Could the RBA cut rates?

| Summary: The Reserve Bank’s latest Statement on Monetary Policy, released today, points to stable interests for the time being, with the central bank revising its economic growth and inflation forecasts down. |

| Key take-out: There are only two things the RBA notes that suggest a rate hike could come: a strong expansion in housing and dwelling prices. Yet, if the RBA and other analysts are right and house price growth does moderate, then there is a high probability of a further cut. |

| Key beneficiaries: General investors. Category: Economics and investment strategy. |

Most people you talk to at this point are wondering when the first rate hike is going to occur.

It’s not a case of if, but when. At the time of writing, the futures market was pricing in the first rate hike around mid-2015, while market economists seem to be split. Just under half look for the first rate hike by the end of 2014, which rises to nearly two-thirds by the March quarter of 2015.

My read of the information at hand now is that the policy decision is more delicately poised – finally balanced. Take the Reserve Bank’s statements this week. They certainly weren’t hawkish (inflation fighting) statements, and in truth there was very little in them to suggest rates could be heading higher. In fact, the opposite is probably true. To see this, consider that the bank’s whole commentary was littered with caution, caveats – a distinct lack of confidence. There was no sense that RBA board was even remotely concerned about ultra-low rates or thought that this stance threatened the recovery.

Take its view on the global economy. It sounds harmless enough: “Growth in the global economy was a bit below trend in 2013, but there are reasonable prospects of a better outcome this year”. All good. And it is harmless – that’s the problem. The RBA is not really expressing any confidence the globe will achieve solid growth. There is no oomph in its commentary. Instead, there are reasonable prospects for better growth. That sounds to me like it expects trend growth at best, and it is not even sure about that. Sceptical even. As a consequence, the RBA notes that commodity prices, important to Australia, have softened.

On the Australian economy it’s the same again – below-trend growth in 2013, with only moderate growth in consumption now. The bank goes on to note that while “some indicators of business conditions and confidence have improved from a year ago … resources sector investment spending is set to decline significantly and … signs of improvement in investment intentions in other sectors are only tentative”. Overall, the RBA isn’t expecting GDP to rise above trend until mid-2015.

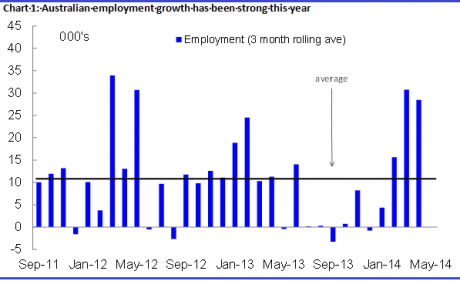

This isn’t my view, it is the bank’s view. There is a great deal of information content in how it chooses, or does not choose, to interpret economic data. Take the labour market numbers we saw this week. An increase of 14,000 coming after a 22,000 increase is a very good result. If the current pace of jobs growth is maintained, the country is looking at an annual increase of 306,000 jobs. We haven’t seen that sort of jobs growth since 2010.

That the bank hasn’t acknowledged the strength of the jobs rebound is telling. Instead, it continues to talk about the weak employment growth we saw last year, noting only “some improvement” now. More importantly, it notes that it is not looking for a decline in the unemployment rate – noting in Friday’s Statement on Monetary Policy that it is only forecasting “less of an increase”. This, of course, means it expects weak jobs growth going forward.

Amidst all of that, there are only two things it notes that suggest a rate hike could come: a strong expansion in housing and dwelling prices, with the latter having increased “significantly”. That’s a score of two factors that argue for a rate hike against four or more that suggest otherwise. The thing is, it’s not even likely that the RBA is overly concerned about the surge in house prices just yet. The reason is simple. It’s not accompanied by a surge in credit growth. Credit growth is lifting, certainly, but from a very low base, and it’s not far off recessionary rates. Noting this, it’s a well-accepted principle that a house price surge only presents a systemic threat to the broader economy when it is accompanied by a surge in credit.

