCI World ex-Australia Index, which reflects global shares prices excluding the ASX.

Certainly the rigid guidelines the fund follows has not negatively affected performance. Indeed, its return over the past three years is one of the reasons we have identified this it.

Specifically, the mandate states the fund must be invested within plus or minus 10 per cent of a country weight, and no more than eight per cent greater than the sector weight within the benchmark. A position in an individual security can't be more than three per cent above the benchmark.

Such a rigid set of rules to follow ordinarily makes it difficult for a fund to consistently outperform the benchmark as managers may be forced to invest in sectors where shareprices are falling. For example, globally, energy companies have been hurt as oil and natural gas prices have sunk – this has made it a sector many would want to avoid.

What's interesting about being forced to stick to benchmark weights is the pressure to find investments that can make up for any weakness within those in struggling sectors. In other words, an unloved pocket of the market notching up negative returns needs to be offset by picking the best performing companies in every other sector. At this fund, the biggest single sector allocation is 14.6 per cent.

Investment thesis

Using a systematic, rules-based approach means there is little room for emotions and gut feelings to influence decisions at the Legg Mason Global Equity Trust. It's a strategy that has proven fruitful, as evidenced by analysing the returns of the fund.

Companies are selected based on bottom-up stock selection and are ranked by their level of attractiveness according to four factors: cash flow potential, earnings growth, expectations and technical factors.

What the fund is trying to determine from the cash flow number is whether the company can use its liquid assets to cover debt repayments, pay dividends and reinvest in the business. It provides an indication of how long the company will be able to be profitable and can uncover any potential weaknesses.

Ideally, the fund would be looking for companies that can either be profitable even though prices are substantially depressed, or will have cash to last them the longest period in a bid to ride out the downturn.

Wider economic conditions of sectors and countries are also considered when constructing the portfolio. However, this is done within the restrictions of the investment mandate.

It should also be noted the fund can only hold a maximum of 10 per cent cash, but it is the intention to be fully invested at all times. This requirement means there is little downside protection if share markets were to collapse in price. This is the opposite of many other managed funds, which use cash as a way to stem potential short-term losses when share market volatility picks up.

Where currency is concerned, the Legg Mason Global Equity Trust can only hedge 20 per cent of the fund value back to Australian dollars. Consequently, the movement between the local currency and the US dollar and the Euro will also impact returns.

The fund is managed by QS Investors, headquartered in New York. The cost to manage the fund is only 0.863 per cent – half the amount of some more popular local managers.

Where the fund invests

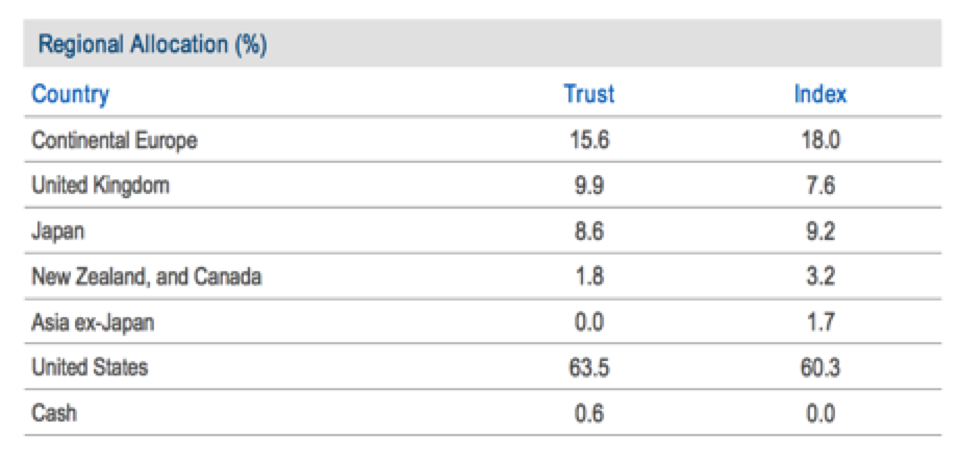

In line with the investment mandate, the fund is invested almost identically to the MSCI ex Australia benchmark, in both the country and sector measures.

Most funds that can invest as they please typically favour a particular country and sector, leaving investors with no exposure to some categories. But, if you want a true market exposure, a fund that is restricted to benchmark weightings offers you this choice.

