Eight investment lessons from 2012

PORTFOLIO POINT: The investment lessons from 2012 are that things are not necessarily as bad as they seem. As markets continue to recover, investors should look at buying in the dips.

Looking back over 2012, I think there are some extraordinarily important lessons for investors. There are lessons every year obviously, but the world is dynamic, it changes, and so too do the lessons.

For me, I think the first lesson the market gave us is that risk is not always what it seems. Markets are learning this, and now we find that they are becoming more resilient in the face of risk events.

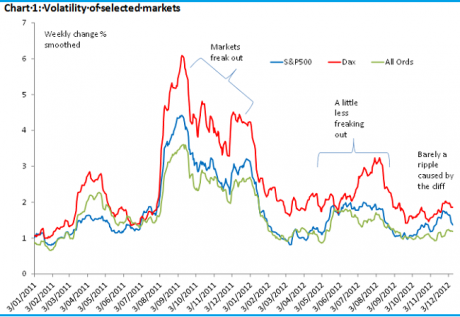

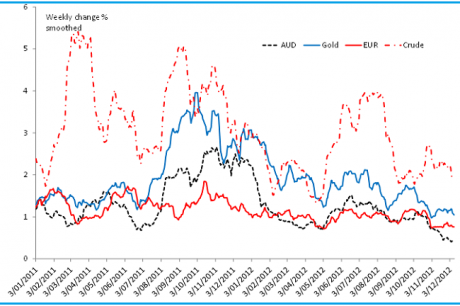

Volatility has always been a feature of any market, but what has been relatively unique about this cycle is the nature of that volatility. ‘RORO’ – or risk-on, risk-off – has meant that many markets have been more highly correlated than they have ever been before. I don’t think there is any doubt that RORO is still the dominant theme, but market volatility and correlations have eased.

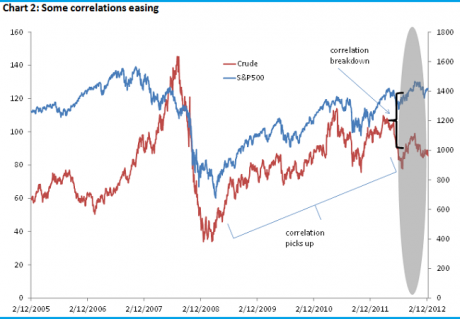

You can see this in the above charts. These show the weekly percentage move (smoothed), over the last couple of years, for a number of key market prices. Clearly volatility has eased, while some correlations have come off as well. Most notably, crude and equities seem to have decoupled of late (see chart 2 below).

The important thing to note in chart 1 is the pattern of volatility. Each episode, or each flare-up in fear, has been met with less panic – it is less destabilising than the previous episode. This has occurred to such an extent that now, as we approach the fiscal cliff, there is barely a ripple in the market – in fact, markets have pushed higher! But this isn’t because the catalyst, or potential catalyst for a flare-up, is less serious. Markets have tanked on some truly ridiculous rumours of fears and you’ll get a better sense of that in lesson 2. Moderating volatility and a shortening in the persistence of that volatility is for me a strong indicator of the first lesson – risk isn’t always as it seems. Markets are learning this and have become more resilient as a result.

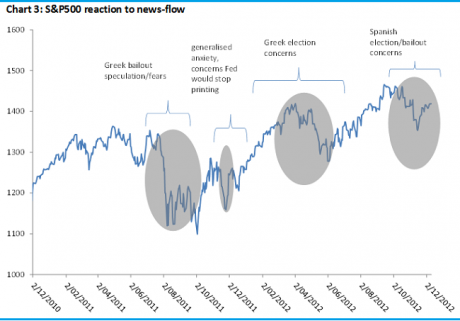

To get a full appreciation of lesson one though, we need to incorporate lessons two and three. Lesson two is that the vast majority of risk-off moments – or at least the big moves – were more often than not driven by political considerations (or irrational bouts of fear), not macro-economic concerns as such (see chart 3 below).

Sure, these bouts of fear were interspersed with economic fears at times –softer-than-expected payrolls or a fall in China’s PMI (Purchasing Managers Index) or something like it, but invariably most of it was political and economic concerns have always proven to be short-lived (a couple of months at most). Some readers may be shaking their heads about that and may argue that the European crisis was fundamentally a debt crisis or a balance of payments crisis – both of which are very macro in nature. Notionally that is true, and certainly Greece was insolvent – although practically Greece didn’t matter. Contagion was what mattered and here, neither Spain nor Italy were even close to default. Their debt is, was, and will continue to be manageable.

