Enviro markets jolted into life

Small-scale Technology Certificates (STCs)

Higher prices and large trading volumes characterised the month leading up to the release of the 2013 Small-scale Technology Percentage. The same can also be said of the days immediately following the announcement. Meanwhile the commercial photovoltaic industry has been dealt at least a brief reprieve from changes advocated in the Climate Change Authority’s RET Review Report.

Recent weeks in the STC market have brought many a highlight with considerable movement in the spot market combined with persistently high levels of trade activity. To begin the year the STC market appeared generally directionless, softening across the early part of January before oscillating around the $31.50-$32.00 range for several weeks.

It was only in mid February that the market’s torpor was broken, though once roused, the results were impressive. The spot market progressively reached and surpassed each milestone ($32.50, $33.00, $33.50 etc...) despite considerable volume coming out along the way. Though volatile at times, the steady rally continued into March with the market breaking through the $34.00 level.

The explanation for the solid recovery appears to have been a general recognition that the sizable surpluses which have previously defined the STC market (being, according to the Clean Energy Regulator’s specific definition, 22.5 million in 2011 and 15 million in 2012) are unlikely to be repeated at the end of 2013.

This is primarily due to the fact that despite the price of photovoltaic panels remaining very low, the combined roll back of subsidies for the PV industry (Solar Credit Multiplier and feed-in tariffs) will naturally reduce the number of STCs created across this year.

The rally in the spot STC market was such that by the early part of March prices had reached levels not seen since the end of the first quarter of 2011; a time when the STC market was rapidly transitioning from scarcity pricing to a level reflective of expectations of a massive oversupply.

While market participants waited with great anticipation across this period (late Feb/early March) for the release of the final, binding 2013 Small-scale Technology Percentage, its arrival appeared to vindicate the market’s rise.

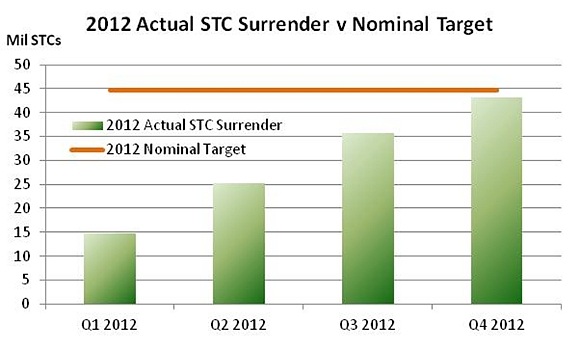

Having been released last Friday, the figure of 19.7 per cent – which is set to be equivalent to 35.7 million STCs surrendered in 2013 – was larger than what most expected. In part the figure was boosted by the fact that 1.5 million fewer STCs were surrendered in 2012 than was expected (see chart below), presumably the result of actual electricity demand outcomes being below forecast.

However it also appears that the Regulator, having benefitted from the passage of time as well as the receipt of the consultants’ modelling reports became a little more bullish following the last update to the nonbinding estimate it released in October.

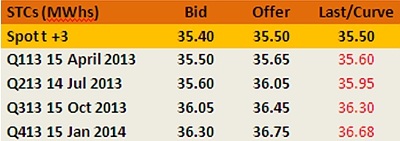

The release of the 2013 STP prompted an immediate surge in prices on Friday afternoon with the market moving from just shy of the $34.00 mark to just above $35.00, before falling back to $34.70 to end the week. Recent days have since seen the market trading between $35.00 and $35.50, representing a 13 per cent rally off its January lows.

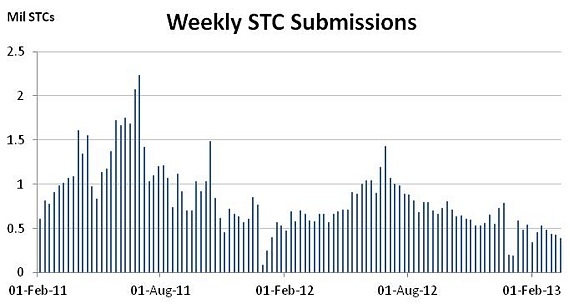

Coinciding with the significant price increases over recent weeks has been the steady decline in STC submission numbers which, along with the STP, constitute the other essential part of the STC supply/demand equation. The last month has seen submission numbers trending downward, however a number of public holidays in different states during this time have also likely contributed.

