Declining demand, rising prices - is there something wrong?

The Productivity Commission has released its final report on electricity network regulation. It provides a wealth of information explaining how we have ended up paying vastly more for electricity networks, while growth in peak demand has almost stagnated.

At the same time as the Commission released its report, AEMO downgraded its expectations of demand growth across the NEM for this year. These downgrades come on top of some very large downgrades in the prior year.

It prompts the reasonable question as to why on earth we are seeing such large increases in network charges when demand hasn’t increased all that much?

As with all things related to electricity market regulation you can easily find yourself lost in quite literally thousands of pages of documents. Yet there’s usually some core data hiding in those pages that are quite revealing.

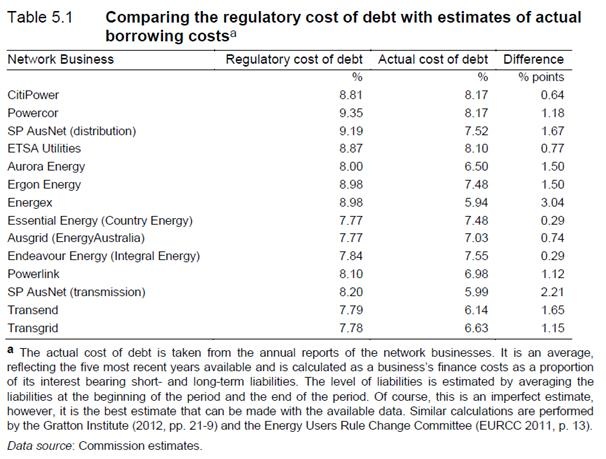

In particular the Productivity Commission report contains the table below which helps cut through most of those pages. It shows the interest rate on debt that the regulator assumed each network business would have to pay lenders, and then the actual interest rate they paid on their debts.

In every single case bar two, the network’s actual debt interest rate was more than 0.5 per cent lower than what the regulator assumed. For those that don’t spend their lives in financial spreadsheets but do have home loans you will probably realise that an interest rate reduction of even 0.5 per cent makes a big difference, and the 3 per cent which Energex wrangled is absolutely huge.

Now imagine that your home loan was in the billions instead of a few hundred thousand dollars. That’s about the quantum we’re dealing with in terms of networks’ assets.

At the lower end if we take Citipower, in 2010 its asset base was $1.24 billion so the 0.64 per cent premium on its debt would equate to $31 million over the five year regulatory period as a tidy windfall gain. At the higher end with Energex, its asset base was $7.87 billion and the 3.04 per cent premium on debt would equate to a $1.2 billion windfall gain.

When you can get such windfalls for doing nothing, it provides a very strong incentive for you to inflate forecasts of electricity demand, which then enables you to increase your asset base. What’s more if it turns out that electricity demand wasn’t as high as you expected, you can pocket all those windfall gains and not actually even spend the money on building the new assets. Although that then means you forgo the revenue over the remaining life of the asset which in network businesses can be decades.

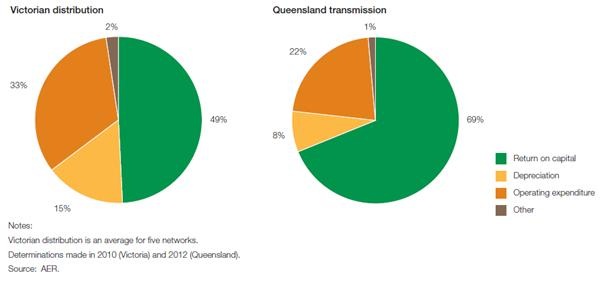

To illustrate how important this is, the chart below from the Australian Energy Regulator provides a breakdown on revenue for Victorian distributors and the Queensland transmission company, Powerlink. You can see that return on capital (green) is easily the dominant part of revenue for both charts. But in the case of Powerlink, it’s almost 70 per cent of revenue.

Indicative composition of electricity network revenues

Now on top of the 1.12 per cent premium Powerlink pocketed on its debt, its shareholder – the Queensland government – picks up some further windfall gains. That’s because it borrows the money on behalf of Powerlink at rates considerably lower than the 6.98 per cent it charged Powerlink.

Powerlink may represent a greater debt risk than the Queensland government as a whole. But when it’s considered that the Queensland government has a pretty big say in the regulation of Powerlink, then the risk is probably pretty darn low.

At the same time the Queensland government sets the reliability standards which determine how many assets need to be built to meet the forecasted levels of electricity demand. High standards of reliability require more assets to cope with possible breakdowns.

For some strange reason the Queensland government in its infinite wisdom believes that Queenslanders need higher levels of reliability than Victorians. How does it know? Well it’s not actually based on any evidence, whereas in Victoria reliability standards are set based on publicly available assessments of the cost to consumers from a loss of supply.

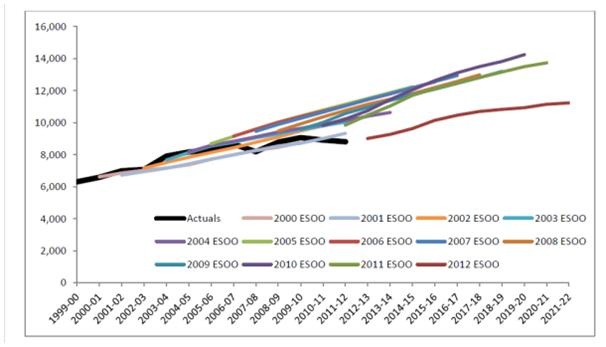

In the end it all makes you wonder whether this might be the reason why Powerlink consistently overestimated electricity demand over many years as shown below (the dark red line that is in line with black actual was a forecast by AEMO not Powerlink).

Powerlink forecasts of maximum peak demand (coloured lines) vs actual (black line)

Source: AEMC (2013)

It also makes you wonder why state governments, other than Victoria, as well as the AEMC, seem to continually drag their feet over AEMO taking on the role of setting reliability standards nationally.

And why they also seem reluctant to accept the idea that construction and payment for major new transmission assets should be contingent on whether demand has grown to levels that actually justify them.

Furthermore it might also be one reason why state governments other than Victoria aren’t all that keen on a widespread roll-out of smart meters with high pricing during peak demand periods.

The Productivity Commission accused the AEMC and the Standing Council on Energy and Resources as being “tardy” in relation to reform of networks. They stated:

“The Standing Council on Energy and Resources needs to accelerate reforms — particularly for reliability and planning — which have been bogged down by successive reviews.”

The Productivity Commission may have been a touch polite.