Cut coming: How latest inflation affects rates

Summary: Despite diminishing returns, the Reserve Bank is almost certain to loosen monetary policy further next week with core inflation sinking to its lowest level in 33 years. |

Key take-out: More weak inflation means Australia's low interest rate, low return environment is here to stay. |

Key beneficiaries: General investors. Category: Economics. |

The Reserve Bank of Australia appears almost certain to cut interest rates by 25 basis points next Tuesday following another weak inflation result. The inflation figures, released earlier today, point towards ongoing weakness in domestic demand following the end of the mining investment boom.

The market reacted unusually to the news. The ASX200 was bid lower in initial reaction to the release but I expect that to be reversed as participants digest the information. This will support the ASX200 through to next Tuesday, while bond yields should ease further. For those who rely predominantly on savings it's another blow as deposit rates tumble again.

The take home point for investors is that Australia's "low interest rate, low return" environment is here to stay. The global search for yield continues which is forcing many investors to take on risks that they wouldn't necessarily consider during a stronger economic environment. As Australia's cash rate converges with overseas equivalents it will become more difficult for domestic investors to achieve the type of returns they have growth accustomed to.

Domestic inflation

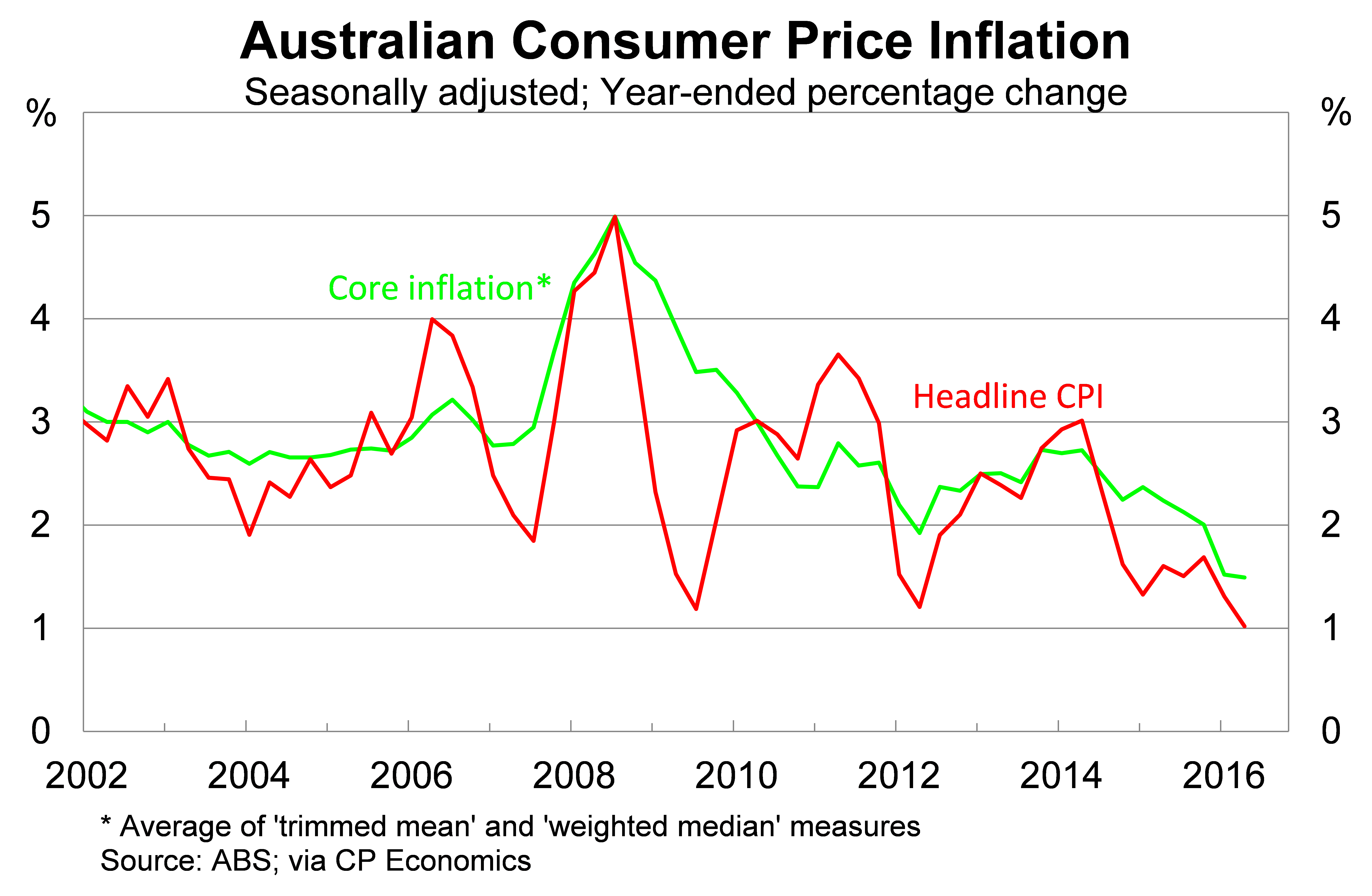

Headline inflation rose by 0.6 per cent in the June quarter, on a seasonally-adjusted basis, to be one per cent higher over the year. The result follows a March quarter where consumer prices fell for the first time in seven years. Inflationary pressures have now eased significantly since peaking at three per cent two years ago.

The measure that the RBA pays the most attention to is core inflation. This measure removes the impact of volatile items and provides a better guide of underlying inflation. By focusing on this measure the RBA avoids overreacting to a big change in, say, oil or fruit prices.

Core inflation rose by 0.5 per cent in the June quarter, following soft growth to begin the year, to be 1.5 per cent higher over the year. Core inflation now sits as its lowest level in 33 years, which is when the statistics were first recorded.

Why does the RBA target inflation?

