Diversified Portfolios - Intelligent Investor Equity Income - 31 December 2016

COMMENTARY

PORTFOLIO COMMENTARY

Like Brexit, the victory by President-elect Donald Trump was a surprise. Unlike Brexit, however, markets quickly took a positive view and have continued to rise ever since. Investors are betting that Trump’s planned infrastructure spending and tax cuts will combine to pump up economic growth and eventually drive interest rates higher. And when the US Federal Reserve raised interest rates by 0.25% in December, it suggested that a further three rate rises could follow in 2017, reinforcing investors’ increasing interest rate expectations.

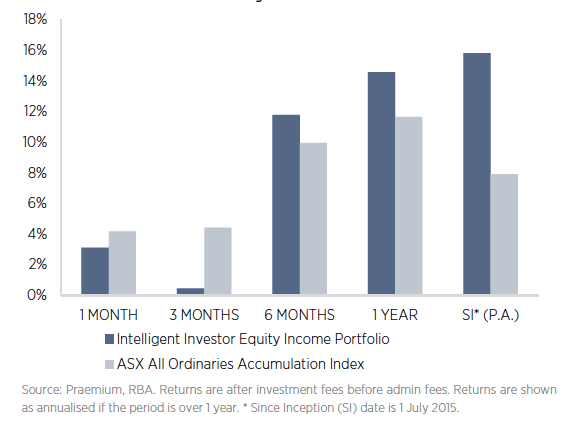

Our Equity Income portfolio gained 11.8% for the six months to 31 December, slightly beating the 9.9% return of the All Ordinaries Index. Since it began accepting real money for investment in July last year it has returned an annualised 15.8% compared to 7.9% for the All Ords; and since inception as a model portfolio in 2001, it has returned 13.6% compared to 8.0% for the All Ords.

The portfolio’s top performer over the first half of 2017 was South32, which rose 76�ter an excellent underlying 2016 result. Rising commodity prices and further cost cuts have helped it rise materially above the $2.13 price it listed at 18 months ago after being spun off from BHP Billiton.

Computershare has so far been one of the biggest beneficiaries of the Trump surprise, rising 38% on hopes that the President-elect’s policies might eventually drive up interest rates. Computershare earns a substantial portion of its profits from the interest on client cash balances – at least when rates aren’t close to zero.

Ansell was another good performer, increasing 38% after its 2016 result suggested an improving outlook and management announced it was considering the sale of the condom division.

Another decent performer was BHP Billiton, which rose 37% as commodity prices improved and, with them, investors’ perceptions of mining and energy companies.

PMP rounded out the top give gainers, rising 30% after announcing a planned merger with larger competitor IPMG, although it is potentially at risk after the ACCC subsequently announced it was reviewing the deal.

At the bottom of the table, OFX Group (formerly OzForex) was the biggest loser, falling 26% after reporting a 21% fall in underlying profit in its interim result. Low volatility in the Australian dollar compared to the US has affected the number of new clients signing up while the fall in sterling since the Brexit referendum reduced the value of sterling-based transactions.

Even before Trump’s victory, infrastructure stocks and listed property trusts declined as investors feared higher interest rates in coming years. This contributed to falls in Sydney Airport (by 13%) and pub owner Hotel Property Investments (by 11%). Sydney Airport was also affected by the Government announcing that the company would have to front more of the cost of developing a second Sydney airport at Badgerys Creek than originally expected.

Financial software company GBST and assisted reproduction provider Virtus Health rounded out the top five losers, both falling 8%.

On 1 September, the portfolio sold 2.0% of its holding in Trade Me because, at 8.6%, it had moved well beyond our maximum recommended weighting of 6.0%. The portfolio also reduced its holdings in ASX (at $51.51) and Virtus Health (at $7.92) each by 1.0%, to 6.3% and 4.3% respectively.

In late October, the portfolio sold its entire 2.8% weighting in Hotel Property Investments (at $2.84) to purchase a 3.0% holding in Crown Resorts, at $10.70, after some of Crown’s staff were arrested in China.

Finally, to maintain the portfolio’s resources exposure but reduce the skew towards South32, the portfolio reduced its holding in South32 by 1.3% to 4.0% (at $2.58), investing the proceeds in BHP Billiton to increase its weighting to 4.0% (at $24.23).

