ER international fund manager series: IFP Global Franchise Fund

Summary: The IFP Global Franchise Fund has beaten the benchmark by at least five per cent over the period of five years or more. The fund undertakes a bottom up research approach and looks for stocks generating free cash flow across consumer goods, technology and health care sectors. |

Key take out: The Global Franchise Fund focuses on stocks that generate income regardless of broader market conditions – including household goods and packaged foods. The management fee is competitive for international exposure. |

Key beneficiaries: General Investors. Category: Managed funds. |

The sharp downturn in the local Australian share market in the first few weeks of 2016 emphasises once again the need to diversify your share portfolio offshore. While our local market fell by around 8 per cent, the falls overseas were less severe – at about 6 per cent on Wall Street and 9 per cent for the MSCI global indices.

What's more, the horrific drop in the value of our resource stocks combined with the lighter – yet severe – reduction in bank share prices also displays our over-exposure to two sectors that together constitute almost half the value of the ASX.

Global investors are continually able to balance the ASX concentration of miners and banks with reliable stocks in the health, pharmaceutical and IT and technology sectors offered by both Wall Street and other leading offshore markets.

But how does a Eureka subscriber, who may find directly acquiring overseas listed stocks too difficult, get some action? Certainly Australian investors often find the mix of currency risk, different tax laws and most notably the lack of franked dividends in offshore markets to be negatives.

While you are probably familiar with the investment options from the best known locally-based internationally focused fund managers, such as Platinum Asset Management and Magellan Group, there are many other fund managers that can give you exposure to this proven investment thesis.

In the weeks ahead we will be bringing you a six part series looking at some of the best managers investing internationally, including those that operate within a specific niche.

To start, we introduce the IFP Global Franchise Fund, managed by UK-based Independent Franchise Partners. Macquarie, acting as the responsible entity, offers local investors access to this fund with a minimum direct investment of $20,000. It is also distributed on a number of platforms, including brightday, where minimum investment amounts are at the discretion of each platform.

IFP Global Franchise Fund – an investment overview

The fund invests in around 30 companies that have strong brand names and a competitive advantage. The investment thesis is easy enough to understand, given the influence that these brands exert in consumer decision making and the luxury of pricing power that comes with being well-known or industry leaders.

Investing in brands is an attractive story, but there is more to it. For one, the fund specifically looks for companies consistently generating free cash flow. This measure is linked to the ability to pay dividends and reinvest in the business.

The ability to consistently generate free cash flow, combined with the intangible value offered by a brand name, narrows down the sectors ripe for investment. Typically companies in consumer durables, pharmaceuticals, media-related companies and information services would tick the box.

Despite telecommunications and airlines having all the attributes of a strong brand, the fund applies a rigorous discrimination policy and typically avoids these companies, because they operate with high fixed costs and free cash flow is susceptible to inputs that are beyond the control of the company.

