Editor's Pick: Car departs

Cars are funny things. For some reason we get emotionally attached to them even though they are just machines. We name them, we talk to them, we reminisce fondly of versions belonging to our past. I guess cars are an extension of our selves, a representation of youthful freedom, of economic progress and our own personalities – flashy or functional, pretty or practical.

I fit into the functional category – I have a ten-year old Astra inherited from my mother – but I get the romanticism. I’ve been lucky to have toured a Vauxhall plant in the UK, a Chrysler plant in Canada and the Holden plant in Adelaide. There is a beauty in the way the cars are made – it’s man’s ingenuity writ large and the end product really can be a work of art.

I guess that’s the reason why governments spend so much money on homegrown car manufacture, despite the fact that it is a terrible investment. Doe-eyed ministers like Kim Carr positively froth at the mouth when talking about GMH, Ford and even Toyota but the bare fact is the industry is just not sustainable without subsidies.

Alan Kohler exposes the irony in all of this because while we are happy to pour money into motors on one hand, we fail to protect them on the other – making us the only country in the world silly enough to go in for the ‘level playing field’ myth.

Steve Keen attributes the blame to a failure of mainstream economists to properly understand the marginal cost curve – makes for interesting reading.

The jammy contracts given to auto workers are a thing of the past but according to Robert Gottliebsen the job losses are the beginning of a worrying wave of redundancies, something that will erode the wealth of the middle class and result in a glut of executives, workers and possibly even push down house prices as mortgage arrears climb.

Those job losses are accelerating the unemployment rate – the top line figure went up this week but the real story is much worse, says Callam Pickering. Count in the declining participation of baby boomers giving up on the job market and the economy has some headwinds.

Perhaps there’s a lesson to be had in the stellar results for both Telstra and the Commonwealth Bank. The one-time state firms are powering ahead, freed from the shackles (and handouts) of government control. Stephen Bartholomeusz writes that the conservatism of both TLS and CBA has put them in extraordinarily strong positions, with potential acquisitions on the cards for Telstra and against interference from the Financial System Inquiry for CommBank.

Most read

Why Toyota is leaving Australia - the real story, by Robert Gottliebsen.

Most commented

Paul Howes provides ‘sparkle’ on the Titanic, by Rob Burgess.

Story you probably didn’t read but should have

How Australia can capitalise on foreign investor wealth, by Peter Cai.

Pic of the week

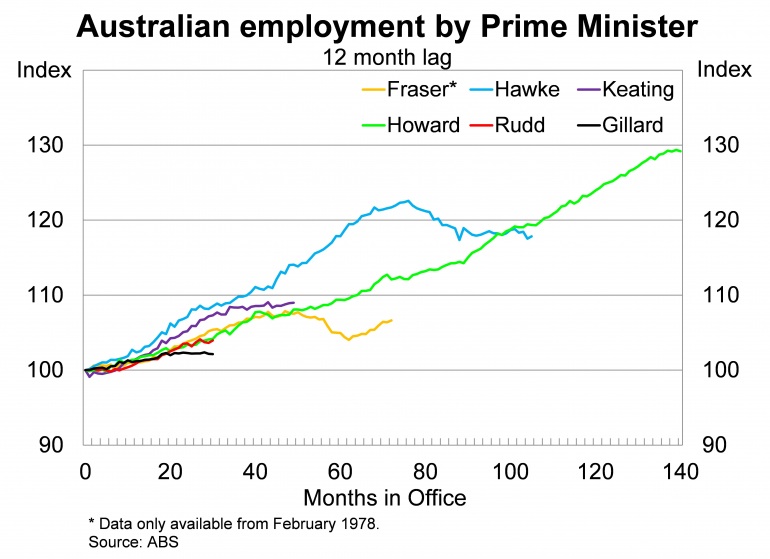

Tony Abbott will likely preside over a spike in unemployment in his first term. How will he compare to previous PMs?