Does a Brickworks demerger stack up?

| Summary: The cross-shareholdings between Brickworks (BKW) and Washington H. Soul Pattinson (SOL) have been in place for decades, but the arrangement is being actively challenged by fund manager Perpetual Investments and investment banker Mark Carnegie. The investors have put forward a detailed proposal to remove the links between the two companies, and have called an extraordinary general meeting of BKW shareholders for November 25. |

| Key take-out: The cross-shareholding makes it hard to value BKW and SOL, and thus deters investors and particularly many major institutions. This tends to depress both share prices and needs to be acknowledged by both of the boards. |

| Key beneficiaries: General investors. Category: Growth. |

| Recommendations: Brickworks: Outperform. Washington H. Soul Pattinson: Outperform. |

The Clime growth portfolio owns Brickworks Limited (ASX:BKW), so this week I would like to review the proposal by fund manager Perpetual Investments and investment banker Mark Carnegie to remove the cross-shareholdings between BKW and Washington H. Soul Pattinson & Co. Limited (ASX:SOL).

BKW shares have risen some 50% since my purchase for the portfolio 18 months ago and now the share price contains an extra premium for the value per share to be created should the cross-shareholdings go.

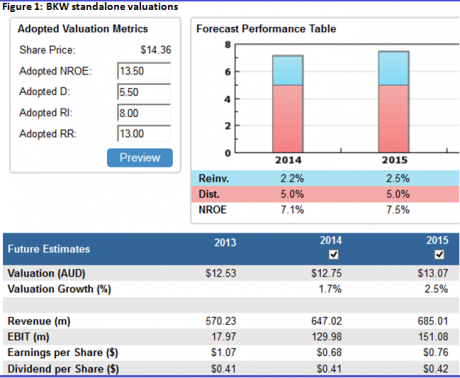

Holding at current levels of $14.50 is not for the fainthearted, as it is at the top of my passive valuation range ($12.75 to $14.50) for June 2014. My conservative valuation of $12.50 is based on a required return of 13%, whilst the upper value is generated if the required return (RR) is lowered to 12%.

Should this proposal fail, then I suspect the market price will drift back towards $13. So the key question is the probability of a restructure? Below I explain why I expect that a hard-fought and expensive legal battle should be negated by some form of beneficial compromise. However, readers will need to make their own decisions to hold or sell but, for the moment I am inclined to hold and let the situation play out.

Source: StocksInValue.com.au

Background to the corporate structure

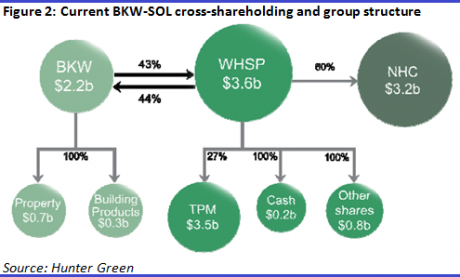

BKW owns 43% of SOL, and SOL owns 44% of BKW. Introduced in 1969 to block hostile takeovers, this cross-shareholding is the last of its kind in Australia. The diagram below depicts the relationship and the current corporate structure of both companies.

In the figure above, NHC is New Hope Corporation Limited, and TPM is TPG Telecom Limited.

The structure has been controversial for a long time, and it was created in a period where asset strippers were active and the Australian equity market was quite unsophisticated. Today markets are well regulated, corporate governance is strongly monitored, and boards of large public companies bear a heavy burden to generate proper returns for the broader population that has invested via the mandated national superannuation savings base.

My thoughts on the current structure are as follows:

- The cross-shareholding makes it hard to value BKW and SOL, and thus deters investors and particularly many major institutions. This tends to depress both share prices and needs to be acknowledged by both of the boards;

- In my view return on equity (ROE) is the primary input into a company’s valuation, but NHC’s $1.2 billion of cash (June 30) dilutes ROE across the whole group because of the equity accounting regime. This distorts valuations and makes it difficult to assess management performance;

- The capital structures of group companies differ and are hard to rationalise. NHC has $1.2 billion of cash and no debt and SOL is ungeared, but BKW has $280 million of net debt. Clearly the decision by NHC regarding its cash affects BKW’s performance, but it has no apparent say in this capital allocation;

- The structure benefits TPM with a strong and stable major shareholder, and yet it is unencumbered by a cross-shareholding. So there is a lack of consistency in the arrangements that were created 40 years ago; and

- The structure has generated commendable returns for SOL and BKW shareholders over a very long period, but over recent years it has become unnecessarily pedestrian as massive retained earnings and franking credits have been accumulated.

The Carnegie-Perpetual proposal

Carnegie and Perpetual own 12.5% of BKW and 11.7% of SOL and have called an extraordinary general meeting of BKW shareholders for November 25. A separate meeting for SOL shareholders has also been requested, but no firm date has been set. BKW directors have advised shareholders to take no action until the board has reviewed the proposal. Directors’ personal and family shareholdings, combined with the cross-shareholdings would appear to exceed 50% of shares on issue at both companies

The components of the proposals are:

- BKW shareholders approve a proposed demerger distribution from SOL of its TPM shares.

- SOL currently owns 213.4 million TPM shares, which would be distributed in-specie and pro-rata across SOL’s 239.4 million shares such that each SOL shareholder receives 0.9 TPM shares per one SOL share held.

- BKW, which owns 102.3 million SOL shares, would receive 92 million TPM shares. The remaining 121.4 million TPM shares would go to SOL’s remaining external shareholders.

- The distribution would be tax-effective, partly as a return of capital and partly as a demerger dividend, which would attract demerger roll-over relief. Subject to an Australian Tax Office ruling neither SOL nor its shareholders would incur any tax impost.