The objectives of the Reserve Bank are as follows and are set out in the Reserve Bank Act 1959:

The stability of the currency of Australia;

The maintenance of full employment in Australia; and

- The economic prosperity and welfare of the people of Australia.

Those objectives are quite broad but since the early 1990s and formally since 1996 these objectives have been interpreted as a target for consumer price inflation of between 2-3 per cent per annum. At various times in the past this has been interpreted differently. For a long time the role of monetary policy was primarily just the stabilisation of the exchange rate.

According to the RBA, price stability or low inflation “assists business and households in making sound investment decisions". Furthermore, low inflation “underpins the creation of jobs, protects the savings of Australians and preserves the value of the currency".

More importantly, inflation provides important insight into the overall health of the economy. Inflation within that 2-3 per cent target band is typically consistent with low levels of unemployment and the economy growing at around trend, which was until recently estimated at around three per cent annually.

Why is deflation undesirable?

When economists speak of deflation with fear, those outside of the field of economics must find it strange. How can lower prices be bad? Shouldn't we be happy that we can buy products at a cheaper price?

The main problem is that deflation, or disinflation, is a signalling event that hits the economy via three specific channels:

- When households and businesses expect prices to fall they are less willing to spend or borrow;

- Deflation causes real interest rates to rise, increasing the debt burden on households and businesses;

- Deflation doesn't occur in a vacuum, it typically leads to lower wage growth as well.

The first relates to expectations. If a dollar tomorrow is worth more than a dollar today then perhaps I'd be better off saving that dollar rather than spending it. Low levels of inflation provide an incentive to spend rather than save; at high levels – such as during periods of hyperinflation – that incentive becomes so strong that people spend their money the moment they receive it.

The second refers to debt and the real interest rate. Deflation increases the value of our debts and makes it more difficult to pay down our loans. Central banks typically respond to this risk by cutting interest rates and freeing up household and business budgets.