With the target for 2013 now known, the trend in STC submissions will be a closely watched factor impacting STC prices in the coming months.

Recent days have also seen the release of the Gillard government’s response to the Climate Change Authority’s RET Review. Of major significance to the STC market has been the government’s decision to avoid major changes to the operation of the Clearing House, which may have had a substantial impact on many STC owners in the transfer list and hence been rather unappealing in an election year.

Perhaps just as important to the photovoltaic industry was the decision to ignore the recommendation to reduce the system capacity threshold for STC eligibility from 100kW to 10kW. The commercial market – which would occupy the 10-100kW capacity range – is seen as a potential source of growth in installations in 2013, while the residential market struggles.

These decisions appear likely to remain the status quo at least until after the coming election, some time after which, should the Coalition win government, another RET Review now appears likely.

Large-scale Generation Certificate (LGCs)

Since the separation of the Renewable Energy Certificate market into its small and large-scale subsets, the LGC market has lost much of its liquidity. With trade remaining sporadic, substantial gaps in price have remained commonplace. Interestingly, recent days have both revealed the Gillard government’s position on the Climate Change Authority’s RET Review, whilst flagged the Coalition’s intention to undertake another review after should it win this year’s election.

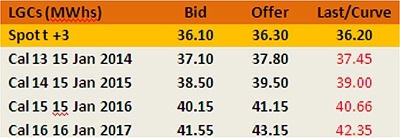

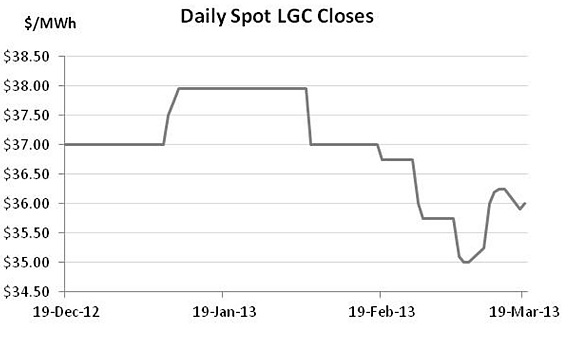

Following a steady rally off lows seen in September last year, the spot LGC market ended 2012 at $37.00. In early January the market strengthened further to fall just short the $38.00 mark. Not for the first time in recent years the early positivity was not maintained and since then the spot market has lost ground in a volatile and ‘gappy’ fashion.

Early March saw the market soften to $35.00 before a recovery more recently to the low $36s. All the while trade activity has remained modest, a reflection of the ongoing oversupply which has provided ample opportunity for obligations under the scheme to be met for several years to come meaning there are few with much to do in the short-term.

It is hard to point to a specific explanation for the recent price movements and the release of the 2013 Renewable Power Percentage, which is the LGC market’s target has done little to change that. This year’s RPP is 10.65 per cent, equivalent to 19.09 million LGCs. It is important to note that unlike the setting of the small-scale target, the Large-scale Renewable Energy Target is outlined in legislation and hence its release is far less controversial.

The LRET appears to have survived the first major round of pressure to alter the manner of its operation. The Climate Change Authority recommended against any change to the target’s calculation methodology (i.e. fixed to floating) and Labor has agreed with that recommendation.

Yet the LGC market continues to be impacted by uncertainty surrounding the likely actions of the Coalition were it to win government in September. In recent days it has announced it would undertake another review of the RET within six months of winning office, a review in which many of the same issues canvassed in the CCA’s recent effort are likely to be re-examined. Then there is of course the uncertainty surrounding the future of the carbon price.

From a project development perspective, while the second half of last year did see a number of projects committed, the lead up to this year’s federal election has seen any activity in this area grind to a halt.

Marco Stella is Senior Broker, Environmental Markets at TFS Green Australia. The TFS Green Australia team provides project and transactional environmental market brokerage and data services across all domestic and international renewable energy, energy efficiency and carbon markets.