- BKW shareholders approve the cancellation of BKW’s holding in SOL in return for cash and interest-bearing promissory notes.

- SOL would cancel its 102.3 million shares currently held by BKW.

- In return BKW would receive $250 million in cash and the remainder in partly secured interest-bearing promissory notes repayable within a year of the share cancellation. The total consideration would be $1.8 billion assuming $22 per cancelled SOL share including the TPM demerger distribution. Consideration would vary with the SOL and TPM share prices.

- The promissory notes would have a face value of $1.6 billion and be repayable by SOL within a year of the share cancellation. SOL could sell assets to fund this repayment. The coupon rate would range between 1,250 basis points over benchmark for the unsecured portion (approx. 15.2%) and 350bp over benchmark for the secured portion (approx. 6.2%).

- BKW would have an income tax liability of $178.9-247.9 million, to be paid from the cash component of the consideration.

- BKW appoints Ms Elizabeth Crouch as an additional independent director.

- Preconditions are shareholder approval from both companies and favourable tax rulings for the demerger of TPM and the cancellation of the SOL shares.

Valuation of BKW under the proposal

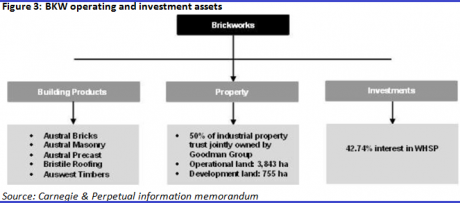

The following chart provides more detail on BKW’s assets.

Post the dismantling of the cross-shares BKW would be left with 100% of its building products and property development businesses, 12% of TPM and $1.6 billion of promissory notes. My post-transaction, sum-of-the-parts valuation is:

Figure 4: BKW sum-of-the-parts valuation

Asset/Liability | Value ($m) |

Building products division | 500 |

Land bank and property development division | 677 |

TPM stake (11.5% of total estimated $3,500m market capitalisation) | 403 |

Promissory notes from SOL | 1600 |

Less existing debt on-balance sheet | -280 |

Less existing deferred tax liabilities | -171 |

Total net asset value | 2723 |

Shares on issue | 147.2m |

Net asset value per share | $18.54 |

Source: StocksInValue.com.au

Will Carnegie and Perpetual succeed?

The success of this proposal may well depend on who can and cannot vote. Clearly it will be important to determine if Carnegie’s and Perpetual’s legal advice is correct and the cross-shareholdings plus those owned by associated entities, primarily the Millner family, are not entitled to vote. I predict a legal battle could well develop in which BKW and SOL argue their shares in each other and the family shareholdings are allowed to vote. This contest could postpone the EGMs, possibly for months. Unfortunately, I suspect that the argument concerning voting rights may take the focus away from a proper review of the proposal or the formation of a proper climate to create an agreed way forward.

In the background is the confusing interpretations of Sections 259D and E of the Corporations Code. These sections are claimed to have frozen the current cross-shareholdings by way of agreement and the direction of the Australian Securities and Investments Commission. As I have noted before, this intervention by ASIC appears to have created a problem rather than solved it.

Conclusion

In my view this proposal needs to be seriously investigated by the boards of both BKW and SOL. Clearly it would be preferable if shareholders were presented with a solid proposal sanctioned by both boards. In this situation it would be preferable if the smartest guys in town, who are represented on the share register, worked on a proposal with the board. Indeed, it is not clear to me why that is not in everybody’s interest.

Thus, to clear the air, would it not be better if the boards of SOL and BKW asked their independent shareholders, by vote, whether they are happy with the current cross-holding? If they are not, then a fiduciary duty would evolve, if it doesn’t exist today, to properly examine the structure. If independent shareholders are happy then there is nothing to change. Maybe that vote should have been taken long ago so the current imbroglio need not have developed.

(We reported in Collected Wisdom on September 25, 2013 Washington H. Soul Pattinson as a neutral).

John Abernethy is the Chief Investment Officer at Clime Asset Management, one of Australia’s top performing equity fund managers. To find out more about Clime Asset Management, visit their website at www.clime.com.au.

Clime Growth Portfolio Statistics

Return since June 30, 2013: 14.56%

Returns since Inception (April 19, 2012): 34.74%

Average Yield: 5.83%

Start Value: $141,128.64

Current Value: $161,682.47

Dividends accrued since June 30, 2013: $2,375.74

Clime Growth Portfolio - Prices as at close on 29th October 2013 | ||||||

| Company | Code | Purchase Price | Market Price | FY14 (f) GU Yield | FY14 Value | Safety Margin |

| BHP Billiton Limited | BHP | $31.37 | $37.59 | 4.64% | $37.84 | 0.67% |

| Commonwealth Bank of Australia | CBA | $69.18 | $76.79 | 7.05% | $69.17 | -9.92% |

| Westpac Banking Corporation | WBC | $28.88 | $34.60 | 7.51% | $30.61 | -11.53% |

| Woolworths Limited | WOW | $32.81 | $34.55 | 5.79% | $35.87 | 3.82% |

| The Reject Shop Limited | TRS | $17.19 | $17.62 | 3.89% | $16.98 | -3.63% |

| Brickworks Limited | BKW | $12.70 | $14.33 | 4.09% | $12.75 | -11.03% |

| McMillan Shakespeare Limited | MMS | $16.18 | $12.81 | 5.02% | $12.20 | -4.76% |

| Mineral Resources Limited | MIN | $8.25 | $11.39 | 8.28% | $13.41 | 17.73% |

| SMS Management & Technology Limited | SMX | $4.55 | $4.63 | 6.17% | $5.29 | 14.25% |