Early move to trading - bad for Abbott says Google

Kevin Rudd’s decision to drop the fixed price period of the carbon pricing scheme one year early will make virtually no difference for emissions and investment decisions, and an almost imperceptible difference for householders’ budgets.

The question is more about whether this might somehow make it more difficult for Tony Abbott to demonise the scheme in voters’ minds through that nasty word: T-A-X. According to the modern oracle, Google, Abbott may well be trouble.

The Labor government’s decision to bring forward trading in permits will mean Australia’s carbon price will plummet on July 1, 2014 from $24.15 to something in the realm of the $7-$10 for European emission allowances. This is instead of plummeting from $25.40 to about the same level on July 2015. This will be neither here nor there for big emitters and clean energy companies. That’s because they make investment decisions with an outlook over decades, not a single year.

Reducing carbon emissions is a bit like turning an oil tanker, it takes time and lots of preparation. Achieving meaningful reductions in emissions requires replacement of some of the longest living equipment and infrastructure in the economy. Buildings, power stations, and industrial facilities like metal smelters which determine our emissions, have lives in the decades. Cars are one of the shorter lived pieces of emissions-intensive equipment, and they still commonly last well over a decade in Australia.

So really what matters is whether this might take the wind out of Abbott’s catchy “axe the tax” slogan.

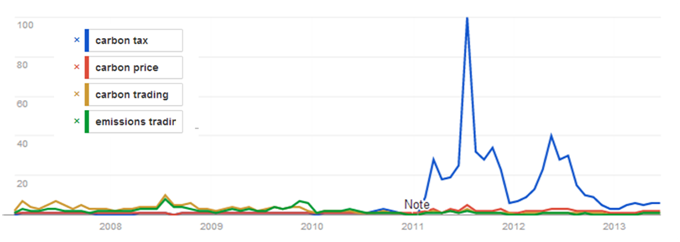

The chart below, using Google Trends, tracks the frequency with which Australians have searched the terms ‘carbon tax’ (blue), ‘carbon price’ (red), ‘carbon trading’ (yellow), and ‘emissions trading’ (green).

Relative frequency that terms are searched for in Google in Australia

Source: Google Trends. Note: Chart is normalised against a scale of 100 where 100 equals the point at which searches for the term ‘carbon tax’ peaked.

Abbott labelled the carbon trading scheme as a “great big tax” from the moment he ousted Malcolm Turnbull from the Liberal leadership in November 2009. Yet the chart above suggests it had very little impact in how people defined the government’s proposed emissions trading scheme – the ‘CPRS’. The term ‘carbon tax’ only managed to briefly and slightly surpass other terminology just after the August 2010 federal election, but then subsided.

It was only in February 2011, when Julia Gillard agreed to the Greens' demand for a three-year fixed price period, that Abbott’s ‘tax’ label caught on. At this point the media jumped on the term 'carbon tax'. The government’s initial carbon pricing scheme, the CPRS, was almost universally described by the media as an emissions trading scheme, not a tax. Yet the two schemes were extremely similar.

So Rudd’s announcement that he will dump the fixed price period, seems likely to make things harder for Abbott.

What’s more recent polling for Fairfax Media found that 62 per cent of respondents didn’t want the carbon tax scrapped if doing so would damage government revenue.

This comes on top of polling in June by JWS Research (detailed here) which found only 37 per cent believed the Coalition should seek to repeal the carbon price if elected. This was down from 48 per cent in May 2012 just before the carbon price came into effect. This polling suggested people were more angry with Gillard about a perceived lie, rather than the carbon price itself.

She’s since gone and now the so-called lie has gone too.

In combination with the fact that the impact of carbon pricing has been almost completely benign for most voters, Abbott’s greatest weapon is looking increasingly impotent.