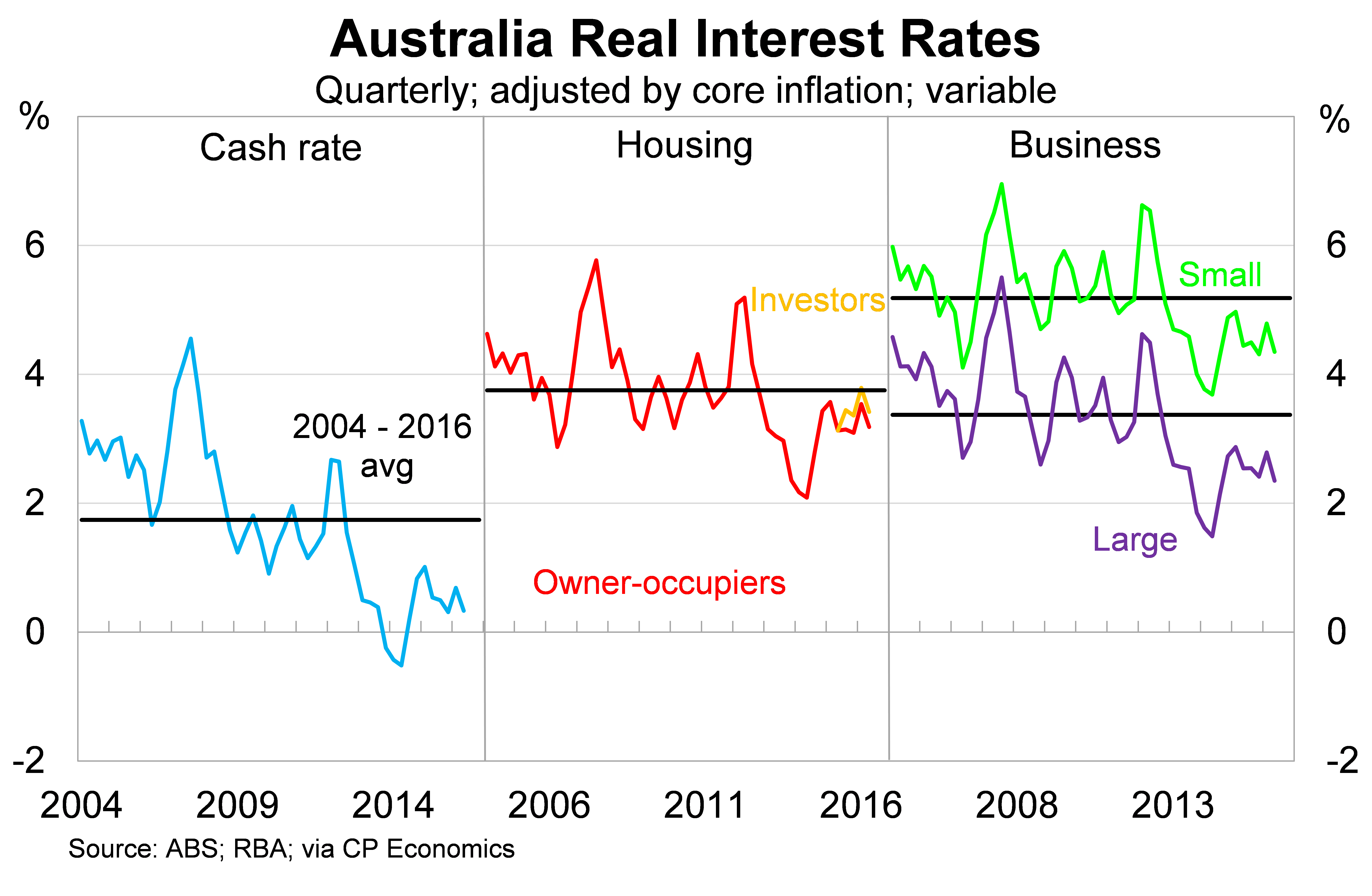

This can be seen quite clearly in Australia. The graph below shows the real interest rate, which is the nominal interest rate adjusted for inflation. While nominal interest rates are at historically low level, that isn't necessarily true once we adjust for inflation. Mortgage rates, for example, are only slightly below their 2004-2016 average once we adjust for inflation. Perhaps more importantly real lending rates are actually much higher now than they were during 2014 and this is almost entirely due to disinflation.

