Diversified Portfolios - Intelligent Investor Equity Income - 30 September 2016

COMMENTARY

PORTFOLIO COMMENTARY

Commentary PORTFOLIO COMMENTARY What a difference a few months makes. Markets took a hammering right at the end of the 2016 financial year thanks to the Brits’ decision to leave the European Union, but three months of mostly sober reflection have reassured investors that the world is not about to end. The ‘flash crash’ in early October – where sterling fell 6% against the US dollar in a matter of minutes – shows that the UK isn’t out of the woods, but markets are taking the view that any damage is likely to be contained. Meanwhile, the greater threat to global stability – a Trump presidency – appears to be receding.

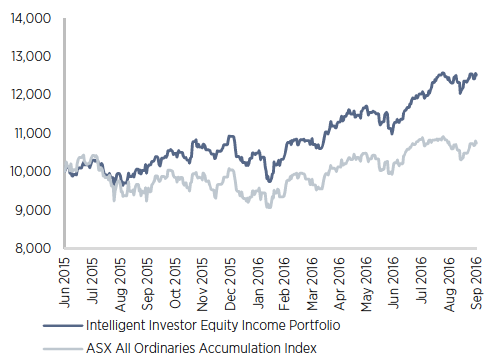

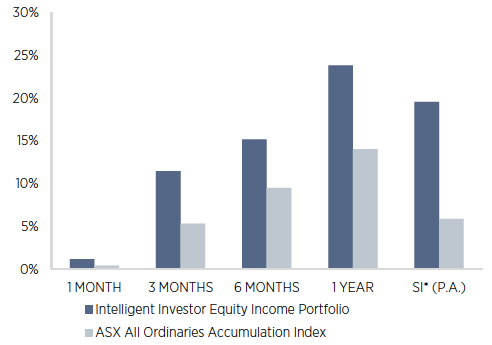

The All Ordinaries Index gained 5.3% for the three months to 30 September, but our Equity Income Portfolio came in well ahead of that, with a return of 11.4%. Since it opened its doors to investment in July 2015, it has generated an annualised return of 19.6%, compared to 5.9% for the All Ords; and since inception as a model portfolio 15 years ago it has returned 13.7% a year compared to 7.9% a year for the All Ords.

Two of the portfolio’s top four performers for the September quarter came from the mining sector. South32 topped the list with a return of 57% as investors anticipated and were delivered an excellent full-year result. Although the miner reported a headline loss of US$1.6bn, it was mostly due to asset writedowns and operating cash flow actually jumped more than 50% to over US1bn.

South32’s former parent, BHP, also had a strong quarter, returning 21% despite a headline loss for 2016 of US$6.4bn. As with South32, the loss was due to writedowns forced by past mistakes of capital allocation, but the underlying net profit of US$1.2bn was a decent effort given weak commodity prices. New management continues to make strides at recuperating the big miner.

The portfolio’s other top performers were Monash IVF and Ansell, with gains of 38%and 28% respectively. Both companies reported full-year results that suggested past difficulties were behind them.

Monash reported a 12% increase in IVF cycles in Australia, increasing its market share from 23% to 24%, and a 10% increase in cycles in its nascent Malaysian business. Price rises meant that revenue rose 25%, while a slower rate of cost growth meant that net profit increased by 35%.

Ansell, on the other hand, was going backwards, with revenue falling 4% and net profit down 15%. That was, however, at the upper end of the guidance provided in February, which caused the stock to fall 20% and prompted us to buy it. Growth is expected to return this year and the market also cheered plans to sell the company’s condoms division to focus on its other operations (mostly gloves) that sell to businesses rather than consumers.

The only significant faller in the quarter was OzForex (formerly OzForex), which lost 18% as investors fretted over increased competition in international payments –including an agreement between CBA and the UK’s Barclays Bank – and potential disruption from ‘blockchain’ technology. OzForex was another significant faller, losing 18% as investors fretted over increased competition in international payments –including an agreement between CBA and the UK’s Barclays Bank – and potential disruption from blockchain technology. Again, given the risks involved we’re content to sit on our hands.

On 1 September we reduced some of our largest holdings – Trade Me by 2.0 percentage points to 6.6% (at $5.32), and ASX (at $51.51) and Virtus Health (at $7.92) each by 1.0 percentage points, to 6.3% and 4.3% respectively. The funds (and some cash) were used to increase our holdings in Commonwealth Bank by 3.0 percentage points to 5.2% (at $71.60) and Westpac by 1.5 percentage points to 3.8% (at $29.55).

We remain very comfortable with Trade Me, but it’s weighting (at 8.6%) had moved well beyond our 6% recommended maximum.

GROWTH OF $10,000

Income Reinvested

PEFORMANCE SUMMARY TO 30 SEPTEMBER 2016

Source: Praemium, RBA. Returns are before expenses and fees. Returns are shown as annualised if the period is over 1 year. * Since Inception (SI) date is 1 July 2015.

Commonwealth Bank and Westpac offer reasonable value at current prices and are particularly suited to an income-focused portfolio due to their high fully franked dividend yields.

