Editor's Picks: Chill winds

Editor’s picks

Well it looks like everybody is getting in the brace position. The airlines are bleeding cash and jobs, business has gone on a capital strike and first home buyers have given up hope of getting on the property ladder. The prevailing mood among readers of Business Spectator is that our 20 some odd years of unbroken growth may be about to come to an end. I’m not that bearish but it does feel like the winds of change are blowing.

The ironic part of this is that, housing aside, Australian consumers have never had it so good. Deflation of goods and services has made our lives far more comfortable.

Anyone who travels would be enjoying the spoils of the dogfight between Qantas and Virgin – since 2003 airfares have fallen by over 20 per cent adjusted for inflation. Stephen Bartholomeusz wonders however how long it can go on. He writes;

There is a lot of finger pointing and conflicting data being presented as to who’s to blame for the capacity increases. Borghetti points to Qantas’ capacity growth last financial year to argue that Qantas has added three times his capacity, while Qantas uses data over two years to show that Virgin has added more capacity, in absolute terms, over that period. However, the bottom line is that between them, they have turned a profitable duopoly into a loss-making sector.

Over in the supermarket world, the intense competition between Woolies and Coles has also pushed prices down, much to most consumers’ delight, if not for farmers. Plus they’ve been very generous by offering deep discounts on fuel. Alan Kohler wonders why the ACCC finds that a problem;

Australia is a small market. Many industries necessarily come down to two players slugging it out because of the need for some semblance of scale, even though it's not what a global operator would call scale. Is the role of the ACCC really to hold prices up so smaller, less efficient operators can gain some kind of protected foothold in the market?

As Alan has written before, deflation is increasingly becoming a problem for world banks. And with the effect of job losses filtering through to the labour market, wages are now growing at their slowest pace in 16 years.

Robert Gottliebsen has a warning for executives about the coming year. He writes (FREE);

My impression is that most Australians see the mass retrenchments planned for motor, Qantas, retail and even the public service cutbacks as something that is happening to someone else. Most say “it won’t affect me”, but the ripple effects will extend a much wider net than is currently appreciated. Already large numbers of executives in non-banking corporate Australia are being told not to expect salary rises in 2014-15. Accordingly if you have a key skill required by an organisation then by all means go for better pay but otherwise it may be better to keep your head down.

Unfortunately the one place we are not seeing deflation is in housing. Callam Pickering has written regularly on the distortion that is taking place in the housing market, where first home buyers are increasingly squeezed out by investors and the shortage of supply as boomers stay in their dwelling for longer. The RBA doesn’t think that is a problem but Callam does. As he points out in his piece, the RBA’s solution to the issue, basically get a rich parent, is unfair.

The RBA can tell us that housing affordability has improved as much as it likes, but actions speak louder than words. The simple fact is that first home buyers across most states have irrefutably declared that housing is unaffordable. With the labour market deteriorating they want absolutely nothing to do with the housing market. Perhaps they just need richer parents?

It’s also worth noting that it’s not just first home buyers going on strike, business is too. Callam has an important read on capital investment intentions. Given the dismal job and investment data, the government’s efforts to get the budget back to surplus will require deeper cuts – and winding back the pension may be a way to get there.

All this debt doom and gloom reminds me of a quote in a Steve Keen piece last week. Australian’s are happy to sit on a mountain of debt in their unproductive houses but shiver of the thought of the government loading up for investment. Quoting the FT’s Martin Wolf;

It is widely believed that it is safer to rely on private borrowing than on public borrowing as a source of demand. An expansion of private borrowing to buy ever more expensive houses is deemed good, but an expansion of government borrowing, to build roads or railways, is not. Privately created credit-backed money is thought sound, while government-created money is not. None of this makes much sense.”

Robert Gottliebsen thinks that Australia’s superannuants can be the solution to this problem. They want the income stream, Australia needs the assets. What are we waiting for?

Most read

Why it’s not a good time to ask for a pay rise, by Robert Gottliebsen

Most commented

Hockey’s real economic plan is still secret, by Rob Burgess

What you probably didn’t read but should have

John Lee has a fascinating insight into China’s desire to graduate into an economy of the sophistication of Singapore. The problem is, he says

When it comes to effective policy implementation, size matters. The smaller, the better. Singapore is easy to govern because it is a country of roughly only 4.5 million people. China has 1.3 billion people. There are 45 million officials in China and only 2 percent are central authorities. No matter how enlightened Beijing’s leaders are, they are reliant on around 44 million unsupervised, poorly trained and often corrupt local officials to execute and implement policy.

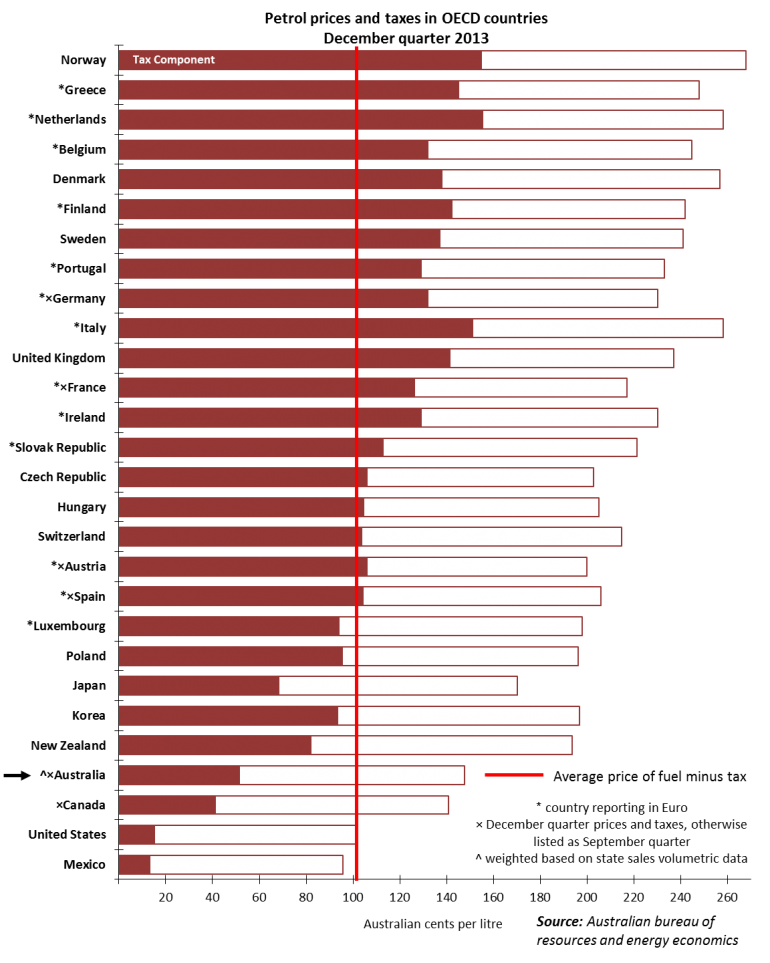

Pic of the week

Think you’re paying too much for fuel? Think again.