The third channel relates to the fact that retailers and supermarkets don't drop prices out of the kindness of their hearts. They do it because of necessity as a way to generate sales and clear stock. In order to maintain profit margins, a company must pass this weakness on to employees via softer wage growth or even a wage freeze.

Nevertheless, even during a very weak economy it is unusual for businesses to cut wages outright. This has one unfortunate consequence: a deflationary environment typically ends up with severe job losses as companies try to cut costs.

Finally, it is worth noting that not all deflation is bad. Lower oil prices, for example, are typically viewed as a positive for the Australian economy. Low petrol prices free up household budgets and promote other economic activity, encouraging greater car usage. When we speak about the dangers of deflation we are really talking about widespread or systemic deflation. When most prices are falling or when people expect prices to fall, then it provides a strong signal that the economy is not on track.

Why is inflation so weak?

Australia's low inflation environment began three years ago when commodity prices, particularly iron ore and coal, began to fall. This initially hit mining income and profits but has since spilled over into other sectors of the economy.

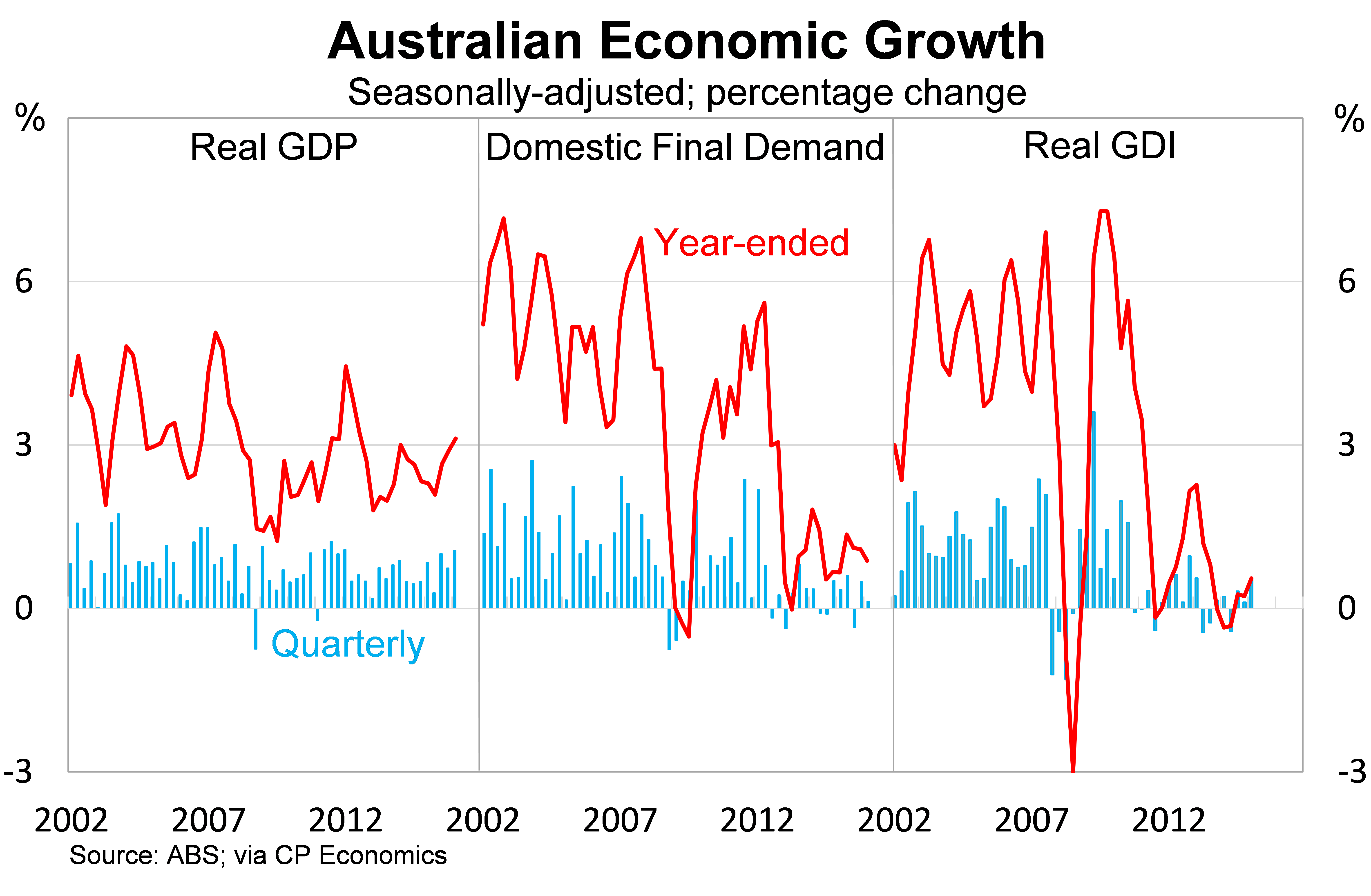

The graph below highlights three separate measures of economic growth. The first is real gross domestic product (GDP), which measures domestic production. The second is domestic final demand, which basically measures domestic demand for goods and services. The third measure is real gross domestic income (GDI), which adjusts traditional measures of real GDP for changes in the terms of trade.

The underlying reason for Australia's low inflation environment is found in panels two and three. In those panels we can see a lack of domestic demand and the income shock caused by the decline in commodity prices and our terms of trade. Over the past few years, domestic final demand and real GDI has hovered around levels not consistently seen since Australia's last recession in the early 1990s.

Real GDP remains a lot stronger than other measures due to strong growth in the volume of iron ore sold to other countries. Unfortunately, that growth has been insufficient to offset the fall in commodity prices, which is why the income and profitability of Australian miners has declined.

Falling company profits has been passed on to households via a smaller than usual rise in wages. In some cases companies have even frozen wages as they try to avoid putting off staff. According to the Australian Bureau of Statistics, private sector wages are rising at their slowest pace since 1998 (when the statistics began). Wage growth is a major driver of domestic inflation and inflation on non-tradeable goods (a useful proxy for domestically-driven inflation) has eased to its lowest level in 17 years.

Furthermore, Australia is importing low inflation from abroad. We aren't the only country experiencing a low inflation environment. Almost every developed economy is experiencing a similar set of conditions. This has helped to contain the price of foreign goods and services that Australians consume. To some degree this has offset the impact of a lower Australian dollar.