At this point, the consensus appears to be that the RBA has limited itself to ‘jawboning’ (talking down) house prices, with the RBA governor noting that house price gains won’t last forever and that house prices do fall. The truth be told, it is probably not even jawboning – it’s likely a genuinely held belief. The way the RBA sees it, house price gains will be capped because households are already heavily indebted, incomes growth is low, and supply is increasing. Indeed, Australian households are among the most heavily indebted in the world, with a debt-to-income ratio of about 150% compared to around 100% for the US.

It’s not an uncommon view, that there’s too much debt etc. – so how high can property prices go? I’m bullish on Australian property. I think we’ve got years to run. But that doesn’t mean price growth won’t moderate for a time. The thing is – and this is a critical point – if it does, then what does that leave the RBA with? Below-trend economic growth, weakening commodity prices, a weak labour market, inflation that’s within the band and likely to weaken given soft wage growth, and a strong Australian dollar. On this point, Treasurer Joe Hockey’s recent comments are very enlightening. It was reported that the Treasurer had directly informed the Reserve Bank he was not happy with the bank’s more neutral tone on interest rates, as this was placing upward pressure on the Australian dollar. The message is clear – Australia is still very active in the currency wars and this government has every intention of continuing the previous government’s failed policy of intervention.

In commentary this week, the RBA board was content to simply note that: “The exchange rate remains high by historical standards”. Yet, the fact it remains elevated suggests to the RBA that it will be less useful in rebalancing the economy. At the moment the $A is pushing US94 cents: it’s an easy ride to US95 cents from here, and many analysts are forecasting a dollar around the US97 cent mark. What happens then?

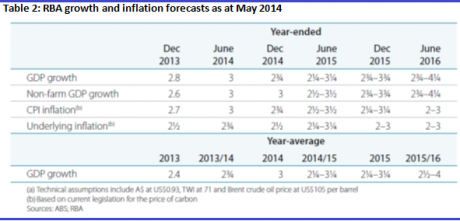

From the RBA’s own statement, and given the ongoing concern about a weak economy and a high $A, there is one thing – one thing only – standing in the way of looser policy ( a further rate cut) – and that is house prices. The flipside is, if the RBA and other analysts are right and house price growth does moderate, then I think there is a high probability of a further cut. It’s clear from the RBA’s recent statement, and the Treasurer’s comments, that policymakers are becoming more concerned about economic weakness. Indeed, in the RBA’s statement on Monetary Policy released today (Friday May 9), the bank revised growth and inflation forecasts down.

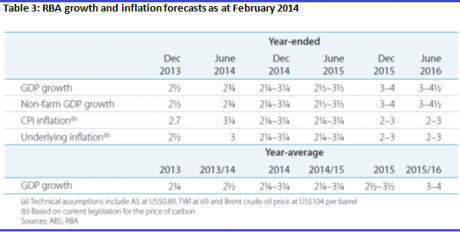

Notionally, the tables above suggest the RBA is more positive on 2014 growth now than it was in February. GDP back then was forecast at 2.25% to 3.25%. It seems to have firmed that up to the top end of that expectation though – and is now forecasting 3% growth.

In reality though, it is more pessimistic on growth and less concerned on inflation than it was even three months ago. Effectively, what it has ruled out is trend growth in 2014 of 3.25%. Moreover, it is less concerned than it was in February that inflation will end 2014 above the band. In February, core inflation was forecast between 2.25% and 3.25%. The forecast now is 2.5%. As you can see from the tables, growth and inflation were also revised down slightly in 2014-15 and 15-16. These are not rate tightening forecasts.

I have to emphasise that this is not how I see things. Yet I do get the clear sense that the RBA board, and clearly the government, see things differently and are becoming more concerned. They are certainly not positioning themselves, at this point, for a rate hike.

There is nothing in the RBA’s commentary this week which points that way. Instead, I think the market is severely under-pricing the risk of a cut. All it would take is a moderation in house price growth – a sign that the housing market no longer stood as a threat. In that case, and noting the bank’s economic view above, I think it a very high probability another cut would ensue.