DIY must-do list for June 30

Summary: There are nearly six weeks left to the end of the financial year. It's a good time to consider salary sacrifice arrangements, minimum pension payments, concessional contributions, your overall investment strategy and a range of other issues. |

Key take-out: If you are trying to maximise your concessional contributions, you need to know how much your employer is going to pay into super and when to make sure that you stay under the concessional contribution limit. The limit for this financial year is $35,000 for anyone aged 49 or more on June 30, 2014. |

Key beneficiaries: SMSF trustees and superannuation accountholders. Category: Superannuation. |

The final month or so of the financial year can become a mad rush, particularly for anyone running their own business.

And being the trustee of your own self-managed super fund is a bit like running your own business. In fact, it's a lot like running a small business. Just usually, hopefully, on a mini-scale.

Sure, there's the investment element. But making the investment decisions is something that is, for most, a critical reason for having a SMSF. And that is something that most are considering on a daily/weekly/monthly basis.

It's the other things that you don't need to think about every single day that, perhaps, you need a reminder to consider at a given time of year.

Now, with nearly six weeks left to the end of the financial year, is that time. Because some things that you need to do with your SMSF (or super fund more generally) are use-it-or-lose-it advantages. So, here are the top things you should be considering.

1. Review salary sacrifice arrangements

Probably the most important thing for anyone trying to maximise their super contributions is to find out how close they are to their limit.

Salary sacrifice is an arrangement between you and your employer to send an amount of your pre-tax salary to your super fund. So, instead of it being taxed at your marginal tax rate (of up to 49 per cent, including the Medicare Levy), it will be taxed at 15 per cent as a concessional contribution.

The big things to remember for the financial year that ends on June, 30 2015 is that the concessional contribution limits changed in this financial year.

For the under-50s – more precisely, those aged 48 or younger on June 30, 2014 – the limit is $30,000, which is up from $25,000 the previous year.

For those aged 49 or more on June 30, 2014, the limit increased to $35,000.

If you are trying to maximise your concessional contributions, you need to know how much your employer is going to pay (SG, or superannuation guarantee payments) and when, because payments are strictly on those received between 1 July and 30 June the following year. And you need to be able to make sure that the combination of SG and salary sacrifice stays underneath your CC cap.

See below for more details on concessional contributions.

Most of you will still have time to make adjustments to your salary sacrifice arrangements, either to increase or decrease those payments, if you act to work it out with your employer immediately.

2. Make your minimum pension payments.

If your SMSF is in pension phase, you need to make sure that you have made the minimum pension payments by June 30. Not doing so can be a breach, with potentially serious tax consequences for your fund.

Your minimum pension amount is determined by your age and your pension fund balance. If you're unsure, speak to your fund's accountant or administrator. But the money needs to leave the super environment, which will generally be made to your personal bank account. (From there, you might wish to recontribute it, if you're eligible. See below.)

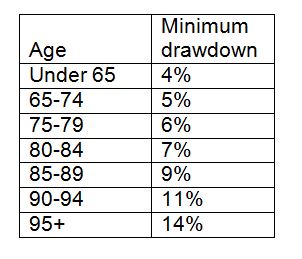

Table 1: Minimum pension drawdowns

Note: If you are on a transition to retirement (TTR) pension, you also need to note that you can't take more than 10 per cent of your pension balance.

3. Maximise concessional contributions (CC)

Concessional contributions are annual limits, outlined above. If you don't use them, they're gone.

Most people will get their CCs made by the 9.5 per cent superannuation guarantee. A smaller number will also get some in via salary sacrifice. And a good number of the self-employed will make contributions to their super fund, for which they will claim a deduction via a tax return from themselves personally, or their business.

But if you're in a position where you should be maximising your limit, it's important that you do so by 30 June.

4. Protect capital gains with super contributions

Sure, markets have taken a beating in recent weeks. But it comes at the end of three strong years of growth for both Australian and international markets, plus property.

The longer this bull market drags on, the more that capital gains are being taken. CGT events are becoming, to a degree, unavoidable, if you're selling assets.