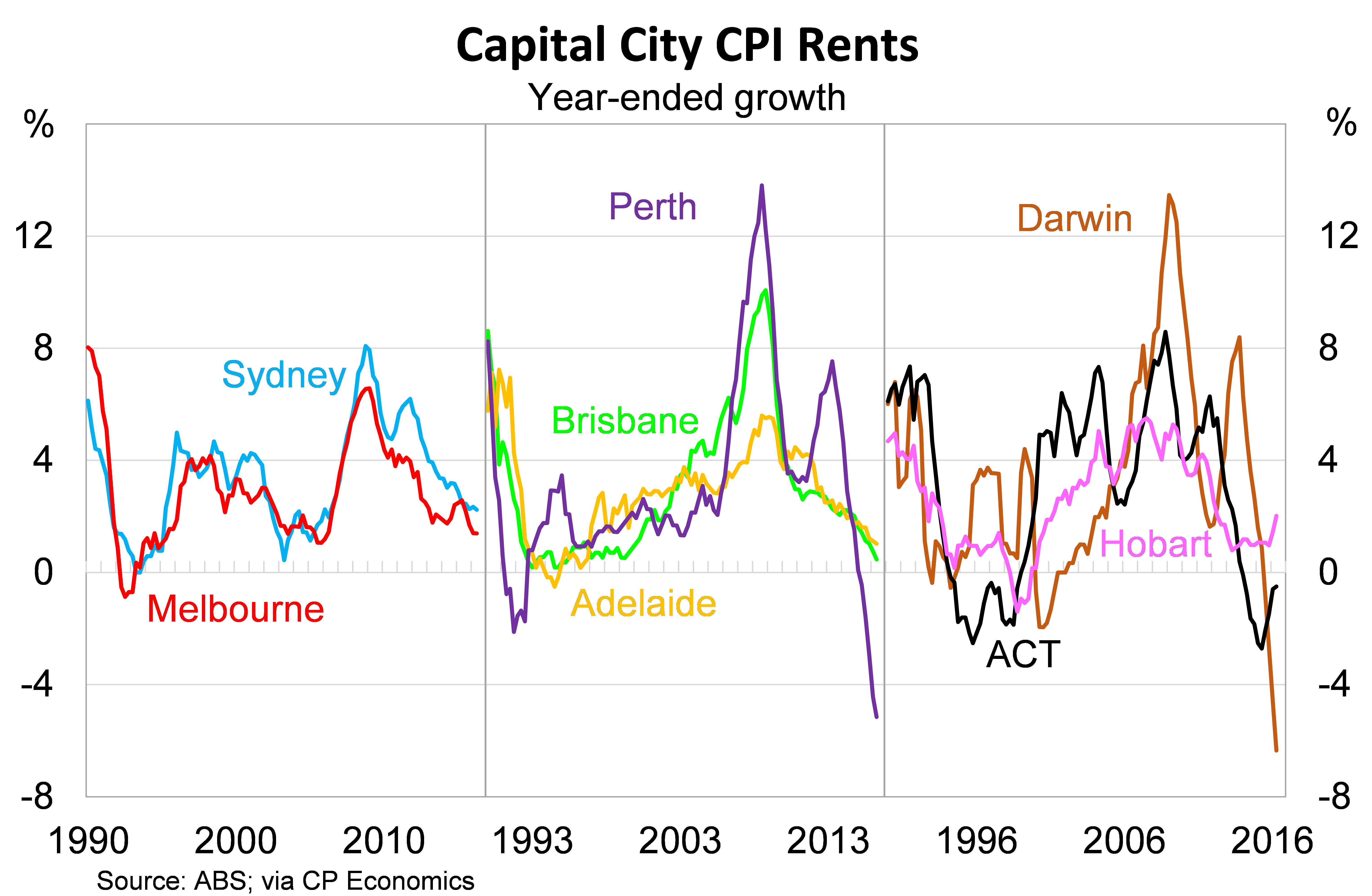

One item that will be of particular interest to Eureka readers who are property investors is the ongoing weakness in rental markets. National rents rose by just 0.7 per cent over the past year, but that hides the remarkable weakness in markets such as Perth and Darwin. Other markets are a bit better but there isn't a single market where you'd conclude that rental conditions are strong.

The income shock that explains the broad-based weakness in consumer prices is amplified in rental markets because prices are determined to a large degree by the wages of younger and typically poorer Australians. As their purchasing power has receded, rents have followed even as house prices surged across Sydney and Melbourne.

Inflation will begin to recover when we achieve a combination of:

a) stronger domestic demand;

b) a much weaker currency; or

c) stronger foreign demand.

The Reserve Bank can directly target the first two and they hope that foreign central banks can achieve the latter. So far the evidence on the latter is mixed with some countries such as the United States headed towards their target while other advanced economies continue to languish.

Consistent with this objective the RBA will cut interest rates when they meet next week. We also shouldn't be surprised if they cut further, although this is unlikely to take place before the end of the year. It's also important to note that the RBA is rapidly approaching the point at which RBA deputy governor Philip Lowe believes monetary policy begins to lose its impact. For more on that issue and the future of monetary policy in Australia see my column from last week: The RBA could consider an unconventional future.