Does Syria matter to investors?

| Summary: Are military actions good or bad for investors? If past military events in the Middle East are a guide, then a US attack on Syria should have only a limited impact on global financial markets. It may spur a short, sharp spike in oil, and possibly gold, but any rises are likely be temporary. |

| Key take-out: There is no immediate need to make major portfolio changes based on limited military intervention. But prolonged activity is another story. |

| Key beneficiaries: General investors. Category: Economics and strategy. |

With what we know from unofficial sources, the US, UK, France and perhaps Germany are/were planning an imminent assault on Syria.

On the best information available, this was likely to be a strike limited to sea-launched cruise missiles that would take out select military targets, avoiding chemical weapons storage facilities, installations, factories and the like. There is talk that there might be some follow up air-strike action, but this would be limited and no ground assault would be authorised. US press suggest the whole operation would take about 48-hours and maybe even extend to a third day.

Now, recent events have shown the western alliance is much more fractured on this issue than previously thought. The UK Parliament, for instance, rejected only last night a motion authorising military action once UN inspectors had reported on the use of chemical weapons. From what I understand, and while the vote isn’t binding, the UK Prime Minister David Cameron has admitted that there is now little likelihood of UK military involvement. In response, the US has said that they would go it alone.

Now, that being the case, and it being far from certain that a strike will indeed actually occur, some European investment banks – notably Societe Generale – have suggested that crude (Brent) could spike to $US150 (currently $US114) should the Americans attack Syria. If that is the case, you can bet stocks will correct aggressively, but the question is, how likely is it that crude would spike like that. So far crude has rallied about 5%, gold maybe 8%.

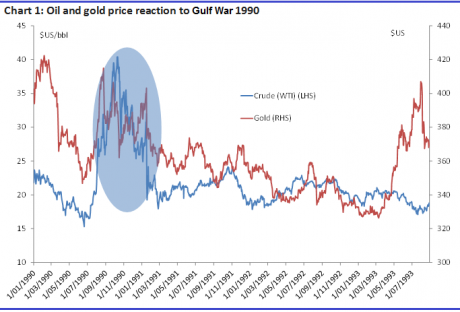

Well there is certainly a precedent for it. During the 1990 Gulf War, for instance, we saw crude spike 116% in the space of three months from around $US18 to over $US39. Similarly, the S&P 500 and the All Ordinaries Index fell about 20%-25% – big moves.

Having said that, it’s certainly not the case that markets always react to violence in the Middle East. Since 1990, there have been about 25 serious conflicts in the region, ranging in severity from the Gulf-Iraq wars to the numerous insurgencies or uprisings – e.g. the ‘Arab Spring’. Most of these in fact have had only a limited, or no impact. Even the Iraq War of 2003. Certainly oil spiked $US10, which was a 40% lift at the time. Having said that, there wasn’t really much of a lasting impact in the equity market. So while US shares fell about 4% and Australian stocks fell 1% – they quickly rebounded after the first few days of the campaign when it was quite clear the initial phase would be over reasonably quickly. The rally in crude itself morphed into the great oil bull run-up to the GFC. Peak oil and all that, you may recall.

Similarly, in Operation Desert Fox of 1998 (which was when the US and UK enforced no fly zones over Iraq, attacking air defence systems) there was no discernible impact on the market and in fact gold and crude prices fell over those four days.

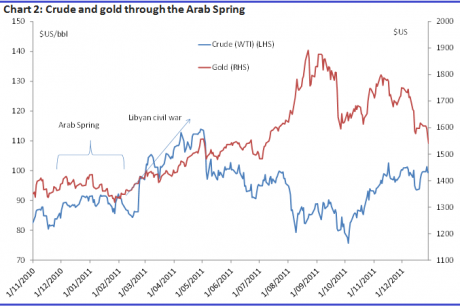

More recently, the series of uprisings and insurgencies that began in December2010 – the Arab Spring – didn’t really have a discernible impact either. In the space of two months there were uprisings in many nations across the Middle East and North Africa – Tunisia, Algeria, Jordan, Oman and Egypt – Libya could perhaps be included, although that was later in 2011.

