Electricity prices go sky high, and then negative

Following from the high demand on Tuesday, we were greeted with this ominous alert from the AEMO on Wednesday morning (08:14 NEM time), courtesy of a Local Alarm configured within a display copy of NEM-Watch in the office:

The main text was as follows:

“AEMO declares a LOR3 condition for the combined Victorian and South Australia Regions from 1400 hrs.to 1700 hrs Wed 15 January 2014. The maximum energy deficit is 290 MW in the combined Victoria and South Australia Regions. AEMO is seeking a market response.”

This forecast was for the period 14:00 to 17:00 NEM time.

A LOR3 condition means that there is not enough capacity to meet the demand – or, in the case shown here, the AEMO was forecasting that this would be the case during the afternoon to the tune of 290MW (or roughly the size of a city of 100,000 people).

If this situation were to prevail (i.e. without the market response the AEMO was calling for), then the AEMO would need to instruct for some load shedding across Victoria and South Australia.

The AEMO followed this up with an even more ominous notice 2 hours later that implied that there had not been a sufficient enough market response, given that at 10:35 the AEMO issued another market notice (Notice ID 44547) that noted:

“RELIABILTY AND EMERGENCY RESERVE TRADER (RERT) INTERVENTION – (Vic and SA) Regions- Wednesday, 15 January 2014

This Market Notice is to advise that AEMO intends to intervene by dispatching Reliability and Emergency Reserve Trader contracts (refer NER clause 3.20) to enable AEMO to maintain the power system in a reliable operating state.

The use of the Reserve Trader is a very rare event in NEM history. I know it has been used before, but can’t remember the last time.

This goes beyond the normal Demand Side Response arrangements, which we’re heavily involved with in a large number of large industrial facilities across all regions of the NEM, and implies that there has been a market failure, in this instance, and that an additional payment is necessary to procure such a response.

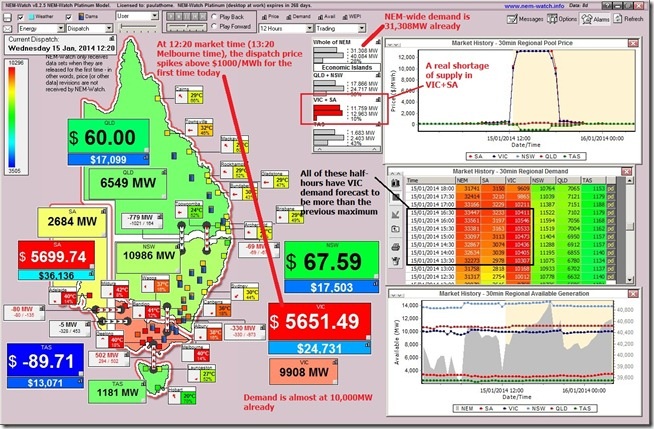

In the following snapshot from NEM-Watch at 12:20 Market Time, we see that the forecast demand peak this afternoon would be higher than it has ever been in Victoria for the entire 3-and-a-half-hour period from 13:30 to 16:30:

Demand did continue to climb through the day …

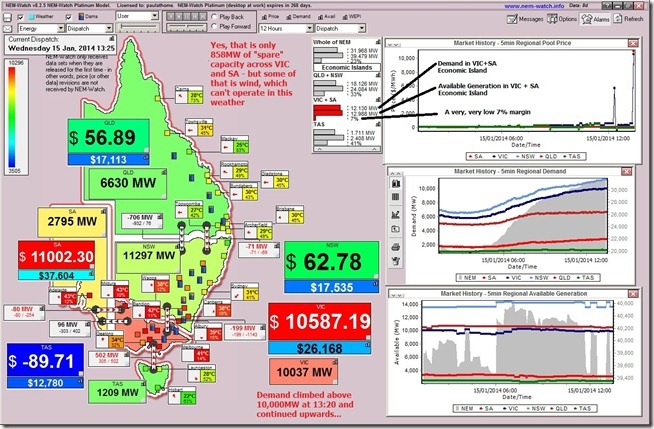

At 13:20 NEM time, the Victorian scheduled demand target passed the 10,000MW mark for the day, and continued climbing to 13:25 when the prices skyrocketed again:

Yes, that’s $10,589.19 per Megawatt-hour or 1,059cents per kilowatt-hour in household electricity bill units – which is orders of magnitude higher than what you pay at an average rate at the retail end.