If you have made a gain in your personal name (that is, outside of super), then making extra super concessional contributions will help lower your overall tax and therefore allow you to both build your super and reduce your tax bill outside super.

5. Strategise for non-concessional contributions (NCCs)

Non-concessional contributions are the higher limits for money that has been taxed outside of super and is not taxed as it enters super.

The limit for last financial year was $150,000. But it is now $180,000. These are the contributions that also come with the three-year pull forward rule, where you can contribute up to three years' worth of contributions (up to $540,000) if you're eligible to do so.

A good thing to keep in mind at this time of year is that, if you have the ability to make these larger deductions, that you time them properly.

The pull-forward nature of the contributions cap here is only triggered once you go over the $180,000 cap.

So, if you haven't made any NCCs so far this year, but have the ability to, you might consider putting in just $180,000 before June 30, then you might be able to put in $540,000 after 1 July ($180,000 x 3, for the FY16, FY17 and FY18 periods).

For a couple, that could mean between now and early July, you could put in up to $1.44 million ($180,000 each for this year, then $540,000 times two, using the pull-forward rule, for the three following financial years).

There are limits to being able to use the pull-forward rule, which include meeting the work test (40 hours work in a 30 day period for the year).

This is a complex area. Make sure you seek advice for your personal situation before making contributions that go close to the limits.

6. Even up super balances

The threats come and go. As soon as one disappears, another one seems to rear its head.

But it's important for couples to make an effort to even out superannuation balances. If one partner has been working for most of a marriage's life, while the other has not, then the super balances might be skewed considerably to the partner who was working.

The ALP's plan to introduce a tax on pensions paid out by super funds that are over $75,000 is a long way away from being realised. For a start, they're in Opposition. But in the ALP's last government, they tried to introduce a tax on super pension funds that earned more than $100,000.

The point is, Labor is keen to tax something beyond what they consider to be a “reasonable” amount to have in super. If you have one member of a fund with a $3 million balance, while the other member has a $200,000 balance, you will probably, at some stage in the future, end up paying more tax than another fund that had two members with $1.6 million each.

The time to start planning is, potentially, with super contributions NOW, not when the law gets introduced. And if you're putting money into super in the next few weeks as part of a couple, keep it in mind.

7. Review your investment strategy

Share and property investments have done very well, thanks very much, in the last three years. It's possible that the performance of those asset classes alone has pushed some super funds outside of the minimums and maximums contained in their official SMSF “investment strategy”.

Investment strategies are designed to be a document to show the ATO that you're taking your role as investment manager for the SMSF seriously. You have put thought into what your super fund should be invested in, given the risk tolerances of each of the members, and you are monitoring those investments regularly.

If, for example, you purchased a geared investment property in the current financial year – and your existing investment strategy said, say, between 0-20 per cent of assets can be held in property – then you have probably taken the asset base wa-a-a-ay beyond that 20 per cent.

Investment strategies need to be reviewed. “Regularly.” Though regularly is not defined by the ATO, it probably means somewhere between every six months and every couple of years.

And if you haven't yet put in a few sentences about the trustees considering the insurance needs of the members, which became law on July 1, 2012, then this would be a timely reminder to catch up on that point also.

8. Sell the dogs

A special reminder for those who have made some capital gains in their SMSF this financial year. If you also have some flea-ridden dogs in your portfolio that have big losses, then perhaps now is the time to get rid of them.

There is nothing wrong with selling loss-making investments to offset capital gains. However, the ATO takes a dim view of “wash sales”, where you sell a loser, then buy it back in similar quantities, just to refresh your cost base.

The information contained in this column should be treated as general advice only. It has not taken anyone's specific circumstances into account. If you are considering a strategy such as those mentioned here, you are strongly advised to consult your adviser/s, as some of the strategies used in these columns are extremely complex and require high-level technical compliance.

Bruce Brammall is managing director of Bruce Brammall Financial. E: bruce@brucebrammallfinancial.com.au. Bruce's new book, Mortgages Made Easy, is available now.