Don't fear a China crisis

| Summary: Is China facing a banking crisis? On the surface, a spike in money market interest rates and bad debts points to looming problems, and a major crisis there would have severe ramifications for Australia. But, digging deeper, it’s evident China’s state-owned banks are extremely well capitalised, profitable, and have very low non-performing loans. |

| Key take-out: China is in the early stages of liberalising its financial markets – temporary spikes in rates will happen when trying to estimate system requirements for cash. |

| Key beneficiaries: General investors. Category: Economy. |

Concerns appear to have resurfaced over China’s banking system in the wake of its strong GDP print.

There are two intertwined issues of concern. Firstly, the spike in short-term money market rates, and the second is the apparent surge in non-performing loans. The two are supposedly linked, because the surge in “repo” rates is, according to some, a symptom of China’s out-of-control credit growth. And the surge in bad debts is symptomatic of the deterioration in credit quality – a deterioration that is resulting from this out-of-control surge.

This obviously matters for Australia given China’s importance to our economy, both as a consumer of commodities and through sentiment channels. A credit or banking crisis in China would almost certainly risk a recession here, and our stockmarket would tank – not least because resource stocks comprise 20% of our market!

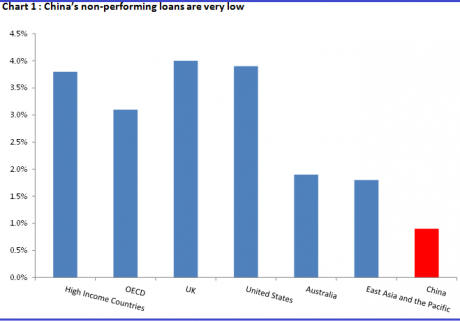

On the face of things there is every reason for concern. Some of China’s biggest banks reported this week, with the biggest, Industrial and Commercial Bank of China (ICBC), noting a 30% annualised lift in bad loans. Similarly, China Construction Bank, the second-largest lender, reported a 12% lift in provisions for bad loans and a 10% annualised lift in actual non-performing loans, while the Bank of China, the fourth-largest lender, noted a 30% increase in impairment losses for bad loans. Worrying statistics by any measure, except you when you consider that the actual proportion of non -performing loans is extremely low. This is shown in chart 1.

This is something that readers may have already known about, but what I don’t think is widely appreciated is just how good this position is relative to other countries – even high income ones.

The chart above shows that China’s non-performing loan position is easily better than the OECD (Organisation for Economic Co-operation and Development) or high-income average. It’s better than Australia’s own very low proportion, and is even lower than other high saving nations in East Asia. The truth is, China’s banking system has one of the lowest non-performing loans levels in the world.

Moreover, the earnings results of China’s biggest banks just this week show that, in some cases, the ratio is falling – not rising. China’s largest bank, for instance, reported that 0.85% of its loans were non-performing, down from 0.91% at the same time last year. Similarly, the Bank of China reported bad loans at 1.2% this year, down from 1.34% at the same time last year.

So, as you can see, the idea that there is some surge in China’s non-performing loans is simply not true. They are not even close to being a problem, and the fact is they have one of the better performing loan books of any banking sector, anywhere.

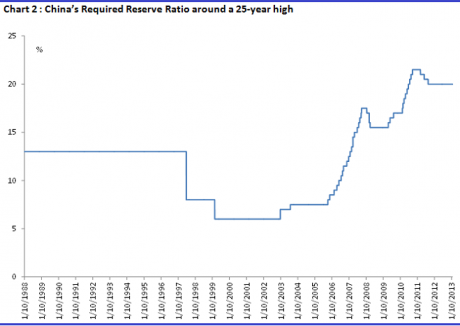

There are two related issues to this, which should also calm investors here. One is that China’s banks are well capitalised and have very high reserves at the central bank. You can see the reserve requirement in chart 2 below. This is the proportion of cash that commercial banks must hold at the central bank in ‘reserve’ to meet any cash demands from customers. You can also see it’s at a 25-year high, at around 20% of assets. Now putting aside any commentary on the effectiveness of the reserve ratio as a monetary policy tool, the fact is banks have lots of excess cash they can tap into in an emergency. There’s not likely to be a crisis any time soon.

Moreover, the capital adequacy requirements of China’s banking system are very stringent. More so than what is required under Basel III – 4-6.5%. So, for instance, the ICBC has a core capital adequacy of 10.6%, the Bank of China 10.4%, and so on.

The second issue, that cannot be ignored, is that China’s banks are, by and large, state owned. This is a critical distinction, because when banks are state owned there is little practical benefit in separating a bank’s balance sheet from that of the state. There are analysts out there who don’t even view them as banks in the ‘proper’ sense, but rather an extension of the Chinese Treasury. They are one and the same, for all practical purposes, I suppose and the thing is, even here, China has one of the best balance sheets going around.

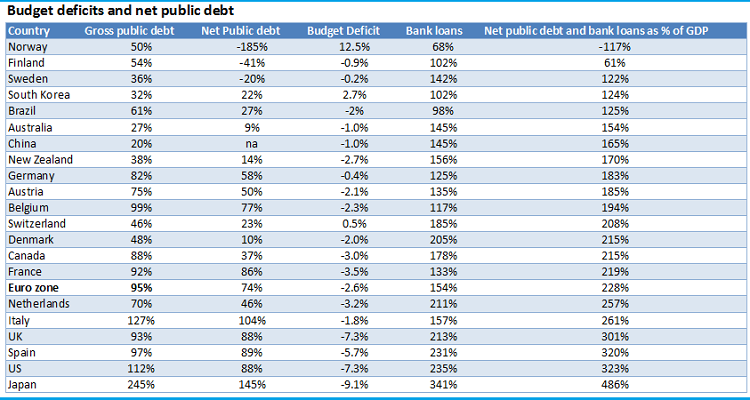

As you can see from the above table, China has one of the lowest gross and net public debt positions going around – around 20-25%. With bank loans, that comes to 145%, which is still well below the European average of almost 230%.

China’s public debt and deficit position, including the potential claims that might be made on the public purse from a banking crisis, are in a much better state than most western countries – certainly the US and Europe. Don’t forget also that Chinese households have something like 50% of GDP in savings, and the central bank has another 30-40% of GDP in FX foreign exchange) reserves – $3.3 trillion.

I should note that some analysts argue that China’s FX reserves don’t matter, because they are not savings as such. Instead, in holding those reserves as an asset, they have a yuan liability on the other side of the balance sheet – i.e. the government had to issue yuan debt to buy FX. This is the wrong way to think. Even if that view is true, FX reserves do matter, not because they are savings but for the simple reason that they cancel debt out. Consequently, underlying government debt – real debt – is lower by the amount of foreign exchange held in reserve, and so China’s actual debt position is much better than reported.

From my perspective then, those who try to place some sort of credit or banking crisis on the Chinese simply don’t have a leg to stand on.

There’s no evidence – nothing. It’s with that in mind that investors should largely ignore recent reports or concerns over a short-term money market spike. For state-owned, extremely well capitalised, highly cashed up, profitable banks, it simply doesn’t matter one iota if the seven day repo rate, or whatever rate, shoots up. The fact is, China is in the early stages of liberalising its financial markets – glitches like that are going to happen when trying to estimate system requirements for cash.

In any case, interest rates in China don’t work the way they do here, where the pricing signal is meant to be the ultimate tool for managing money demand. In China, while rates are certainly used, so are direct credit controls.