Performance

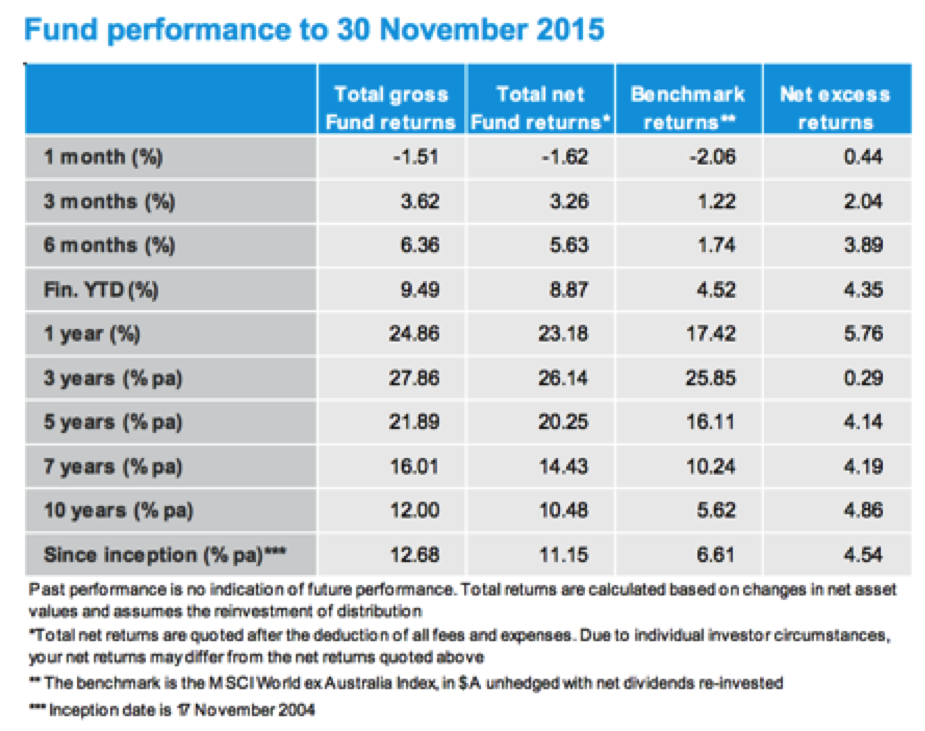

The fund has outperformed the benchmark by more than four per cent over the time period "five years or longer" – this is an exceptionally impressive historic record. This can be explained by avoiding sectors like materials and mining entirely, as well as being prudent on investment selection.

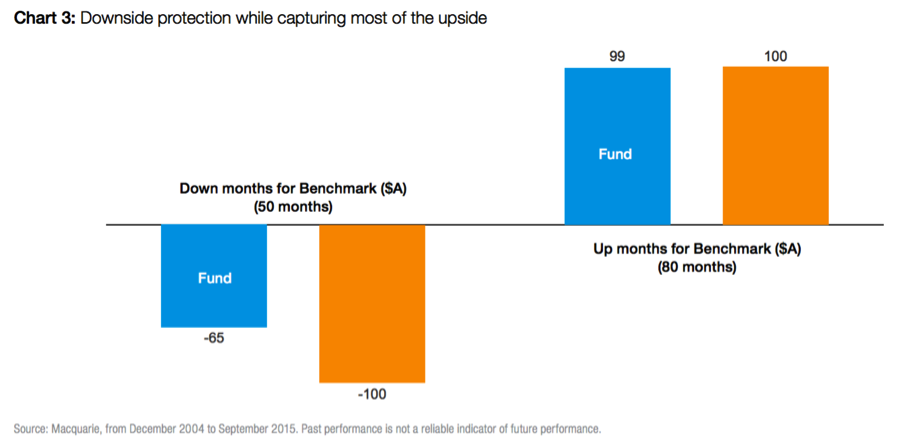

As global share markets whipsaw between bouts of enthusiasm about international economic prospects and fear over China's reform measures and currency issues, capital preservation is key for many self-funded retirees. Consequently the downside protection the fund has been able to historically offer might be of interest to investors bothered by downturns – regardless of how long these downturns persist.

Since inception of the fund in December 2004, through to September 2015 it has only fallen around 65 per cent of the benchmark in the months the market is down. For a “long-only” equity fund (there is no shorting here), this is a comforting reflection on management's stock selection and ability to manage money regardless of the economic cycle. All of this is without forgoing upside, which is nearly collected entirely by capturing 99 per cent of the monthly market gains.

The process

Part of being a good manager is knowing what your investment universe is and sticking to it. It keeps the team on track to pick the right companies and gives investors a clear picture of what the fund might own.

Another tick in the box of IFP is the disciplined approach taken to identifying and owning companies. The fund undertakes “bottom up” research, getting to know individual companies and the competitive environment they operate in and confirms investment decisions only after interviewing senior management.

The fund is continually looking for management with a proven track record - stocks that have runs on the board when it comes to delivering what they said they would. Those in management ranks need to meet the expectations of the fund before an investment is made.

What the fund owns

The best processes don't always lead to funds matching, or even outperforming their benchmark. This is dependent on managers investing in the right companies, in the right sectors.

