Equity gearing in super gets the thumbs up

Summary: Despite concerns about gearing by SMSF investors, new research shows Protected Equity Loans boosted the performance of a range of share portfolios. These loans allow investors to hand back shares to a lender if any stock falls during the term of the loan, rather than making top-up payments. Research found PELs perform well when share prices rise or when they fall heavily, but unprotected portfolios score better when stocks rise or fall by small amounts as loan costs eat into relative returns. |

Key take-out: Share portfolios investing using Protected Equity Loans outperformed the same portfolio purchased without gearing by more than 7% per annum between 1994 and 2014. |

Key beneficiaries: General investors. Category: Strategy. |

The David Murray-chaired Financial System Inquiry is due to report later this week and is expected to make adverse comments regarding the use of gearing by SMSF investors. That builds on earlier concerns expressed by the Jeremy Cooper-chaired Super System Review, delivered to the federal government in 2010.

Of course the majority of the attention in relation to gearing in DIY funds relates to property investment – but there are much wider and more sophisticated gearing activities that investors are only beginning to discover and explore.

At Eureka Report several commentators have argued strongly to defend the right of DIY investors to gear within their super funds if they wish to do so.

What's more, new research I'm releasing this week (which underpinned a submission to the inquiry) questions the accuracy of these concerns over DIY gearing and shows that share gearing using Protected Equity Loans (PELs) boosted the performance of a range of different share portfolios.

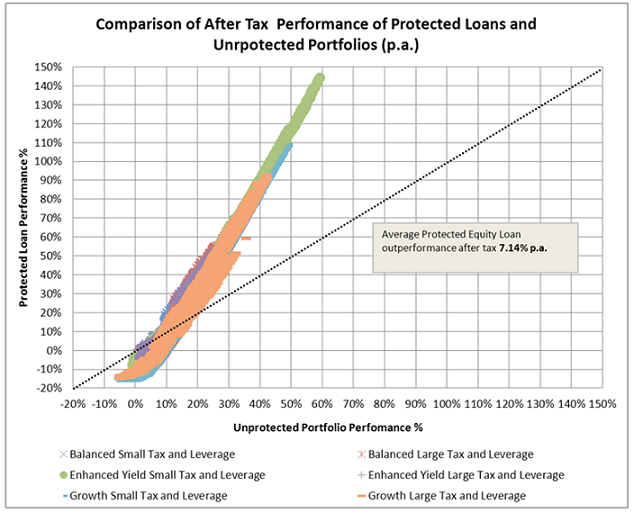

For an SMSF investor the share portfolios invested using Protected Equity Loans outperformed the same portfolio purchased without gearing or protection on average by 7.14% per annum between 1994 and 2014, and the PEL outperformed the equivalent ungeared/unprotected portfolio 60% of the time during this period.

The research uses share portfolios currently offered by CBA and uses real data for their performance during this period - though similar products are offered by all of the other big four banks: ANZ, NAB and Westpac. CBA has not offered PELs during the whole of this period and so, for years prior to them being offered, the PEL returns have been reconstructed using equivalent loan terms. Real share prices, dividends, franking levels and tax rates were used in the data. The returns are analysed assuming the investor is an SMSF which is in accumulation phase and is paying 15% tax. The gearing level used for the analysis was set at 100%, that is, the investor did not contribute any of its own capital to the investment, instead limiting the outlay to interest and borrowing costs.

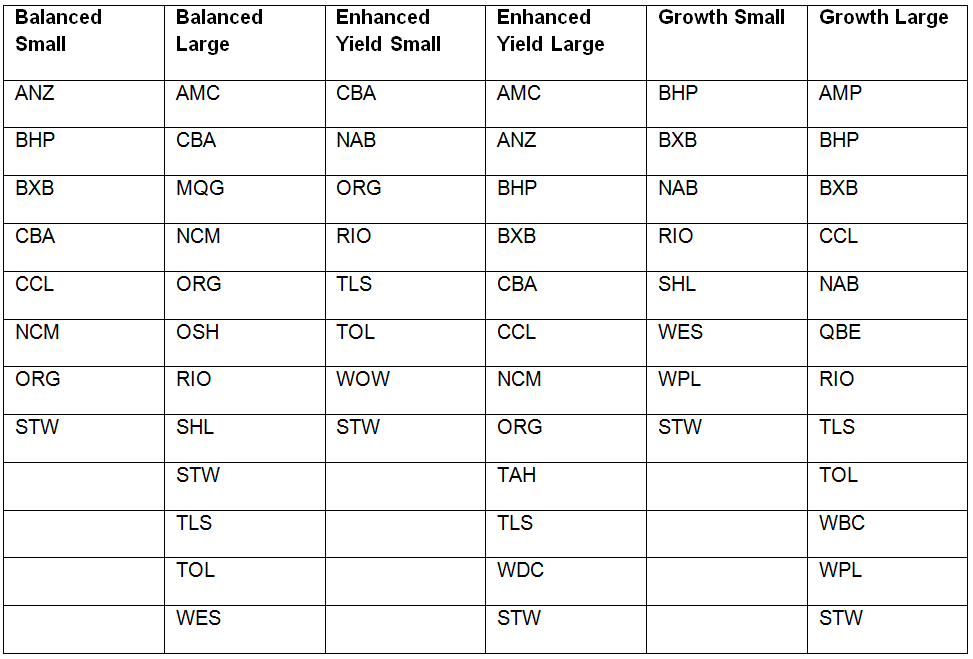

The share portfolios used are set out in Table 1 below:

