Economics' odd couple highlights a Nobel folly

I would love to be in the audience watching the body language at this year's "Nobel" ceremony for economics. Robert Shiller, who is far too polite a person to make it obvious, will nonetheless at least fidget as he listens to Eugene Fama's speech, since Fama continues to dispute that bubbles in asset prices can even be defined. Shiller, in contrast, first came to public prominence with his warnings in the early 2000s that the stock and housing markets in the States were displaying signs of "irrational exuberance".

Fama came to prominence within economics – though not in the wider body politic – in the 1970s with his PhD research that argued that asset markets were "efficient" not just a first order (getting the actual values right) but even to a second order (picking the turning points in valuation as well).

How can two such diametrically opposed views receive the Nobel Prize in one year? The equivalent in physics would be to award the prize to one research team that proved that the Higgs Boson existed, and another that proved it didn't.

The answer, of course, is that economics is not a science. Nor is the Nobel Prize in Economics a true Nobel Prize. Both facts have been obvious for decades to insiders and some astute observers, but this year's award throws that reality into such sharp relief, especially since it coincides with the never-ending aftermath to the global financial crisis. That it was announced in the same week of the US farce over public debt and healthcare showed just how juvenile our appreciation of economics still is.

The basic background to the real Nobel Prizes themselves is that they were devised by the inventor of dynamite, Alfred Nobel, who endowed a fund to award annual prizes in Physics, Chemistry, Medicine, Literature and Peace. There was no prize for economics, nor was there one for mathematics, for example.

Mathematicians lived with this situation, accepting logically that there couldn't be a Nobel Prize for everything – or that if there were, then despite Nobel's enormous bequest, the prizes themselves would be infinitesimal. Instead, the Canadian mathematician Jack Fields campaigned for an award to encourage young mathematicians.

He died before his idea was implemented, and he left $47,000 towards its funding in his will, compared to the half-billion dollar fund that grew out of Nobel’s will and backstops the Nobel Prizes today. The Fields Medal is awarded every 4 years to up to 4 mathematicians under 40, who each receive the princely sum of $15,000 Canadian dollars.

The Nobel Prizes, in contrast, carry an award of 8 million Swedish Krona each today, which is well over $US1 million. Mathematicians now have a couple of other better endowed awards, including the Abel Prize that grants 6 million Norwegian Kroner (less than the Nobel, but still roughly $1 million). But unlike the Nobels, which can be spent at the recipients’ discretion, the Abel funds have to be used for mathematical research.

Something as discreet as this wasn’t good enough for economists it seems. Instead, when the “Sveriges Riksbank” (the Swedish Central Bank), considered how to celebrate its 300th anniversary, it proposed the establishment of a “Prize in Economic Science dedicated to the memory of Alfred Nobel”. Its proposal – which included it providing the sum for both the prize and its administration – was accepted by the Nobel Foundation. So now we have the “Nobel Prize in Economics”.

To give the Riksbank its due, it is the oldest Central Bank in the world – the US Fed is still a baby at a mere century old, for example. There was good reason to celebrate its 300th anniversary, and a prize in economics makes some sense as part of that.

But a “Prize in Economic Science dedicated to the memory of Alfred Nobel”? What? Firstly, the Swedish Central Bank had nothing to do with Alfred Nobel. Secondly, Alfred Nobel had nothing to do with economics. Associating their prize with Alfred Nobel was and remains one of the most outrageous and most successful examples of false advertising in the history of capitalism.

However, there is one thing that makes this deception palatable: the Nobel Prizes themselves were an even more outrageous and successful example of false advertising (or perhaps false eulogising), since the reason that Alfred Nobel instituted them was that eight years before his own death, he got the chance to read his own obituary. And he wasn’t happy.

Nobel was an outstanding intellect, who had over 350 patents in his own name – the most famous of which was for dynamite, which was a much safer alternative (for the user) to both gunpowder and nitroglycerin. He was also a highly successful businessman, with a specialisation in both explosives and armaments, though he regarded himself as a pacifist. But one glance at the obituaries published after his brother’s death was falsely attributed to him made it obvious that his belief that he was a pacifist would die with him: a French newspaper carried the headline “The merchant of death is dead.”

His clever response was to create the Nobel Prizes in his will. So now we associate the name Nobel with peace, with literature, and with advances in fundamental sciences. And, by a subterfuge built upon a subterfuge, we associate economics with the real sciences as well.

Some science, when two individuals with diametrically opposed views can receive it in the same year, and for research in the same field! But that said, what are the merits of the two? (yes I know there is a third recipient, but I’d barely heard of him before this year’s award, and to give the prize the respect it deserves, I’m going to ignore him here too)

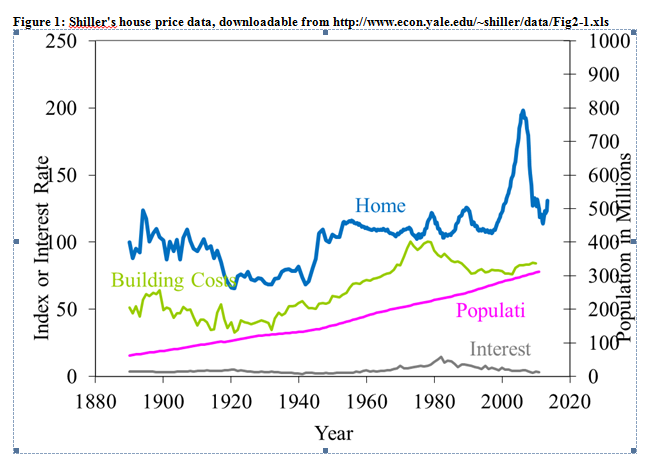

Shiller is a worthy recipient for a number of reasons. First and foremost, he has emphasised the need for long term empirical data in economics, and he has provided it as well. He developed a long-term database of house prices in America, using data on repeat sales of the same property (see Figure 1). It remains the gold standard of house price indices around the world.