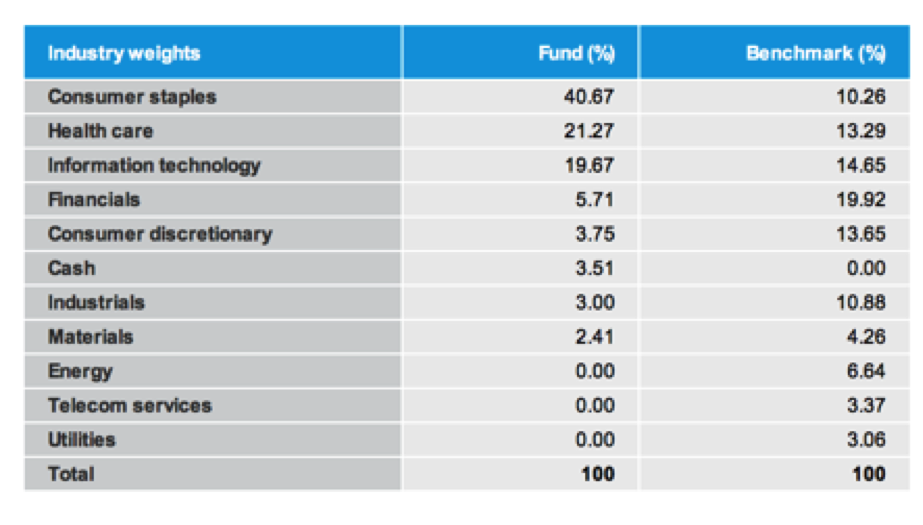

As we can see from the sector allocation, the fund favours companies in consumer staples, healthcare and information technology.

Broadly speaking, these sectors have companies that can generate profits in a variety economic cycles. Companies that the fund has invested in have already survived multiple business cycles.

The nature of these businesses also means predicting cash flows can be done with a high level of predictability in combination with the fact the numbers are often consistent. This makes it possible to generate a valuation with a high degree of confidence.

Consumer staples

You would be forgiven for thinking consumer staples were a sector to avoid if you were taking the performance Woolworths and Coca Cola - leading local companies within the sectors - as global bellwethers. But there are many other global brands offering strong returns, such as Kirin of Japan.

IFP allocates around four times the benchmark exposure to household products, packaged food, soft drink and tobacco companies, which are some of the largest held positions in the portfolio.

Here's why Tokyo-based Kirin Holdings meets the fund criteria. It owns a variety of brands across beer, wine, juice and dairy products and has returned over 10 per cent (in yen) per annum for the past five years.

Moreover, well-chosen consumer staple stocks can be a stalwart of any portfolio when economic conditions are weak, on the basis people still need to buy the essentials to run the family home. Not being as sensitive to economic cycles as other sectors, these types of companies are favoured when investors are looking for a flight to safety.

Information technology

A sector made up of software and information technology services companies is bigger than just Apple or Facebook. The sector offers both defensive and growth characteristics.

Financial performance is often highly predictable as companies generally have a significant proportion of recurring revenue. Companies focusing on service often have a low churn rate due to the financial costs of moving a workforce from one program to another.

Microsoft, which is a top ten holding for the fund, has returned over 17 per cent (in US dollars) annually for the past five years. It generates around 70 per cent of revenue from infrastructure software.

Health care

Product developers and service providers in the health care and pharmaceutical industries are primed to capitalise on a globally aging population. As more countries increase in affluence, it's expected that the amount spent on basic health needs will rise.

The combination of demographics and rising global wealth mean the focus of health care within the fund doesn't need to rely on new drugs and vaccines to find growth – companies providing the basics are well positioned to capitalise on markets once foreign to them.

Take the example of top ten holding Johnson & Johnson, which has returned over 14 per cent per annum for the past five years (in US dollars). While best known for its bandaids, it has a suite of other products, including baby care and over the counter medicines, both suitable for emerging markets. It also has a division directed at medical devices - think orthopaedics and surgical instruments.

How this fits into your portfolio

A fund like this could complement existing holdings in exchange-traded funds or other specialist managed funds.

With a management cost of 1.38 per cent, it is priced competitively compared to other international managers, which tend to sit around 1.5 per cent. Interestingly, the fund doesn't charge a performance fee. While some investors prefer managers to be rewarded when they do better than the benchmark, it clearly hasn't hindered the returns the fund has generated.

While it is a diversified investment, a maximum allocation might fall around the 10 per cent mark. Even though the fund has a management team of proven performers (based on the return generated), investors should always be mindful of management risk of their investments. Having a maximum amount allocated is a good way to identify this.