GROWTH OF $10,000

Income Reinvested

PEFORMANCE SUMMARY TO 31 DECEMBER 2016

Source: Praemium, RBA. Returns are after fees and before expenses. Returns are shown as annualised if the period is over 1 year. * Since Inception (SI) date is 1 July 2015.

| PERFORMANCE TO 31 DECEMBER 2016 | 1 MONTH | 3 MONTH | 6 MONTH | 1 year | SI* (P.A.) |

|---|---|---|---|---|---|

| Intelligent Investor Equity Income Portfolio | 3.12% | 0.46% | 11.78% | 14.56% | 15.81% |

| ASX All Ordinaries Accumulation Index | 4.17% | 4.41% | 9.94% | 11.65% | 7.91% |

| Excess to Benchmark | -1.05% | -3.95% | 1.84% | 2.92% | 7.91% |

Important Information

While every care has been taken in preparation of this document, InvestSMART Financial Services Limited (ABN 70 089 038 531, AFSL 226435) (“InvestSMART”) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and see professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided. This document has been prepared for InvestSMART by InvestSense Pty Ltd ABN 31 601 876 528, Authorised Representative of Sentry Asset Management Pty Ltd AFSL 408 800. Financial commentary contained within this report is provided by InvestSense Pty Ltd. The information contained in this document is not intended to be a definitive statement on the subject matter nor an endorsement that this model portfolio is appropriate for you and should not be relied upon in making a decision to invest in this product. The information in this report is general information only and does not take into account your individual objectives, financial situation, needs or circumstances. No representations or warranties express or implied, are made as to the accuracy or completeness of the information, opinions and conclusions contained in this report. In preparing this report, InvestSMART and InvestSense Pty Ltd has relied upon and assumed, without independent verification, the accuracy and completeness of all information available to us. To the maximum extent permitted by law, neither InvestSMART, InvestSense Pty Ltd or their directors, employees or agents accept any liability for any loss arising in relation to this report. The suitability of the investment product to your needs depends on your individual circumstances and objectives and should be discussed with your Adviser. Potential investors must read the PDS, Approved Product List and FSG along with any accompanying materials. Investment in securities and other financial products involves risk. An investment in a financial product may have the potential for capital growth and income, but may also carry the risk that the total return on the investment may be less than the amount contributed directly by the investor. Past performance of financial products is not a reliable indicator of future performance. InvestSense Pty Ltd does not assure nor guarantee the performance of any financial products offered. Information, opinions, historical performance, calculations or assessments of performance of financial products or markets rely on assumptions about tax, reinvestment, market performance, liquidity and other factors that will be important and may fluctuate over time. InvestSense Pty Ltd, InvestSMART Financial Services Limited, its associates and their respective directors and other staff each declare that they may, from time to time, hold interests in Securities that are contained in this investment product.

Frequently Asked Questions about this Article…

The Intelligent Investor Equity Income Portfolio gained 11.8% for the six months to 31 December 2016, slightly outperforming the All Ordinaries Index, which returned 9.9% during the same period.

The portfolio's performance was boosted by strong gains in companies like South32, Computershare, Ansell, BHP Billiton, and PMP, which benefited from rising commodity prices, cost cuts, and positive market reactions to political events like the Trump election.

South32 was the top performer, rising 76% due to an excellent underlying 2016 result, rising commodity prices, and further cost cuts.

Computershare rose 38% on hopes that President-elect Trump's policies might eventually drive up interest rates, benefiting from the interest on client cash balances.

The portfolio faced challenges from companies like OFX Group, which fell 26% due to a 21% drop in underlying profit, and infrastructure stocks like Sydney Airport, which declined due to fears of higher interest rates and increased development costs.

The portfolio made several adjustments, including selling a portion of its holdings in Trade Me, ASX, and Virtus Health, and selling its entire holding in Hotel Property Investments to purchase a stake in Crown Resorts.

Since its inception as a model portfolio in 2001, the Intelligent Investor Equity Income Portfolio has returned an annualized 13.6%, compared to 8.0% for the All Ordinaries Index.

Investors should consider their individual objectives, financial situation, and needs, and seek professional advice. It's important to note that past performance is not a reliable indicator of future performance, and investments carry risks.