Don't be too concerned about deflation in the UK

Annual inflation in the UK has tumbled to its slowest pace since 2000 as lower oil prices make short work of the inflationary pressures that took quantitative easing years to generate. But is there cause for concern and should the Bank of England take action? Absolutely not.

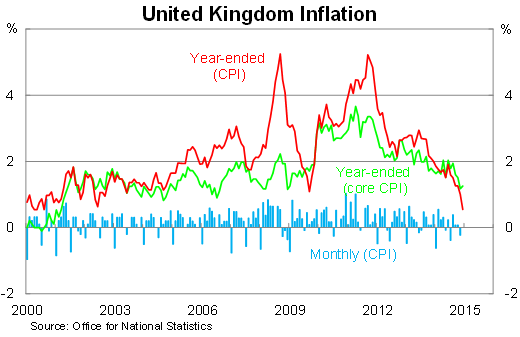

Following a weak result during November, consumer prices in the UK were unchanged in December and rose 0.5 per cent over the year. Momentum has slowed considerably in recent months, to the extent that it has triggered a letter of explanation from Bank of England governor Mark Carney to the Chancellor George Osborne (this occurs when annual inflation falls below its 1 per cent threshold).

The recent weakness relates, of course, to the sharp fall in oil prices that have now fed through to lower petrol prices. The price of fuels and lubricants -- which account for 3.5 per cent of the consumer basket -- have declined by 10.5 per cent over the year to December. Fuel prices are also having an indirect effect on other prices as they are a key input in production.

Food prices have also been much weaker, helped in part by a stronger pound, to be 1.9 per cent lower over the year.

Core inflation -- which excludes volatile items such as energy, food, alcohol and tobacco -- rose by 0.2 per cent in December and is now 1.3 per cent higher over the year. That's not a strong result but it highlights the influence that these more volatile components are having at the moment.

So should UK consumers -- and the economies exposed to the UK -- be concerned about these developments? Everyone seems to be concerned about the risk of deflation in the eurozone so shouldn't the same apply to the UK?

It's important to make a distinction about the source of deflation or disinflationary pressures. Both food and petrol are necessities; this means that they are generally quite resistant to changes in price. As a result, a sharp fall in these prices acts like a tax cut that boosts the purchasing power of UK wages. In other words, households can now buy more food and petrol but also more of other goods and services.

By comparison, weaker inflation in the eurozone largely reflects more persistent domestic factors -- although softer oil prices are obviously one part of the equation. Inadequate domestic demand explains much of their recent weakness whether it be in consumer prices, growth or employment and, as a result, a period of deflation runs the risk or eroding confidence further and encouraging consumers to delay their purchases in the hope of a more favourable deal.

That shouldn't be the case in the UK. It certainly won't be the case in other countries such as the US and Australia.

It's also worth noting that even if the BoE wanted to intervene they are unlikely to gain much traction. Interest rates are a blunt instrument at the best of times and quantitative easing is more inadequate still. These are not the tools with which you can effectively battle an adverse oil price shock. It's not even worth trying.

But it does mean that the BoE has more time to make its move. Mid-last year it appeared as though a rate hike by the end of 2014 was possible. Obviously that didn't happen but beyond inflation the same underlying conditions exist.

The labour market continues to improve and that is feeding into economic growth. Softer oil and food prices should boost household spending and that will support another round of employment growth. The outlook for the UK economy remains bright -- wages and production remain its chief concerns -- and it appears likely that interest rates will rise once oil prices begin to stabilise.