Table 1: Share portfolios (source: Commonwealth Bank of Australia)

Protected Equity Loans

Eureka Report readers will be familiar with the features of PELs which embed a protection facility which permits the lender to limit its security to the shares purchased using the Protected Loan, with no right to demand early repayment (apart from non-payment of interest) during the term of the loan (see Is it time to gear? and Protect yourself … like an institutional investor). PELs are offered with gearing levels between 50% and 100% of the share price. This is effectively a “walk away” mechanism, meaning that if any individual share falls during the term of the loan, the investor can simply hand it back to the lender in full satisfaction of the loan attributable to that share. If less than 100% gearing has been used, in the event of “walking away” the investor will sacrifice some or all of the capital outlaid. PELs do not impose any requirement on the borrower/investor to make any top up payments/increase security in the event of the share price(s) falling during the investment term.

PELs are radically different to other forms of share gearing such as:

- Margin loans

- Synthetic gearing facilities of the type known as “equity lever” or “share lever”

- ASX listed instalment warrants with a “stop loss” mechanism

Unlike these products, PELs do not impose a requirement that the borrower/investor must provide any top up to the security which supports the loan, in the event of a fall in the price of the share(s) which have been purchased using the loan.

In the case of margin loans and synthetic gearing facilities, the investor can be required to pay a “margin call” (or equivalent) in the event of a price fall, and failure to make this margin call will give the lender the right to sell some or all of the underlying shares.

In the case of “stop loss” style ASX listed instalment warrants, it is typically the case that the issuer/lender can simply sell down shares in the event of a price fall, i.e. it will not permit the borrower/investor to make a margin payment.

As a result, each of these styles of products exhibits the feature known as “short gamma” – where some or all of the share(s) will be sold during a period when the market falls. “Short gamma” positions are inherently risky because they expose an investor to the prospect of crystallising losses during periods of market disruption, rather than permitting the investor to continue to hold shares until the market recovers.

PELs avoid the problem of “short gamma” and thus provide important investor benefits not available with other forms of share finance.

Results

The analysis compared the returns for a specific outlay which was used to purchase the share portfolios in Table 1. In the case of the PEL the outlay was limited to the cost of the PEL with the loan to value ratio of 100% – i.e. the outlay was used to pay interest and borrowing costs. In the case of the unprotected/ungeared portfolio the outlay was used to buy the stocks themselves. Using this methodology allows for a comparison on a “like for like” basis. The portfolios are selected based on quantitative models that CBA produces and provides to clients, with no specific means taken to “optimise” the underlying stocks as being “suitable” for use within a Protected Loan strategy. Table 2 shows the returns for all portfolios.

Table 2: Returns for PEL compared to unprotected/ungeared portfolios. Source: CBA

Table 2 shows the level of outperformance through the portion of the “scatter diagram” that sits above the dotted diagonal line.

Further, the analysis shows that:

- The relative performance of portfolios selected with regard to yield (12.69% pa average return) scores better than portfolios selected with regard to growth (7.95% pa average return)

- The “balanced” portfolios underperform the “yield” portfolios

- The small concentrated portfolios perform better than the larger portfolios.

Conclusions

PELs can deliver strong benefits, especially when used to buy portfolios of stocks with good dividend income. These dividends defray the overall cost of the gearing and this reduces the “hurdle” by which the geared stocks need to perform to overcome gearing costs. Small portfolios performed better than large portfolios, primarily because this reduces the dispersal of returns – the gap between the best and worst performing stocks. PELs perform really well when share prices rise and also beat unprotected portfolios when stock prices fall heavily. When stocks rise or fall by small amounts the PEL costs eat into relative returns and the unprotected portfolios score better.

This analysis highlights the benefits for SMSF investors of using well designed share gearing to add to their returns. It will be interesting to see how hard the FSI goes in recommending changes to gearing rules for SMSF.

Dr Tony Rumble provides asset consulting services to financial product providers and educational services to BetaShares Capital Limited, an ETF provider. The author does not receive any pecuniary benefit from the products reviewed. The comments published are not financial product recommendations and may not represent the views of Eureka Report. To the extent that it contains general advice it has been prepared without taking into account your objectives, financial situation or needs. Before acting on it you should consider its appropriateness, having regard to your objectives, financial situation and needs.