Over that period crude certainly did rise about 11%, although gold was only 1.8% higher and the S&P 500 was up 7%, and the All Ords 2%. But those sort of moves don’t reflect a market gripped by fear or anything, and there was no sign of safe haven flows at all. Indeed, the moves don’t really appear to have had anything to do with the ‘Arab Spring’.

Crude had been in a broad uptrend since mid to late 2010 and for equities it was more a case of ‘risk on’.

The Libyan civil war itself, from about February 2011 to September 2011 was overshadowed by other events elsewhere, although crude did spike briefly (for two months) by the looks – by about 20% to $US120 (Brent crude) and by about 30% on WTI (West Texas Intermediate) to $US113 – before correcting in the ensuing six-month period. US equities themselves range traded, ending slightly higher over that period, before a correction kicked in on Spanish and Italian debt fears.

The crucial factor that determines the level of market reaction to events in the Middle East is the extent to which economic assets (read oil) are threatened directly or indirectly. In the case of the Gulf War, the Iraqi army was intact, large and well armed. If you recall, the particular concern was Scud missiles and the fact that oil producing and distribution facilities, shipping channels – the Persian Gulf – were within range of Kuwait and the border with Saudi Arabia. There was a clear and present danger to global economic interests.

Syria

That wasn’t the case in many of those other conflicts and, as it stands now, this is not the case with Syria. For a start, Syria is not a notable oil producer or exporter, that is, not in the top 20 – and can’t credibly threaten any nearby countries. Neither crude production nor distribution is likely to be adversely affected. Secondly, the proposed nature of US action, limited to cruise missiles and air attacks for a 48 hour period or so, isn’t likely to disrupt markets for too long, nor provide much momentum for a fear trade. The US assault would be ‘a symbolic gesture only’, as some have suggested.

Given this, it’s likely that market reaction to a US strike now would be similar to Libya’s civil war. A short, sharp spike in crude of maybe 20% or so (so 15% upside from here), which implies WTI at $US124 and Brent at $US130. Global equities would likely be unaffected in that scenario, although given the pressure for a correction anyway and given we are going into the September/October correcting season, we may actually see some modest selling pressure.

Now that doesn’t mean global economic interests couldn’t be threated and markets will react more violently, but there would need to be a material escalation of Syria’s civil war into a wider regional conflict – involving Saudi Arabia and Iran. This seems unlikely.

Firstly, it’s questionable as too how much action the US will in fact be able to take.

- The Assad Government does have legitimate support within the country.

- No-one – Russia, China, US – wants to risk another Islamist government forming.

- While Russia, China and Iran might tolerate punitive measures against Syria, I don’t think any of them would stand idly by and watch the US enforce any strategic changes given the importance Syria holds for all three (as a counter to US influence in the region).

- The UK vote shows the appetite for war simply doesn’t exists among key US allies – the US would be isolated and acting without global sanction.

- Despite the bravado, the US will likely act cautiously then, and take measures not likely to provoke or risk a wider conflict. It can’t afford one anyway, and any act that brought China, Russia and Iran together would be, quite simply, an act of sheer stupidity.

If I’m wrong on that, then I think Societe Generale’s forecast for oil at $US150 will prove conservative. Syria is of key strategic importance to many countries, and while I can’t tell you how that would unfold, I suspect there would be significant concern/uncertainty over global economic interests – given that most of the key players (Russia, Iran and Saudi Arabia) are oil major oil producers. The fear alone would likely drive a major equity correction, a spike in crude, and safe haven flows more generally (think rally in US bonds, and a spike in the $US).

Impact on portfolio allocation

With all that in mind, I don’t currently see any need to make major portfolio changes. Market moves are likely to be brief (and temporary) in the commodity space (something for traders) and equities unaffected.

If the US does, for whatever reason, decide to go it alone and engage in anything other than a short, sharp punitive aerial bombardment, then I would certainly look to lift your exposure to gold and crude – and adopt a more defensive stance in the equity space.