Moreover, European politicians had vowed to help Greece if they undertook reforms. In my opinion, these factors transformed the debt crisis in to a political one – or a bout of irrational market panic at worst. Eurozone politicians and even the European Central Bank were adamant and consistent in stating that Greece would not leave the Eurozone and things would be sorted in time. Market fears were then based around one or the other party being unable to fulfil their side of the bargain. Were these really justified? In hindsight it’s more than reasonable to ask whether any of these risks were really as bad as was made out at the time. Certainly economists do not understand what is going on in Europe and the reality, as we now know, is that Europe is sorting through their problems and is committed to the union. The crisis, as we know it, is by and large over.

Just a quick word on those macro-economic concerns though, which have been driven by two key themes – a US double-dip recession, and a China hard-landing. Throw in the constant fear over the Eurozone break-up and you’ve got the three-track CD, as I’ve referred to it in the past. Needless to say, that history has shown each episode of concern to be misplaced. Again, that begs the question – how high were the risks really?

This then brings us to lesson three! Risk appetite was driven by two key factors:

- Political resolution, of which there are two subsets:

- The realisation that European leaders mean it when they say Greece would not be leaving the Eurozone.

- Spain and Italy are not insolvent.

- The second key factor is the recurrent realisation that the US isn’t double-dipping, nor is China undergoing a hard landing. Indeed, the US economic recovery is not as fragile as claimed. Despite this, the Fed is not close to ending Quantitative Easing – which in itself is something that has supported the risk bid, or rather the hunt for yield.

Lesson four is that the media has been a significant tool in magnifying RORO and identifying value. As things stand, there are literally only a handful of large global media players and they control public perception around any given point. I’m not suggesting there is some kind of conspiracy here, but deadlines are tight, analysis isn’t what it used to be, and there’s nothing like a good story! The lesson for investor s is to read with a critical eye, and certainly don’t believe everything you read in the newspapers. Inevitably the focus and dramatisation of a few key issues allows opportunities to be identified – lessons two and three. You’d be surprised how many analysts and traders take their cues from the media and the angle they put on things.

As a result, the success or otherwise of your investment decisions will depend on getting the macro view right. Good macro-economic and geopolitical analysis is the key to making money.

All of which leads me to lesson five. The investment game is changing. So far the above lessons have taught us that that each episode of volatility is becoming less pronounced. And that’s not because each new event is potentially less serious. It’s not. I mean the fiscal cliff at face value is a much more serious reason to believe in a double-dip than what we’ve seen in the past – yet markets are pushing higher! The reason is because markets have learned lessons two and three and have become much more resilient. There is an unfortunate aspect to this though. As markets wise up, it means the investment game is changing – dramatically – compared to what we’ve seen over the last few years. The fact is that past volatility has bred great investment opportunities, although it has made diversification more difficult.

Thought of another way, lesson five is that deep value is becoming harder to find, although diversification is becoming easier.

Lesson six is that Australian pessimism is entrenched and has driven our sharemarket’s underperformance. Lower rates don’t seem to be helping. As a result of this, investors should diversify globally, if they haven’t already, especially with the strong Australian dollar, and maintain an overweight position.

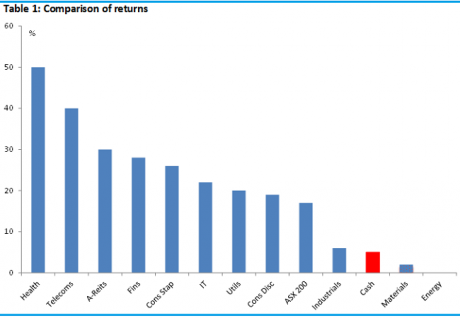

Lesson 7 is a simple one: given that the world is not as risky as many make out, cash is not king and an underweight position is long overdue, so seek alternatives. Table 1 below shows the returns offered by cash compared to the return (accumulation) of the major sectors on the ASX over the last year.

Lesson eight is to buy the dips! While the ASX has had a good run over the last year, we’ve still largely range traded since 2009. Given the extent of pessimism in this market, I’m not yet convinced we’ll break out of that over the next six months at least.

On a longer-term view I don’t doubt that we will. That being the case, and risk being what it is, (misunderstood) I think investors should look at any dips as a signal to buy – watch for these opportunities and research hard to see if there is any misalignment. See what’s behind it, don’t just read the paper and assume risk has in truth increased sharply. Certainly if a flare-up is driven by political concerns or unfounded growth concerns, buy.