Did we learn nothing from the GFC?

It’s been six years since Lehman Brothers collapsed and households and businesses throughout the developed world scrambled to pay-down or write-off existing (and often toxic) debt burdens. During those six years, you might be tempted to think that the global community has been weaned off its reliance on debt, but that’s far from the truth.

The 16th Geneva Report on the World Economy assesses the global debt environment and provides fresh insight into developments since the onset of the global financial crisis. It found that the global debt-to-GDP ratio continues to rise at a rapid pace, with the global financial crisis creating only a temporary moderation in borrowing tendencies.

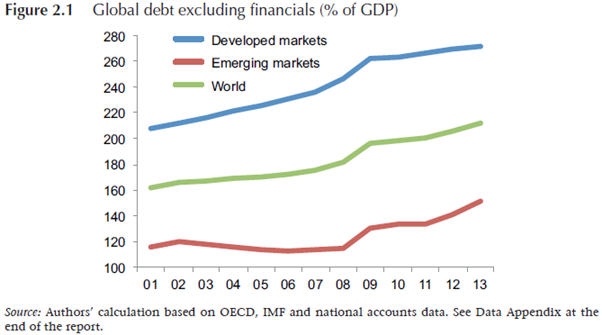

Global debt, excluding financials, increased to 212 per cent of nominal GDP in 2013, up from 180 per cent in 2008. To the limited extent that deleveraging has occurred -- primarily in the US, the UK and the euro Area -- it has been centred on the household and business sectors and has been partially or entirely offset by government borrowing.

Debt within the developed world is estimated to be 272 per cent of nominal GDP compared with 151 per cent in emerging countries. At the top of the class is Ireland and Japan, with a debt-to-GDP ratio of 442 and 411 per cent, respectively.

For Ireland, its debt is concentrated in its business sector, although leverage within their financial sector is the more pressing concern. In Japan, its level of debt is largely concentrated within the public sector at an extraordinary 243 per cent of nominal GDP.

How does Australia compare?

According to the report, Australia has a debt-to-GDP ratio of 209 per cent in 2013. The distribution of our debt is somewhat unusual among developed countries, with a high share of debt concentrated in the household sector, below average debt in the business sector and relatively little government debt.

Among developed countries, Australian household debt of 110 per cent of nominal GDP sits second to only the Netherlands. But for the business sector we sit above only Greece and Germany among countries assessed. The result is perhaps a little surprising given Australia’s reputation for preferring debt financing over equity issuances.

Our financial sector is not especially leveraged by international standards at only 89 per cent of nominal GDP -- compared with Ireland at a remarkable 584 per cent -- although Australia’s financial debt is largely concentrated within four banks who are all considered ‘too big to fail.’

Analysing cross-country debt dynamics is notoriously difficult. Why do some countries default all the time -- such as Argentina -- while Japan can successfully manage debt levels that tower over the likes of Greece? Cross-country analysis should always be treated with some caution.

It’s important to acknowledge that institutions matter, as does the composition of borrowers. Japan, for example, can service its incredible debt quite easily because it primarily borrows from Japanese citizens and can simply print more money to cover the debt. The United States is often considered to be in the same boat due to the role the US dollar plays in global transactions.

Nevertheless, the report is concerned about recent developments. Has loan quality improved sufficiently within developed countries? Have they improved their risk management systems? And will higher leverage in emerging economies pave the way for more frequent financial crises?

The next global debt crisis is most likely to occur in either Europe or among emerging economies.

A central concern of the report is the combination of rising leverage and moderating growth. Global growth is increasingly dominated by China but when you dig below the surface it becomes obvious that the global economy has shifted towards a lower growth environment. Nowhere is this more evident than Europe.

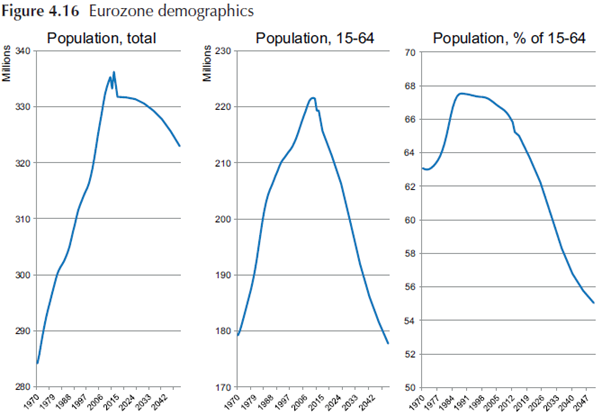

The persistence of the crisis in the euro zone has eroded the productive capacity of most euro zone economies. The ongoing legacy of the sovereign debt crisis will not be easily forgotten and while progress has been made, debt remains exceptionally high in a number of countries.

The very architecture of the euro zone -- including a range of poorly matched countries utilising the same currency and inadequate policy co-ordination among those countries -- leaves the euro zone particularly susceptible to financial imbalances and crises.

Europe is also confronted by a truly nasty set of demographics that are set to weigh on growth and will make it more difficult to service existing debt burdens.

Emerging countries pose a very different threat and much of it is centred on China. Rising leverage helped to shield China and other emerging economies during the global financial crisis but it isn't without its risks.

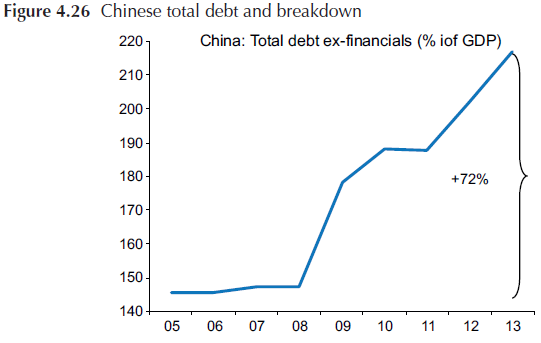

In China, the debt-to-GDP ratio has increased by around 70 percentage points since 2008, which has helped finance its residential investment and infrastructure boom. It proved highly beneficial for the Australian economy but is clearly on an unsustainable footing.

China now faces the undesirable combination of rising debt and moderating nominal GDP growth. The country's ability to service its debt will be stretched -- although with relatively low government debt it remains reasonably well placed to ride out any storm. The same can not necessarily be said of other emerging economies.

The report indicates that collectively we learned relatively little from the global financial crisis. We shouldn't forget that it was the countries with relatively low debt that were best able to weather the crisis and the countries that can deleverage -- without compromising employment or growth -- would do well to ease their debt burdens.

Debt among emerging economies is not necessarily too high, but, it is increasing at a rapid pace. Don’t be surprised if they find it more difficult to service their debt burden than has traditionally been the case for more developed countries.

As for Australia, overall we sit in the middle of the pack but our household sector debt is exceptionally high by international standards. As such it should come as little surprise that the Reserve Bank is contemplating policies to reducing lending activity.