Deflation could be good for the US economy

Deflation continues to rear its ugly head -- this time in the US. Consumer prices have fallen for the past two months -- driven by lower oil prices -- but could it be a blessing in disguise?

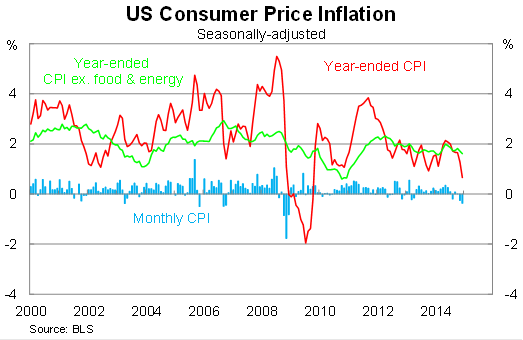

In the US, headline inflation fell by 0.4 per cent in December, in line with market expectations, to be 0.7 per cent higher over the year. Inflationary pressures have eased considerably in recent months, driven by lower oil prices, with annual inflation now at its lowest level since October 2009.

Despite this, there is evidence that underlying inflation remains solid and could push higher in coming months. Core inflation -- which excludes volatile items such as food and energy -- was unchanged in December, to be 1.7 per cent higher over the year. That result remains within striking distance of the Federal Reserve's annual target of 2 per cent inflation.

At the centre of these figures sit oil prices and their flow through to petrol and energy prices. Energy prices fell by 4.7 per cent in December, following a fall of 3.8 per cent last month, to be 10.8 per cent lower over the year.

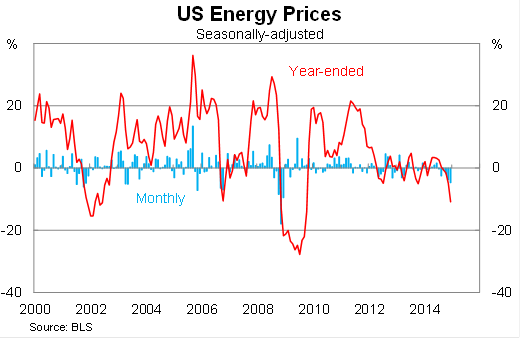

Historically energy prices have been exceptionally volatile. As a result, it is understandable that economists and central banks try to look through the volatility by focusing on core measures of inflation.

It's not that energy or food prices are unimportant -- far from it -- but as the graph below shows there is a tendency for prices to fall and rebound quite regularly and any central bank that conducts policy based on those numbers would look foolish a lot of the time.

Deflation will be one of the buzzwords of 2015 but this source of deflation (assuming overall consumer prices eventually fall) may actually be good for the US economy.

Typically deflation arises due to insufficient demand; it's a sign of an economy that is underperforming. That's not the case this time.

The US labour market is rising at its fastest pace since November 1997. Over the past 12 months, the US economy has experienced a net increase of 2.95 million jobs – completing its strongest calendar year since 1999 (Why the Fed won't rush to raise rates, January 12).

As such, lower consumer prices are set to meet rising domestic demand in what should be a good period for US consumers. As necessities, lower fuel and food prices will effectively translate into a tax cut for US consumers (and consumers in most countries).

Naturally there are risks associated with the current trend. If oil prices stay persistently low then a number of oil investment projects in the US will be at risk. Expect some consolidation within that sector as the shake-out continues.

But when oil prices stabilise, consumer prices in the US will quickly head back towards the Federal Reserve's target. Wage growth will be the key throughout the medium-term; with the unemployment rate now down to 5.6 per cent it is only a matter of time before firms begin to compete more fiercely for available talent.

So far that hasn't eventuated and to some extent that may reflect ongoing compositional change across the US economy. The jobs created since the crisis have tended to be lower-paying positions, which has effectively weighed on measures of wage growth.

Conventional wisdom suggests that central banks need to be forward-looking with regards to monetary policy. The Federal Reserve takes that belief seriously, hence its application of forward-guidance (which probably hasn't worked but that's an entirely different issue).

The recent decline in oil prices provides a textbook example of contemporary monetary policy. Some analysts and commentators will panic as disinflation and potentially deflation becomes a central part of the US narrative but expect the Fed to remain fairly upbeat.

They will acknowledge that deflation exists but they will place increasing emphasis on core measures of inflation. They won't want to be side-tracked by what could prove to be a fairly temporary problem.

The outlook for inflation remains fairly benign and obviously there will be some weakness in the near term. I expect the Fed to begin placing greater emphasis on measures of wages which -- combined with the unemployment rate -- will largely dictate the timing of the next rate move.