Decoding the two sides to the retail story

Retail sales were weak during December but strong over the quarter. The market was both shocked on the downside and on the upside. But what does it really mean? Two clear takeaways are that household spending will be fairly solid when the national accounts are released later this month and that retailers should brace themselves for another difficult year.

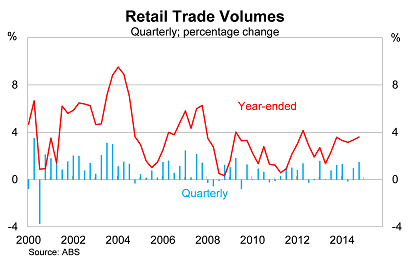

The value of retail sales rose by 0.2 per cent in December, missing market expectations, to be 4.1 per cent higher over the year. However, at least part of the weakness appears cosmetic, with volumes surging over the past three months.

On a quarterly basis, retail volumes -- which are retail sales adjusted for changes in consumer prices -- rose by 1.5 per cent in the December quarter, to be 3.6 per cent higher over the year. By any measure this is a fairly strong result -- the biggest since March 2013 -- and suggests the retail trade component of household spending will contribute solidly to real GDP growth in the December quarter.

But analysts shouldn't get ahead of themselves. Retail trade only accounts for a mere fraction of total consumption, with spending on services now accounting for almost two-thirds of total spending. Increasingly the retail trade survey is a poor measure of household activity but unfortunately there are few timely or comprehensive measures of expenditure on services.

Activity in the December quarter was driven by household goods (up 5.5 per cent in the quarter), while sales at clothing & footwear and department stores both rose by 1.9 per cent in the December quarter. But the so-called ‘dining boom' may be over, with spending at cafes and restaurants declining in two of the past three quarters.

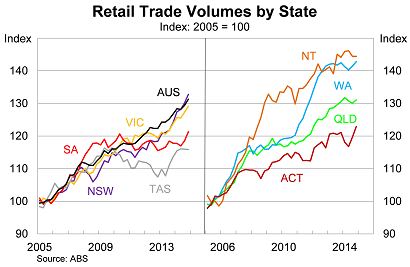

At the state level, growth continues to be driven by New South Wales and Victoria. Our two most populous states accounted for almost 68 per cent of growth in the quarter and around 80 per cent of growth over the year. The rebalancing of the Australian economy remains a work in progress but it's clearly evident within the household data.

The two measures -- sales and volumes -- paint fairly different stories. The reason for this is because price growth has slowed considerably in recent quarters. Part of that story may reflect that retailers are concerned about their sales but lower oil prices have also contributed in recent months.

The retail trade deflator was unchanged during the December quarter, with prices falling for household goods -- possibly reflecting Christmas sales -- and climbing modestly in most other industries.

The outlook for the household sector remains intrinsically tied to conditions in the labour market. Those conditions appear to have improved a little in recent months but there are a number of headwinds that need to be navigated before the labour market is out of the woods.

The first relates to structural shifts across the economy. Both the mining and manufacturing sectors -- particular automobile production -- are in a state of change. Both sectors will cut jobs sharply over the next year or two and those workers may struggle to be absorbed within the broader economy. Our recent experience -- where the Australian economy has failed to absorb population growth --increases the risk that this may occur.

Second, real wages remain weak and, in the medium term, that will largely dictate our spending patterns. Households can only devour their personal savings for so long and given the uncertain outlook for the Australian economy, they may be more cautious than they have been in the past.

Third, while a lower Australian dollar should provide net benefits for the economy, it may provide some near and medium-term pain for the household sector. A lower exchange rate increases the costs of imports and will either result in Australians paying those higher prices or substituting towards higher priced Australian alternatives. The latter will be beneficial for domestic production and eventually employment but that boost may take some time to eventuate.

Finally, the terms of trade continues to decline, lowering the income received from Australian exports (Australians are missing out on the benefits of rising exports, February 4). This has given rise to what some have termed an ‘income recession', by which I mean that Australian households and businesses feel a lot poorer than measures such as real GDP suggest. This will continue to weigh on household spending (although the extent is uncertain) over the next couple of years.

Household spending was weak in the month of December but the volume of goods sold surged towards the end of the year. That's good news for real GDP growth, but it remains uncertain how sustainable that will be. Lower interest rates should help -- and the Reserve Bank is expected to cut again in either March or April -- but retailers should brace themselves for another challenging year.