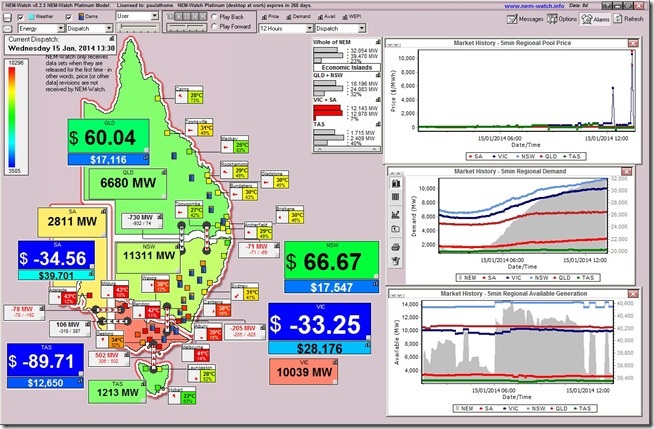

And just to illustrate how wacky the NEM can be, we see (five minutes later) the prices plunge below zero in Victoria and South Australia as generators load in volume (what spare volume they have) in order to generate more in that half-hour payment period (13:01 to 13:30) and so secure the benefits of the price spike at 13:25. [Editors note: The Market Operator settles market payments based on the average price over an entire half hour interval rather than each individual five minute bid, so generators may be happy to bid low for the last five minutes in a 30 minute interval because it means they’ll capture an averaged price which includes times when prices were above $10,000].

This see-sawing of prices continued through the afternoon.

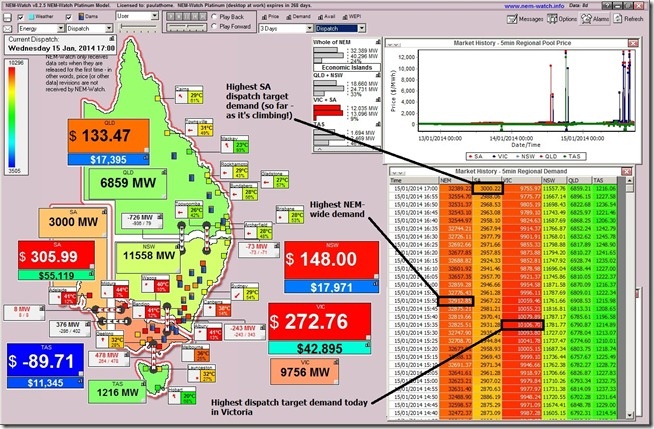

However, despite the very ominous warnings that were seen Wednesday morning about a stellar demand peak (and load shedding) expected for Victoria, the actual scheduled demand was still 189MW lower than the Black Saturday peak, while still soaring to be as high as 10,107MW at 15:35 (when measured on a dispatch target basis).

As shown in this snapshot from NEM-Watch at 17:00 market time, the demand in South Australia was climbing late in the day and had passed the 3000MW mark, the Victorian peak was at 15:35, and the NEM-wide peak was at 15:50 (reaching 32,913MW – making it the highest demand achieved so far this summer):

And in good news we saw that the the LOR3 warning (i.e. forecast of the need for load shedding) was cancelled at around 15:00.

Paul McArdle is the managing director of Global-Roam, a business that provides computer software that helps users to analyse and understand energy markets

This article was originally published on WattClarity. Republished with permission.