How is outperformance achieved

Considering the fund must invest so closely to the benchmark, you might be wondering how it consistently outperforms the it so convincingly.

Although the fund doesn't detail its top ten share holdings or offer commentary on companies in the portfolio, the difference in returns between two investments within a sector will determine just how well it performs. A manager can't simply pick a popular company in a sector with momentum and be confident it will deliver the required returns.

The information technology sector is rich pickings for big name investments: We have Facebook, Amazon, Netflix and Google – given the acronym FANG – just to name a few. While we don't know if the fund holds these or not, the difference in returns across these companies will shed some light on how a decision can make a big difference to the end return of the fund.

Let's look at Google and Yahoo, the two major search engines specialising in information sorting. In 2015, Google returned close to 50 per cent, while Yahoo lost 34 per cent – this was against a 5 per cent gain for the information technology sector (all in US dollars).

The difference between holding 3 per cent in Google and Yahoo is a little more than 2 per cent in a year. Add that up across the entire portfolio and we can see why the fund has to be on the money with most calls when the option to avoid wilting sectors is no longer on the table.

Performance

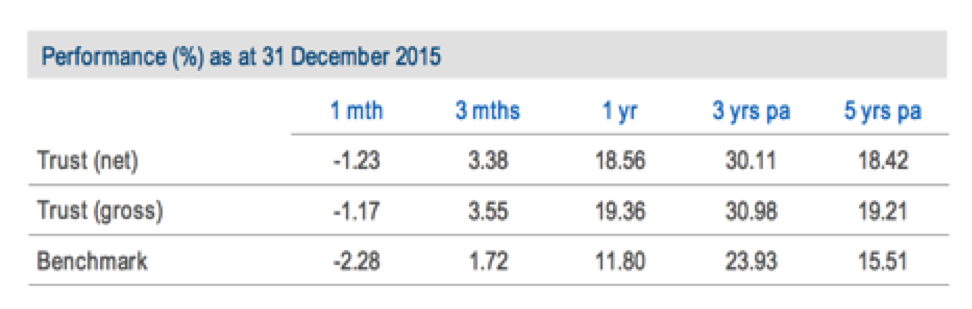

The fund has comfortably eclipsed its own target of beating the MSCI World benchmark by 2.5 per cent over a rolling three-year timeframe.

The three-year performance in particular is a standout. Other funds also offering international exposure – Magellan Global Equity Fund and Macquarie Global Franchise Fund – have also still beat the index, but their returns have come in at 2.5 per cent.

While past performance is no indication of future performance, the beauty of the three year number lies in the fact the team is consistently able to identify companies generating the best performances within each sector. An investment mandate that comes with many rules makes it difficult to outperform over any time period, because you can't simply pick the companies in the sectors with strong earnings potential that leads to rising share prices.

Even looking at the one-year number is impressive. Energy lost over 20 per cent and materials were down 13 per cent, which makes up around 10 per cent of both the index and the fund's portfolio. Despite the detraction of these sectors, the fund still outperformed the index by eight per cent during that same time.

The year ahead

Rising US interest rates and the ending of quantitative easing have led some market commentators to believe the Australian market could be in with a chance to edge out the largest share market, the US-based S&P500, this year. However, even if this is the case there will still be global companies generating strong returns and with an overwhelming track record the performance of a wider market doesn't spell doom for the fund.

You could think of it like this: you want to own the best companies, not an aggregate of either market. Companies with a track record of picking winners and outperforming international investing still make sense.

Indeed if you are investing your retirement savings, your time horizon should be much longer than a year alone as your investment period spans many decades – this affords you the luxury to weather market tantrums and market downturns.

Your portfolio

If you're not sold on investing in a particular theme, but still want an actively managed exposure to international shares, this could be the fund for you.

Given the similarities between this fund and an index, it could be an ideal fund in any portfolio needing exposure to international shares. The investment aim of beating the index by 2.5 per cent over rolling three years will ideally give investors a greater return than investing in an ETF tracking a similar benchmark.

As always, for conservative investors – those who don't want a great deal of their fund invested in shares –a lower percentage of your portfolio invested in this asset class would make more sense, compared to someone trying to grow their wealth.