Figure 1

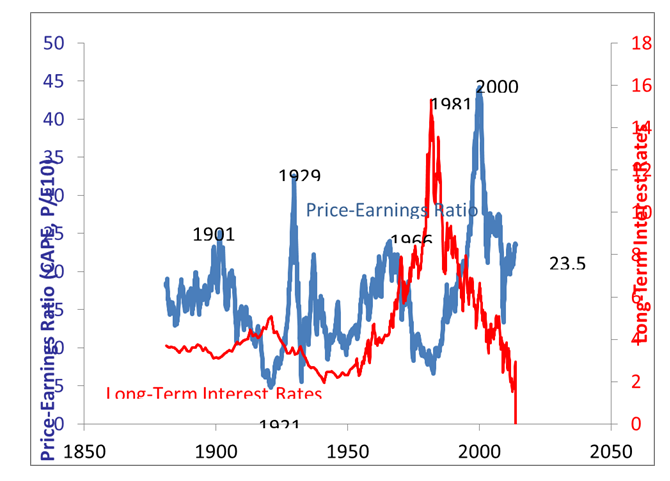

He also maintains (though he didn’t originate) a stock market index which compares the price of stocks now to their accumulated earnings over the previous decade (see Figure 2).

Figure 2: Shiller's long-term share PE ratio data (available here).

These two contributions in effect make him the Tycho Brahe of economics, and for those alone, I support the award to him. Economics generally behaves as a pre-Galilean discipline in which observation comes a very poor second to theoretical beliefs. Shiller has instead always emphasized that the data must be considered—especially when it contradicts beliefs, which is so often the case in economics.

The clincher for me, however, comes from Shiller’s third contribution: his personal courage in speaking out against the economic mainstream in the lead-up to the bursting of the DotCom bubble in 2000, and during the Subprime bubble. I’ve spent 40 years as a rebel in economics, so it’s no problem for me to lambast conventional thinkers, as I did during a session of the American Economic Association’s annual conference in Denver in 2011. But at that same session I saw how much personal intimidation shapes the “debate” within American economics.

The session, called “Adding A Bit More Creativity to the Graduate Economics Core”, was organized by David Colander, a respected textbook writer who is more open than most to including non-orthodox thought in the curriculum. David’s intention was to consider how the staunchly neoclassical core of the graduate curriculum might be expanded to allow in some alternative viewpoints. Not a bad idea, you might think, especially since this was 4 years after an economic crisis that Neoclassical economics completely failed to anticipate. But instead, John Cochrane (and others on the panel) hijacked the discussion by interpreting the topic as “how can we get more innovative students to undertake economics PhDs”? The body language against even discussing alternative thought was a prime lesson in primate behavior.

Somehow, Schiller has managed to speak out over decades about and against bubbles in asset markets, despite the primal peer pressure against him. For that reason, were I in the audience on December 10, I would join the standing ovation to him.

And Fama? Curiously, he has also done some empirical work that I find extremely valuable. Two papers of his in 1999 provide empirical support for my own work modeling the change in corporate debt as being driven by the difference between retained earnings and desired investment:

The leverage and debt regressions (Table 4) then confirm that, for dividend payers, debt is indeed the residual variable in financing decisions.

My favorite Fama paper is one where he empirically disproves the “Capital Assets Pricing Model”, which is the Siamese twin of the “Efficient Markets Hypothesis”:

"The attraction of the CAPM is that it offers powerful and intuitively pleasing predictions about how to measure risk and the relation between expected return and risk. Unfortunately, the empirical record of the model is poor—poor enough to invalidate the way it is used in applications… whether the model's problems reflect weaknesses in the theory or in its empirical implementation, the failure of the CAPM in empirical tests implies that most applications of the model are invalid."

But Fama has received the award for proving "that stock prices are extremely difficult to predict in the short run, and that new information is very quickly incorporated into prices".

Poppycock. Years before Fama promoted the “Efficient Markets Hypothesis” as an equilibrium-fixated explanation for the obvious fact that it’s “extremely difficult to predict in the short run”, Benoit Mandelbrot had developed the concept of fractals which gave a far-from-equilibrium explanation for precisely the same phenomenon. Economics ignored Mandelbrot’s work completely – so much so that he gave up on economics and moved across to geometry and geography, where his perceptive ideas were rapidly accepted. Today, his vision has returned to economics and finance in the “fractal markets hypothesis”, and its explanation for the behaviour of stock prices is the utter opposite of Fama’s thesis. If anyone deserves a Nobel for asset pricing models, it’s the now deceased Mandelbrot (whose work was ignored by Fama as well, despite the fact that Mandelbrot was one of his PhD supervisors).

On the intimidation front, Fama’s outspoken championing of an equilibrium approach to modeling asset markets was the exact opposite of Shiller’s brave resistance to the groupthink of American economics. He has been an enforcer of conformity to mainstream thought who has stuck with his equilibrium beliefs despite evidence to the contrary.

Shiller, on the other hand, has been willing to accept that the messiness of the real world is indeed reality, even if it conflicts with the mainstream economics preference for believing that everything happens in equilibrium.

The Odd Couple indeed. Give me Robert Shiller’s messy Oscar over Fama’s anally retentive Felix any day.

Steve Keen is author of Debunking Economics and the blog Debtwatch and developer of the Minsky software program.