In spite of the excitement around Brexit and Trump, the greatest short-term threat for our portfolios – as for markets generally – is that interest rate expectations start to creep up. That would force investors to raise the ‘opportunity cost’ they put into their valuation models and knock down their valuations accordingly.

The good news is that any increase in rate expectations is likely to be accompanied by improved prospects for growth. Both our portfolios are largely comprised of stocks that add value and enjoy plenty of pricing power, and that should enable them to take their share of any growth that eventuates.

As ever, the sharemarket could see some sharp movements in the short term as investors adjust their expectations for rates and growth. But that’s the penalty for being in an asset class that tends to outperform others over the long term. We see no reason for that to change.

| PERFORMANCE TO 30 SEPTEMBER 2016 | 1 MONTH | 3 MONTH | 6 MONTH | 1 year | SI* (P.A.) |

|---|---|---|---|---|---|

| Intelligent Investor Equity Income Portfolio | 1.14% | 11.43% | 15.18% | 23.81% | 19.55% |

| ASX All Ordinaries Accumulation Index | 0.40% | 5.30% | 9.51% | 14.01% | 5.86% |

| Excess to Benchmark | 0.74% | 6.14% | 5.67% | 9.80% | 13.69% |

Important Information

While every care has been taken in preparation of this document, InvestSMART Financial Services Limited (ABN 70 089 038 531, AFSL 226435) (“InvestSMART”) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and see professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided. This document has been prepared for InvestSMART by InvestSense Pty Ltd ABN 31 601 876 528, Authorised Representative of Sentry Asset Management Pty Ltd AFSL 408 800. Financial commentary contained within this report is provided by InvestSense Pty Ltd. The information contained in this document is not intended to be a definitive statement on the subject matter nor an endorsement that this model portfolio is appropriate for you and should not be relied upon in making a decision to invest in this product. The information in this report is general information only and does not take into account your individual objectives, financial situation, needs or circumstances. No representations or warranties express or implied, are made as to the accuracy or completeness of the information, opinions and conclusions contained in this report. In preparing this report, InvestSMART and InvestSense Pty Ltd has relied upon and assumed, without independent verification, the accuracy and completeness of all information available to us. To the maximum extent permitted by law, neither InvestSMART, InvestSense Pty Ltd or their directors, employees or agents accept any liability for any loss arising in relation to this report. The suitability of the investment product to your needs depends on your individual circumstances and objectives and should be discussed with your Adviser. Potential investors must read the PDS, Approved Product List and FSG along with any accompanying materials. Investment in securities and other financial products involves risk. An investment in a financial product may have the potential for capital growth and income, but may also carry the risk that the total return on the investment may be less than the amount contributed directly by the investor. Past performance of financial products is not a reliable indicator of future performance. InvestSense Pty Ltd does not assure nor guarantee the performance of any financial products offered. Information, opinions, historical performance, calculations or assessments of performance of financial products or markets rely on assumptions about tax, reinvestment, market performance, liquidity and other factors that will be important and may fluctuate over time. InvestSense Pty Ltd, InvestSMART Financial Services Limited, its associates and their respective directors and other staff each declare that they may, from time to time, hold interests in Securities that are contained in this investment product.

Frequently Asked Questions about this Article…

The Intelligent Investor Equity Income Portfolio outperformed the ASX All Ordinaries Index with a return of 11.4% for the three months to 30 September 2016, compared to the All Ords' 5.3% gain. Since its inception in July 2015, the portfolio has generated an annualized return of 19.6%, significantly higher than the All Ords' 5.9%.

South32 was the top performer in the portfolio for the September quarter, delivering a return of 57%. Despite reporting a headline loss of US$1.6 billion due to asset writedowns, its operating cash flow increased by over 50% to more than US$1 billion.

BHP reported a headline loss of US$6.4 billion for 2016, primarily due to writedowns from past capital allocation mistakes. However, the company achieved an underlying net profit of US$1.2 billion, reflecting its efforts to recover amidst weak commodity prices.

Monash IVF reported a 12% increase in IVF cycles in Australia and a 10% increase in its Malaysian business, leading to a 25% rise in revenue. This, combined with slower cost growth, resulted in a 35% increase in net profit.

Ansell's stock price increased by 28% as the market responded positively to its plans to sell its condoms division and focus on its core operations. Despite a 4% fall in revenue and a 15% drop in net profit, the results were at the upper end of the company's guidance.

OzForex faced a significant challenge with an 18% drop in its stock price due to investor concerns over increased competition in international payments and potential disruption from blockchain technology.

Holdings in Trade Me, ASX, and Virtus Health were reduced to manage portfolio weightings and to reallocate funds towards increasing holdings in Commonwealth Bank and Westpac, which offer reasonable value and high fully franked dividend yields.

The greatest short-term threat to the portfolio's performance is the potential increase in interest rate expectations, which could raise the 'opportunity cost' in valuation models and impact stock valuations. However, any rate increase is likely to be accompanied by improved growth prospects.